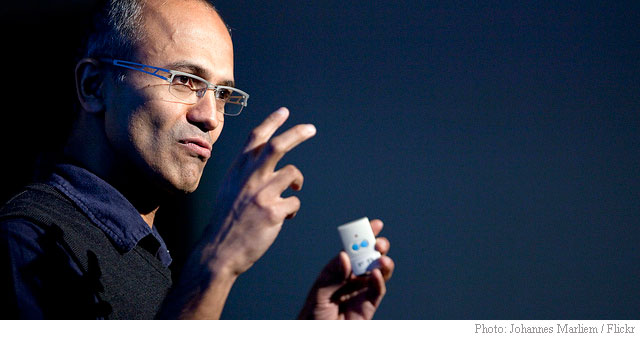

Microsoft CEO Satya Nadella disclosed in a regulatory filing last Friday (Aug. 10) that he had sold 328,000 shares in the software company valued at $35.9 million.

The stock sale, which is the second for Nadella since becoming CEO in 2014, was completed via multiple trades at prices ranging from $109.08 to $109.68. Nadella’s sale of almost one-third of his common shares in the software giant comes as Microsoft‘s stock (NASDAQ:MSFT) trades near record highs.

MSFT hit an all-time high of above $111 a share on July 25, a few days after the Redmond, Wash.-based company crushed fourth-quarter earnings by beating on both the top and bottom lines. Microsoft stock closed down 0.61% to $109 following Nadella’s sale as the S&P 500 index dropped 0.71%.

“The stock divestitures made today were for personal financial planning and diversification reasons,” Microsoft said in a statement. “Satya is committed to the continued success of the company and his holdings significantly exceed the holding requirements set by the Microsoft Board of Directors.”

Yet, and despite the statement’s reassuring tone, Nadella’s selling of a large part of his holdings is certainly not what shareholders would like to see-particularly at a time when the stock’s price-per-share is near all-time highs. In a way, the move reinforces the notion that Microsoft may be overvalued. But then again, just because a CEO is dumping shares doesn’t mean the company is in bad shape or the stock is about to tank. In fact, when it comes to a company like Microsoft, there really isn’t anything for the bears to consider sinking their claws into.

As mentioned previously, the company announced last month that for the quarter which ended on June 30, as a whole, it grew revenue by a whopping 17%. Redmond also said that is faring well across most of its business units with its main divisions all posting double-digit year-over-year (Y/Y) growth rates. More specifically, Productivity and Business Processes, which includes Dynamics, LinkedIn and Office, had 4Q revenue of $9.7 billion, up 13% Y/Y. The More Personal Computing segment, which contains Windows, devices, gaming and search advertising, generated $10.8 billion, up 17%. Intelligent Cloud delivered in total $9.6 billion in revenue, up 23% from a year ago. Meanwhile, the exact revenue for Azure (Microsoft’s cloud-based architecture) wasn’t revealed but the company said it spiked by nearly 90%.

“The law of large numbers is kicking in,” Evercore ISI’s Kirk Materne told CNBC during an interview, referring to Azure’s growth. “The base is getting bigger. It is growing faster than [Amazon’s] AWS did when it was at a similar size. This is probably a $9 billion business growing at more than 80 percent.”

For fiscal 2018, Microsoft reported revenue of $110.4 billion, up 14%. Redmond said it spent $14.7 billion on research and development in fiscal 2018.

Looking ahead – for 1Q/19, Microsoft expects revenue to range between $27.35 billion to $28.05 billion, a Y/Y growth of almost 13% at the midpoint of guidance.

It goes without saying that the results highlight a broad-based revenue generation and growth company firing on all cylinders.

Microsoft Stock

From a technical standpoint, yes – the argument can be made the ticker’s P/E multiple of more than 22x earnings represents a certain degree of overvaluation. Our risk assessments, however, when it comes to MSFT’s valuation, justifies the current share price given the name’s EPS is projected to surge from $1.08 in FY 2018 to $4.28 and $4.91, respectively, over the next two years. And if we factor in here that earnings will roll in according to current expectations, then the growth trend suggests the increase in Microsoft’s share price is warranted.

To that point, current profit and operating margin for Microsoft over the last 12 months are 15% and 31.8%, while the current return on assets and equity print 8.6% and 19.4%, respectively.

Our believe is that MSFT could drop only in case of bad news, recession or a general market correction. Otherwise, based on company fundamentals – remember, instead of doing things sequentially, Nadella is now doing them in parallel – the stock’s long-term trend is definitely up.

Microsoft is up nearly 26% year-to-date through Thursday. The stock has soared nearly 50% in the past year.

At $831 billion, the name currently sports one of largest market cap of all U.S. companies.

Leave a Reply