Trimas Corporation (TRS) continues to set new 52-week highs, but share are still trading with good valuations.

Company Description

TriMas makes engineered and applied products for a variety of industries. The company is broken down into 5 segments; Packaging, Energy, Aerospace & Defense, Engineered Components and Cequent (recreational products).

Excellent Growth

The Zacks Consensus Estimate for 2010 is currently 76 cents, which is a 78% improvement over 2009. Estimates are up 9 cents on average over the past 3 moths. Next year’s consensus for TriMas is $1.08, up 16 cents and representing a 41% growth rate.

Good History

TriMas topped Wall Street estimates in the past 4 quarters. The company has only fallen short of expectations once since its IPO in May of 2007.

TriMas’s next earnings release is scheduled for Aug 3.

Nice Valuations

Share of TRS have excellent growth prospects, but are trading with good valuations as well. The forward P/E is just under 15 times and the PEG ratio is a 0.8. TriMas’s price to sales ratio is only 0.5 times.

However, the company is well behind its peers with a price-to-book approaching 6 times.

Comparison to Industry

TriMas operates with just a 1.1% net profit margin, about half of the industry average. But the leveraged operation yields and ROE of 30%, almost 5 times higher than the 6.5% that its peers average.

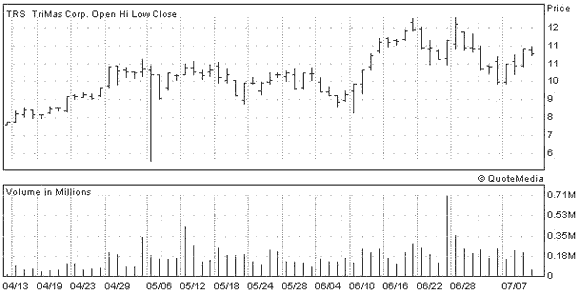

The Chart

TriMas has been performing very well, especially given the slumping indexes. TRS continues to set new 52-week highs and if the announcement on Aug 3 goes well, the stock should continue that trend.

TRIMAS CORP (TRS): Free Stock Analysis Report

Zacks Investment Research

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply