Perhaps it was always going to happen. After the hawkish drum beat of evidence for the prosecution going into Friday’s payroll data, the employment figures were skewed well to the weak side of expectations. And while euro-dollars gapped up and stayed up, the impact on other asset markets lasted, oh, at least forty-five minutes before “risk on, baby” re-asserted itself.

And if that wasn’t enough, Macro Man’s email box was peppered with sell-side missives over the weekend trumpeting China’s excellent export data. Even his equity-manager chum was talking about Chinese exports on the train this morning. To be sure, the figures were impressive. Macro Man is always somewhat bemused by the focus on Chinese exports, given that these are a) at least partially driven by the country’s mercantilist policies, and b) as such, at least partially represent the vulturing of market share away from other producers.

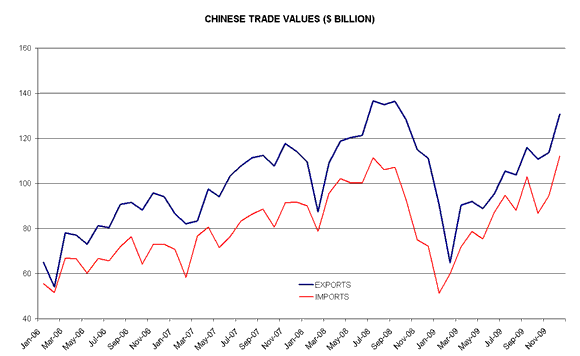

Far more interesting to Macro Man is China’s import data, which was truly stunning; up 55% y/y, taking the nominal dollar amount to new highs.

Unsurprisingly, this has been taken well by other markets, with developed-markets equity indices (and futures) reaching post-2008 highs. In many ways, it feels as if there is no market advantage to weighting risks and considering expected values on sundry investments. CHINA RULZ, BEARS ARE FOOLZ is looking like a manifestly superior investment methodology for the time being.

In any event, whether it’s “China rulz” or simply the ongoing abundance of liquidity available for certain types of investment, whatever is driving markets has spread its tentacles far and wide. Commodities have ripped higher; while oil could perhaps be explained by the cold weather gripping the entire Northern Hemisphere, gold has also made a Lazarus-like comeback after the $150/oz smackdown observed last December.

While Macro Man is sceptical that oil can extend another 30% or so and hang onto those gains, there would appear to be little to stand in the way of further upside in the nearer term. CL2 has sustained a break above its Q4 trendline, and aggregate open interest (shown in the lower half of the chart below) is at post-Lehman highs. New OI highs could be an obvious trigger to a further melt-up.

(click to enlarge)

So what’s a bear to do? Those of an ursine persuasion have morphed from terrifying creatures that can crush a bank skull with one blow to cartoon caricatures who may think that they are “smarter than the average bear” but are undone by their own “cleverness.”

One of the lessons that Macro Man has taken from last year is that trying to call the top in risk assets when the market is “in the mood” is little short of a fool’s errand. Sure, it’s fine to have doubts about the sustainability of “China Rulz” in light of the abject consumer credit data from Friday night (which is what the US economy ultimately needs, but is not necessarily bullish for the “we’re in a sustained recovery” view), but there’s no point hopping off the Risk Train until it starts performing like Macro Man’s 6.33 to London Bridge.

(click to enlarge)

Perhaps earnings season (which kicks off tonight with Alcoa) will give stocks pause for thought. Then again, maybe not. Either way, as long as the market wants to play CHINA RULZ, it’s a bit foolish to stand in the way.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply