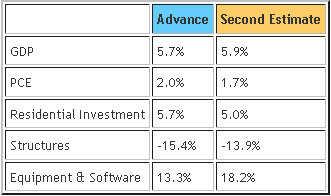

This is discouraging news: GDP for Q4 was increased to 5.9% from 5.7% but the sustainable components were revised down. This table from Calculated Risk shows consumption (PCE) and investment dropping while the most transitory part of GDP, inventories, made up the increase:

Worse, deflation also added to GDP. The nominal GDP stayed the same at 6.3%, but the price deflator was reduced by 0.2%, meaning less inflation, pushing real GDP from 5.7% to 5.9%.

Excluding inventory rebalancing, GDP would have been revised down from 2.2% to 1.9%.

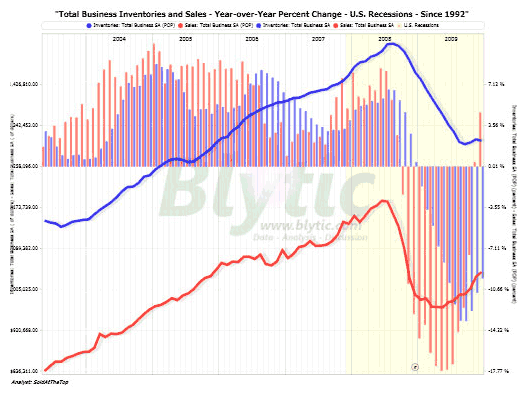

Let’s look forward, starting with inventories. Will inventory rebalancing continue? It has gone back to a “healthy” ratio of 1.25 months, but the actual increase is modest, remaining about 10% below YE2008 levels, and actually declined in December. The good news in this chart is sales (red line) are rising faster than inventories (blue line) giving credence to continued inventory restocking in Q1 and Q2.

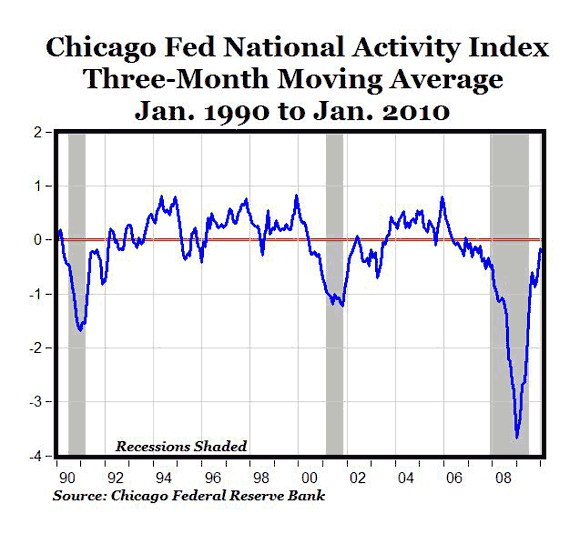

Durable goods have been rising, supporting positive manufacturing data, but excluding aircraft ticked down in January. It had been rising for a number of months, and this it should be no surprise that business activity shows a V shaped recovery:

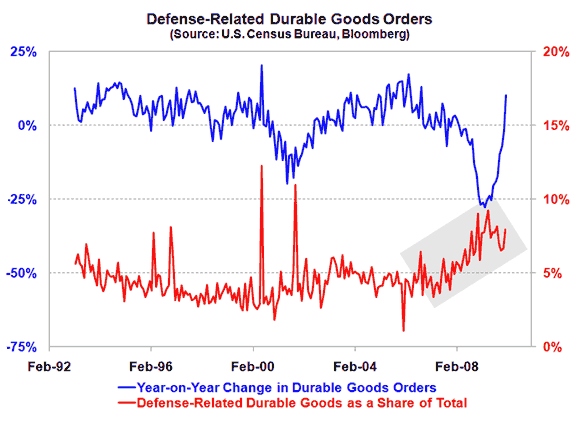

Parsing the durables, however, shows this chart, which says a lot of the growth is due to defense spending, not the private economy:

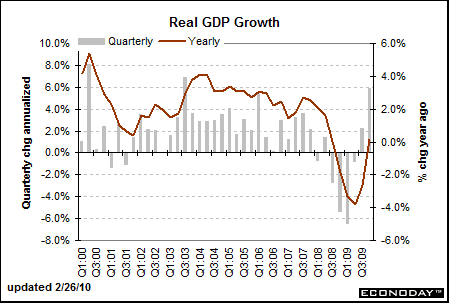

Overall the GDP chart looks like a V shaped recovery, but as The Big Picture reports, “even with the big Q4 GDP, U.S. GDP was down 2.4% in 2009 — the worst showing since 1946 (down 10.9%). [Also] ‘In 2009, business investment fell the most since 1942, while imports fell the most since 1946.’ ”

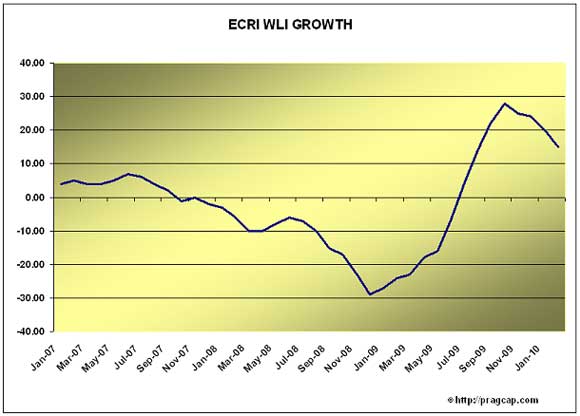

All in all the data is a mixed bag, as manufacturing still seems on an uptick even as organic growth seems sluggish at best, with declining new and existing home sales for example. I have noted how leading indicators seem to be flattening if not beginning to dip. ECRI still insists that a double dip is out of the question:

“with the 6 percent GDP growth and the jobless rate having peaked back in October… a double dip is still out of the question.”

Hmmm. Unemployment is not looking that promising right now, having just spiked up. What if it rises again after the census temp workers flow through and out? ECRI says their flattening indicators suggest that the recovery “will begin to ease off by mid-2-10.” They conclude that it is all but certain now:

An even more negative view comes from looking inside the leading indicators. A steepening yield curve is considered a positive indicator, since (as described in my recent Bond Fundamentals post) it normally means that business activity is picking up, and demand for longer-term debt is increasing; yet right now commercial lending is not increasing. Instead, the wide rate spread is an artifact of the Fed keeping the short end artificially low. Without that steep curve, the LEI would have dropped 0.1% last month.

Mish’s take on the leading indicators is the double dip may begin as early as Q2 this year.

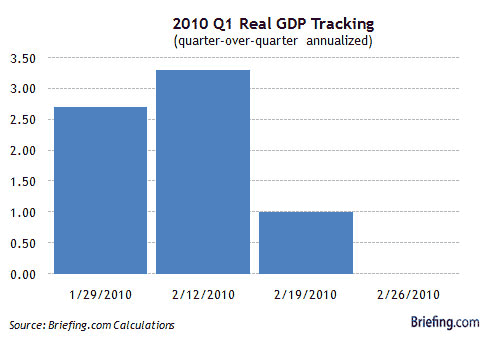

GDP models summarized at Briefing.com are begin to show a drop in projected Q1 GDP to 1% growth, albeit based on increased inflation not decreased business activity:

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply