What have we learned from the experience of the last two years? The Wall Street Journal offers up one discouraging conclusion:

“For much of the past century, America has served as the global model for the power of free markets to generate prosperity…

“In the 2000s, though, the U.S. quickly went from being the beacon of capitalism to a showcase for some of its flaws…

“But one thing is certain: America’s success or failure over the next decade will go a long way toward defining what the world’s next economic model will be.”

One of the article’s implied alternatives for the world’s next economic model seems a bit of a stretch:

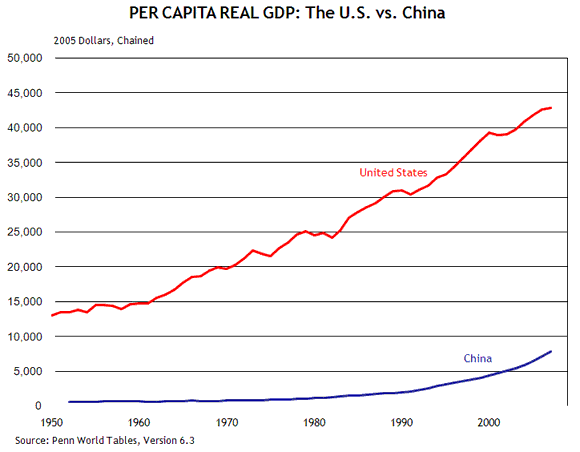

“The troubles in the U.S. stand in sharp contrast to the relative success of other countries, notably China. With a system that is at best quasi-capitalist, China’s economic output per person grew an inflation-adjusted 141% over the decade, and hardly paused for the global crisis, according to estimates from the International Monetary Fund. That compares with 9% growth in the U.S. over the same period.”

Let’s put that comparison to rest right away:

The theory of economic growth is rich, interesting, and somewhat unsettled, but it stands to reason that emerging economies, where the fruit hangs low, can for a time grow much faster than advanced, fully developed countries. Furthermore, I find it reasonable to assume that, contrary to representing an alternative economic model, the Chinese experience over the past decade is itself evidence that even incomplete movements in the direction of free markets can pay large dividends. But even if you doubt that interpretation, the gap between the material circumstances of the average American and Chinese citizen is so large as to make comparisons about the success of the respective economic models premature by several decades.

In fact, the picture above nicely illustrates what I believe is a more on-the-mark observation in the WSJ article:

“At least twice in the past century, the U.S. has re-emerged from deep crises to reinvent capitalism. In the 1930s, the Depression compelled Franklin Roosevelt to introduce Social Security, deposit insurance and the Securities and Exchange Commission.

“After the brutal stagflation of the 1970s and early 1980s, then-Federal Reserve Chairman Paul Volcker demonstrated the ability of an independent central bank to get prices under control, ushering in an age in which powerful, largely autonomous central banks became the norm throughout the developed world.”

So what, then, is the alternative model waiting in the wings to replace the current one? It’s not given a name, but the features are clear in the article:

“Policy makers’ focus now, though, is on the financial sector that failed so spectacularly. Progress has been slow, and key pieces are missing, but the contours of a new system are taking shape. Banks will face stricter limits on their use of borrowed money, or ‘leverage,’ to boost returns. The Fed will keep a closer eye on markets during booms, and possibly step in to curb excessive risk-taking—a U-turn from its previous policy of mopping up after bubbles burst.

“Such changes would amount to a grand bargain: Give up some of the growth and dynamism of the U.S. economy for a safer, more equitable brand of capitalism—one that could avoid the kind of busts that turned the 2000s into such a disaster.”

OK, but here is the central question: How can we be sure that the “new system” will be an improvement on the one it replaces? Some of the most significant failures of the last couple of years occurred in highly regulated industries. So the absence of regulation is not really at issue, but rather what kind of regulation we will have, and how it will be implemented. And there is the obvious point that regulatory change is not really reform if it undermines a system’s existing strength. Some of the reform proposals on the table, for example, have the potential to seriously compromise “the ability of an independent central bank to get prices under control,” the very feature of our current system that the article identifies as an historical source of resilience.

I worry about a regulatory change that commences from the proposition that we must “give up some of the growth and dynamism of the U.S. economy for a safer, more equitable brand of capitalism.” In their introduction to a comprehensive set of reform proposals from New York University’s Stern School of Business, professors Viral Acharya and Matthew Richardson have this to say:

“There are many cracks in the financial system, some of which we now know, others no doubt we will discover down the road.… A common theme of our proposals notes that fixing all the cracks will shore up the financial house but at great cost. Instead, by fixing a few major ones, the foundation can be stabilized, the financial structure rebuilt, and innovation and markets can once again flourish.”

One of those major cracks is the “too-big-to-fail” distortion. Is it important to remember that too-big-to-fail is itself a creation of regulation, not markets? I think so.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply