In a speech delivered Tuesday to the Japan Society in New York City, Federal Reserve Bank of New York President William Dudley offered his view on how he might assess the appropriate pace of the Federal Open Market Committee’s (FOMC) current $85 billion per month asset purchase program:

Let me give a few examples of how my own thinking may evolve. In terms of our asset purchase program, I believe we should be prepared to adjust the total amount of purchases to that needed to deliver a substantial improvement in the labor market outlook in the context of price stability. In doing this, we might adjust the pace of purchases up or down as the labor market and inflation outlook changes in a material way. For me, the base case forecast is not the sole consideration—how confident we are about that outcome is also important.

Because the outlook is uncertain, I cannot be sure which way—up or down—the next change will be. But at some point, I expect to see sufficient evidence to make me more confident about the prospect for substantial improvement in the labor market outlook. At that time, in my view, it will be appropriate to reduce the pace at which we are adding accommodation through asset purchases. Over the coming months, how well the economy fights its way through the significant fiscal drag currently in force will be an important aspect of this judgment.

My own boss, Atlanta Fed President Dennis Lockhart, expressed a similar view in a speech to the Birmingham Alabama Kiwanis Club last month:

The key word in the phrase “substantial improvement in the outlook for the labor market” is outlook. For my part, a critical consideration in judging how much longer asset purchases should continue will be confidence in the positive outlook. Confidence that is solidly grounded in improving economic data, accumulated over a sufficient span of time, will help me conclude that the work of the large-scale asset purchase program, as a temporary supplement to conventional interest-rate policy, is complete.

And there is this, from the minutes of the latest meeting of the FOMC (emphasis added):

Participants also touched on the conditions under which it might be appropriate to change the pace of asset purchases. Most observed that the outlook for the labor market had shown progress since the program was started in September, but many of these participants indicated that continued progress, more confidence in the outlook, or diminished downside risks would be required before slowing the pace of purchases would become appropriate.

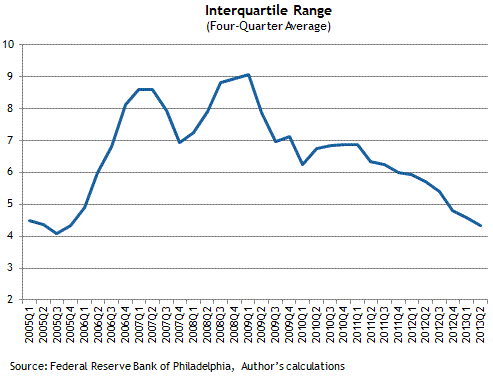

Neither President Dudley nor President Lockhart (nor the minutes) indicates where we are on the confidence scale at the moment. But at least outside the Fed, there is some evidence confidence in the labor market forecast is increasing. The following chart shows year-over-year averages of the interquartile range of four-quarter-ahead unemployment rate forecasts from the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters:

The interquartile range is essentially the difference between the most optimistic one-fourth of the forecasts in the Philadelphia Fed’s panel and the most pessimistic one-fourth of forecasts. It is thus a measure of dispersion, or forecast disagreement.

The trend in this measure of forecast disagreement is clearly—very clearly—downward. That doesn’t exactly say that each individual forecaster is becoming more confident about his or her individual outlook (though this type of dispersion measure is often used as a proxy for overall uncertainty). Even less does it mean that forecast uncertainty has fallen to the level President Dudley, President Lockhart, or any other Fed official would deem sufficient to alter policy in any way. The FOMC minutes, for example, include this…

A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome.

… and following his congressional testimony Wednesday, Chairman Bernanke engaged in a Q&A, and the New York Times summed up the state of the policy discussion this way:

When asked by Kevin Brady, the Panel’s chairman, whether the Federal Reserve could start winding it back before before September’s Labour Day holiday, Mr Bernanke responded, “I don’t know. It’s going to depend on the data.”

It really need not be emphasized that I don’t know either. But the narrowing of opinions of where things are headed must signify some sort of progress.

Leave a Reply