For the second month in a row, the US nonfarm payroll figure came out bang in line with expectations, missing the consensus forecast by just 3k (after missing by 1k the previous month and 1k in January.) Macro Man isn’t naturally prone to wearing tin-foil hats; if he were, he could only conclude that the Street’s newfound forecasting prowess is the result of government manipulation of the numbers.

In any event, the data brought to mind a comment from last summer, when the US government first announced a support package for the Agencies. “When I picked up my newspaper yesterday, I thought I woke up in France,” quipped Jim Bunning last July, before excoriating the Federales in a Senate hearing.

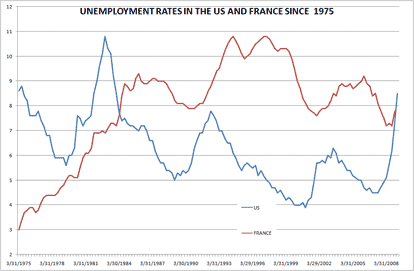

Well, Senator, many Americans would gladly wake up in France these days. The US unemployment rate is now above France’s for the first time since the early stages of the Reagan revolution, despite (or is that because?) US workers toiling for a Gallic 33.2 hours per week. At least the French get good health care, decent grub and an unshaken faith in their own superiority. No wonder Sarko would shout the death of Anglo-Saxon capitalism from a soapbox, if only he could climb up that high.

It seems clear that we are living and trading in historic times, an epoch that will be seen by future generations much as our own regards the Great Depression. Putting on his long-term forecasting hat, Macro Man can see a scenario where regulation and government control of various aspects of economic activity endure for a decade or two, until eventually a backlash emerges and a new Reagan or Thatcher emerge fifty or sixty years after the originals.

Regardless, the people in power today have the opportunity (or, depending on your perspective, excuse) and the will to make a new world. Now, the thing about modern media (both mainstream and alternative) is that are ten guys offering criticism and lobbing barbs from the cheap seats for every guy offering a prescriptive suggestion. It is, after all, easier to tear down than to build up, and regular readers will know that Macro Man has not been averse to hurling shells from the peanut gallery.

Today, however, he wishes to offer a few small suggestions as to how he would make a new financial world. The list is by no means meant to be comprehensive. nor indeed is every item on the list replete with detail. Still, you gotta start somewhere:

- Change the regulation and/or incentive structure of the ratings agencies. One of the fundamental flaws in the current (or is that prior) economic system is that the ratings agencies were paid by the sellers, rather than the buyers, of bonds and structured credit. They were therefore incentivized to help those sellers game the models to win the most favourable ratings. If, however, they were compensated by the buyers of bonds and structured credit, they should be incentivized to, you know, get things right.

- Migrate the CDS market to exchanges with position limits and heavy margining. This has obviously been suggested elsewhere, but bears repeating. In its worst form, the CDS market has a) added untold leverage into the system, and b) represented little more than Mr. Smith buying fire insurance on the houses of Mr. Jones and Mr. Wesson. If a fire (whether natural or via arson) consumes the entire street, the neighbourhood as a whole loses out, but Mr. Smith is quids in. What sort of incentive structure does this give Smith, and what is the impact on society at large?

- Grant loans and mortgages held on balance sheet more favourable tax treatment than those sold off to a secruity factory. One of the primary problems behind the subprime fiasco is that mortgage lenders had little to no incentive to critically assess the quality of borrowers, since they had no intention of holding the loans themselves. If, however, more loans were held on balance sheet, rather than nested in the A tranche of some steaming turd of a CDO-squared, lenders would exercise a bit more responsibility in the allocation of credit moving forwards. And if there’s one thing that the new world could use, it’s a little more responsibility.

- Re-institute some sort of Glass-Steagall split between commercial and investment banking. In the modern era of Goldman Sachs, bank holding company, the pendulum has obviously swung pretty far in the other direction. And in all honesty, Macro Man hasn’t been through the fine detail of what this would entail with enough rigour to provide a checklist of costs and benefits. What he does know, however, is that the creation of financial leviathans that make both loans and securities hasn’t done much other than create firms that are too big big to live and too big to die. Rather a sticky situation, that. In any event, splitting investment banks off feeds through into the next suggestion:

- Create tax incentives for investment banks to function as partnerships rather than as publicly listed companies. One could argue that this is all John Gutfreund’s fault. Back in the days when investment banks were run as partnerships, the amount of leverage that they could take was constrained by the amount of capital in the firm. Moreover, because partnerships risk their own money, rather than that of some anonymous shareholder, they have every incentive to act within the bounds of reason; if they don’t make money, they don’t get paid without reducing the capital of the firm. By taking Salomon public in the 80’s, Gutfreund helped usher in the era of the firm-wide “Acapulco trade”: swing for the fences on Friday and jet out to Acapulco. If the trade works, come back on Monday and collect the plaudits and start mentally spending your bonus. If it doesn’t, stay in Mexico and let someone else clean up the mess.

If there is one tenet that Macro Man would like to see introduced into the financial system, it is that more actors should be incentivized to act as if they are in partnerships managing their own capital.

- Scrap the dollar if you want, but get ready to pay. China and Russia have been particularly vocal about the desirability (if not the need) for an alternative to the US dollar as a global reserve currency. Evidently they are tired of paying the toll for the “exorbitant privilige“, which in practice has kept the US dollar artificially strong and led to a cessation of some monetary policy sovereignty (the bond conundrum.)

Reserve currencies are, of course, a matter of choice. No one is forcing China and Russia to hold as many dollars as they are, both in terms of gross levels of reserves and in terms of currency allocation within their reserve holdings. If they want to IMF to create and maintain a new “store of value” unit based on the SDR, fine. Run with it. But a store of value unit is an incredibly, er, valuable resource, which should not come free. Currently, China, Russia, and other reserve managers are paying the cost of low US nominal yields and a burgeoning supply of bonds for using the dollar as their primary store of value. Perhaps a new system could have a transaction tax on SDR purchases above a given threshold to discourage over-accumulation of FX reserves. At the very least, a new system should include a heavy does of oversight of the reserve accumulation policies of large current account surplus nations, with both carrots and sticks included in the policy arsenal.

So there’s a starting point for discussion. Readers are encouraged to submit their own suggestions and/or critiques in the comments section.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply