Anne Seith has written an interesting article in today’s SPIEGEL ONLINE where she addresses Eurozone weaknesses that threaten, among other things, the future of the union’s common currency.

Spiegel online: “The disastrous budget situation in Greece has highlighted the common currency’s [deterioration] in recent weeks and similar situations in Spain, Ireland, Italy or Portugal could aggravate the situation even further,” Seith writes.

Seith also takes a close look at several proposals from the world’s most powerful trade bloc that include ideas such as the formation of a common EU economic gov’t ; having a better and automatic economic stabilizers ; and the creation of a Europoean Monetary Fund [EMF].

There is considerable skepticism about the idea of an EMF… Jörg Krämer, chief economist at Commerzbank, is worried that an EMF could undermine the Stability Pact even further, because, on the one hand, rules would be established to encourage solid government finances and, on the other hand, the EMF would create mechanisms to address the possibility of those rules being violated. “This makes the system less credible from the start.

There is yet another problem: It will take years to develop an EMF.

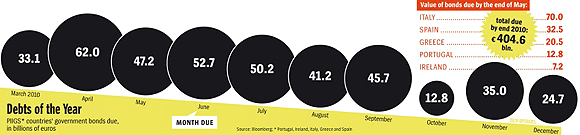

According to Seith, the Eurozone, as a result of Greece’s financial difficulties, which has debts that are nearing 120% of GDP, now seems split between countries like Germany and Finland on the one side, with large current account surpluses, and countries like Portugal, Italy, Ireland, Greece and Spain [PIIGS] on the other, with spiking deficits.

Debt coming due in PIIGS states

Graph: Spiegel Oline

Needless to say, EU’s recent financial anomalies have shaken its foundations as the cost of PIIGS’ government borrowing keeps increasing to the point where default is a very real possibility.

Seith in her article also questions if the Stability and Growth Pact, which was designed to provide for a strong European common currency, has failed.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply