It is increasingly likely that the Eurozone could become the Humpty Dumpty of currency unions. If so, this is a tragedy foretold by many observers. Martin Feldstein, for example, argued back in the late 1990s that there were too many cultural, institutional, and economic differences in the EU nations for a single currency to work. He even claimed that the currency union could lead to more conflict instead of reducing it as many Euro supporters claimed it would do. His skepticism of the Eurozone was shared by many others, particularly American economists, who saw a one-size-fits all monetary policy as destabilizing to the regional economies in the EU. For all these naysayers, though, there were supporters who argued that political gains will trump any economic costs in the monetary union and that over time many, if not most, of these costs would disappear as the regional EU economies converged. Well so much for the Euro optimists. Many folks are now saying that at a minimum there needs to be a “shock and awe” bailout package as high as $1 trillion to keep Eurozone intact. Yikes.

Given the real possibility of the Eurozone ceasing to exist in its current form, it is worth taking stock of important lessons from this experience. Here are what I see as the four big lessons of the Eurozone crisis:

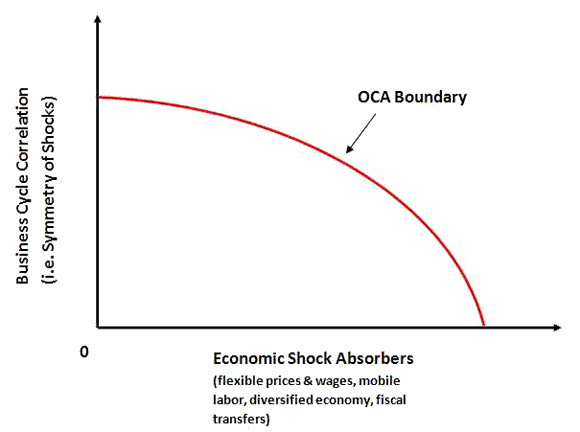

(1) The optimal currency area (OCA) criteria should be taken seriously ex-ante. Before any country joins a currency union it should make sure it has met some combination of the OCA criteria. These criteria tells us that members of currency union should (1) share similar business cycles or (2) have in place some combination of economic shock absorbers including flexible wages and prices, factor mobility, fiscal transfers, and diversified economies. In the former case, similar business cycles among the regions mean that a common monetary policy, which targets the aggregate business cycle, will be stabilizing for all regions. In the latter case, dissimilar business cycles among the regions make a common monetary policy destabilizing—it will be either too stimulative or too tight—for regions unless they have in place some of the economic shock absorbers. In short, if a region’s economy is not in sync with the currency union’s business cycle and the above listed shock absorbers are absent then it does not makes sense for a country to be a part of the currency union. Instead, the country should keep its own currency which itself will act as a shock absorber. This understanding can be graphically represented as follows:

As shown in this recent post of mine and by others, several of the Eurozone countries fell inside the OCA boundary, Greece being one of them. This is not a surprise to most folks including the Euro optimists, but many hoped that these criteria would be met ex-post as the economies integrated. This leads to the second lesson.

(2) Don’t hang your hope on becoming a successful currency union by meeting the OCA criteria ex-post. Some observers argued around the time of the Eurozone’s inception that looking at the OCA criteria ex-ante was not warranted since the criteria themselves would emerge once a currency union was formed. This “endogenous” view of the OCA gave hope to the Euro optimists and lent support to their cause. Now there is evidence that joining a currency union does stimulate trade as transactions costs are lowered. One study found currency unions more than tripled trade among members. It is apparent now, though, that some of the Eurozone periphery did not integrate enough to justify the cost of being a member in the currency union. It is best not to base the survival of a currency union on hope.

As an aside, it is worth nothing that even if a region does endogenously meet the OCA criteria further problems can arise from being a part of the currency union. The increased trade flows and economic activity within the currency union can over time lead to regional specialization that makes the regions more susceptible to economic shocks. Paul Krugman first made this point in 1998 and the idea has become known as the “Krugman Specialization Hypothesis” (KSH). I think the best example of KSH is the United States. Despite being a currency union for many years, the United States did not become an OCA until the 1930s according to Hugh Rockoff. One reason is because there was so much regional specialization and until the New Deal reforms, many of the economic shock absorbers necessary to offset the lack of regional economic diversification were simply missing. So even if the Eurozone were a functioning OCA there is no guarantee it would stay that way.

(3) Take the real exchange rate seriously. A summary measure of a country’s external competitiveness is its real exchange rate. If a country’s real exchange rate is appreciating then its goods are becoming more expensive to the rest of the world. And, as a result, it will begin losing foreign earnings and the ability to meet external obligations. In a time of crisis for a country dependent on foreign funding this problem becomes more pronounced. As seen in the next figure, most of the Eurozone periphery has had a real appreciation on average since the inception of the Euro!

(3) Take the real exchange rate seriously. A summary measure of a country’s external competitiveness is its real exchange rate. If a country’s real exchange rate is appreciating then its goods are becoming more expensive to the rest of the world. And, as a result, it will begin losing foreign earnings and the ability to meet external obligations. In a time of crisis for a country dependent on foreign funding this problem becomes more pronounced. As seen in the next figure, most of the Eurozone periphery has had a real appreciation on average since the inception of the Euro!

Now to understand why the periphery has had the real appreciation, one has to look at the three components of the real exchange rate: domestic prices, foreign prices, and the exchange rate. For Greece the problem was twofold. First, because of wage pressures domestic prices rose, more so than in the core Eurozone countries. Second, given its membership in the Eurozone, Greece had a fixed exchange rate and, thus, no chance for its currency to depreciate. To get out of this bind Greece can either have painful deflation or end its use of the Euro. Given where Greece is now, leaving the Euro may seem like lesser of two evils for Greek leaders. (Just to be clear, a depreciation will not solve Greece structural problems, but it make it easier to address them.) Any country joining a currency union should consider the implications of membership on its real exchange rate.

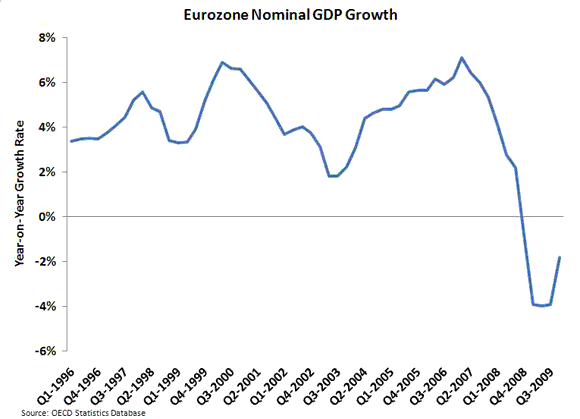

(4.) The central bank contributes most to macroeconomic stability by stabilizing aggregate demand (i.e. total cash spending). I have made this point before for the United States, but it applies just as well to the Eurozone. And based on the following figure, the European Central Bank (ECB) has not done a very good stabilizing total cash spending during this crisis:

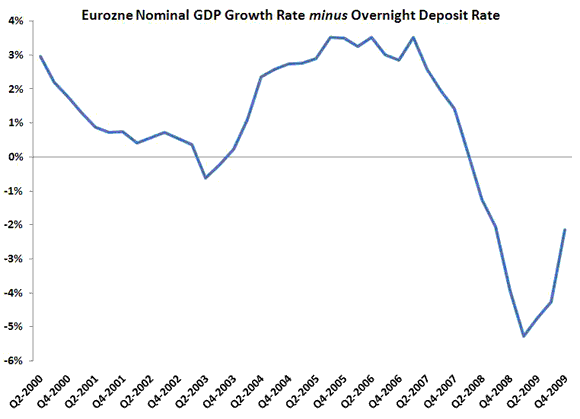

As Nick Rowe notes, the sharp decline in the Eurozone’s aggregate demand was avoidable had the ECB really tried to stabilize it. Instead, the ECB mistakenly looked to low short-term interest rates as an indicator of loose monetary policy and became convinced it was doing enough. A better indicator of the stance of monetary policy I have discussed before is to look at the growth rate of aggregate demand relative to the policy interest rate. Using this metric, the ECB policy rate should not deviate too far from the aggregate demand growth rate otherwise monetary policy is either too loose (the policy rate is significantly below the total spending growth rate) or too tight (the policy rate is significantly above the total spending growth rate). This next figure shows this measure for the Eurozone:

According to this measure, monetary policy in the Eurozone has been rather tight over the last year. The Eurozone’s future would have been more secure had the ECB been more vigilant in stabilizing aggregate demand.

So what lessons do you see from the Eurozone crisis?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply