China Green Agriculture (CGA) recently completed a major acquisition which will boost its fertilizer production by 6 times its previous production. China Green is also cheap, trading at just 7x forward earning, well under the industry average of 11.6.

China Green Agriculture produces 148 different humic acid-based compound fertilizer products which are sold in 21 Chinese provinces, 4 autonomous regions and 3 municipal cities.

Its products are certified by the Chinese government as “Green Food Production Materials” which is a trademark that lasts for 3 years.

The criteria for getting the trademark include meeting standards that increase human safety and ecological protection of the environment, which means encouraging non-polluting products and the use of non-genetically modified raw materials. It doesn’t necessarily mean “organic”, in the American sense of the word.

5 provinces currently account for 40.4% of the company’s fertilizer revenue: Shaanxi, Shandong, Anhui, Henan, and Sichuan.

China Green Closed on Big Acquisition

On July 6, China Green announced that on July 2 it had completed the closing of its acquisition of Beijing Gufeng Chemical Products Co. and its wholly owned subsidiary.

Gufeng was founded in 1993 and is Beijing-based. It will increase the company’s fertilizer production from 55,000 metric tons (MTs) to 355,000 MTs.

The deal was for $8.8 million in cash plus 2.276 million shares of stock to Gufeng shareholders.

The acquisition is expected to contribute $10.6 million in net income, or about 39 cents per share, for fiscal 2011, which ends in June 2011.

Big Increase in Fiscal 2011 Zacks Consensus Estimates

Given the company’s July 6 announcement, it’s not surprising that the estimates have jumped for the first quarter and for fiscal 2011.

2 out of 3 estimates have moved higher for the fiscal first quarter by 6 cents to 32 cents per share.

The fiscal 2011 Zacks Consensus Estimate jumped 20 cents to $1.33 in the last week as 2 estimates also moved higher in that time. Analysts are expecting earnings growth of 47% over fiscal 2010.

But fiscal 2010 isn’t looking too shabby either. Analysts still expect 16.2% earnings growth with the Zacks Consensus holding at 91 cents over the last 60 days. On June 15, the company had reaffirmed full year guidance of between 90 and 91 cents per share.

China Green made just 78 cents per share in fiscal 2009.

China Green is scheduled to report fiscal first quarter 2011 results on Sep 14.

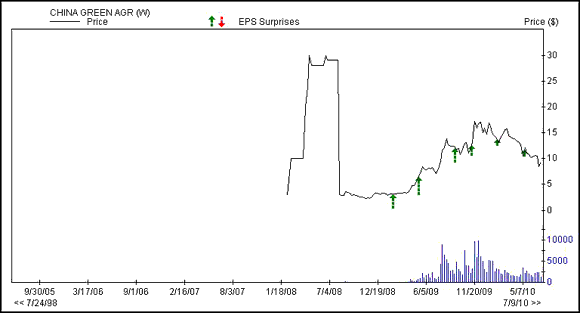

Public Only Since 2008

China Green has surprised on the Zacks Consensus every quarter since it went public in 2008. It has beaten 4 quarters in a row by an average of 14.1%.

On June 10, the company announced it had met its fiscal 2010 sales forecast of an increase in net sales volumes of 40%. The company hit this mark 20 days before the end of the quarter.

Fiscal 2010 was boosted by favorable market conditions in China and an effective marketing campaign.

Value Credentials

In addition to its low P/E, the company also has a low price-to-book ratio of 2.5 which is slightly above the industry average of 2.1 but is well within the value parameters.

The company also has a stellar return on equity (ROE) of 50%, much higher than the industry average of 13.8%.

China Green is a Zacks #1 Rank (strong buy) stock.

CHINA GREEN AGR (CGA): Free Stock Analysis Report

Zacks Investment Research

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply