Twitter Inc (NYSE:TWTR) stock continues to see strong upside momentum take it to fresh intra-day highs, recently touching $17.88 a share. The name’s recent strength, currently up 8.10%, is being attributed to a sell side shop suggesting the embattled social networking site could be a possible takeover target.

CNBC’s Scott Wapner, however, a short while ago dispelled the recent rumors, saying that after talking to SunTrust Robinson Humphrey analyst Bob Peck, such a deal is unlikely, especially this year.

Wapner also said that Peck doesn’t think Twitter would agree to a sale and that the company fully support Jack Dorsey’s plan. Peck however, told Wapner that a deal in fiscal-year 2017 could happen.

In February, Twitter stock surged more than 6% following a report from ‘The Information’ suggesting that venture capitalist Marc Andreessen was planning to team up with private equity firm Silver Lake on a deal to acquire the company. Just like today, the speculation turned out to be just another a Twitter rumor.

It seems that unless the company can increase the number of users or engagement levels, and somehow find a way to crack the advertising big leagues, there will most likely be more rumors about a Twitter takeover. For the time being however, looks like Twitter’s only hope lie with an acquisition. In fact, last month sell side shop MoffettNathanson was quoted as saying it sees “no compelling reason” to own Twitter other than the possibility it may be bought.

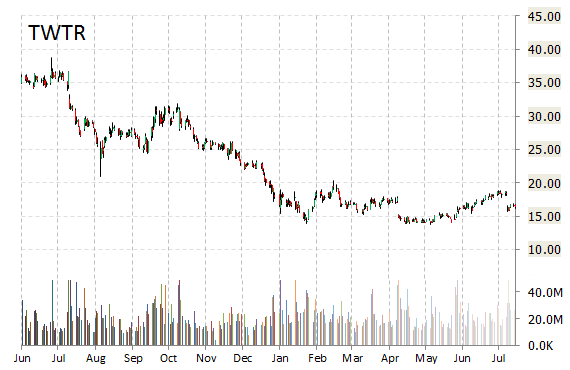

Can’t blame the firm’s grim analysis given the fact Twitter’s stock is still down nearly 23% this year and more than 31% below its $26 IPO price from Nov. 2013. Moreover, the nosedive has dragged down the company’s market cap from nearly $35 billion last spring to about $12.5 billion.

Stock Reaction

TWTR shares have declined 4.98% in the last 4 weeks while advancing 17.20% in the past three months. Over the past 5 trading sessions the stock has lost 11.00%. The name has also plunged 51 percent from its 52-week high of $36.67. Technically speaking, Twitter stock has found some support around the $16 level. Should it drop below that level, the next support looks like $15.

Currently there are 7 analysts that rate TWTR a ‘Buy’, 28 rate it a ‘Hold’. Three analysts rate it a ‘Sell’. TWTR has a median Street price target of $16.00 with a high target of $23.00. The San Francisco, California-based company is down 43.90% year-over-year, compared with a 3.8 gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply