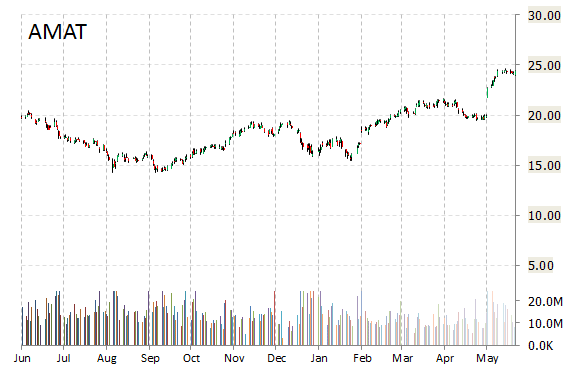

Applied Materials, Inc. (AMAT) was reiterated as ‘Sector Perform’ with a $26 from $24 price target on Friday by RBC Capital Markets.

In the past 52 weeks, Applied Materials stock has traded between a low of $14.25 and a high of $24.65 with the 50-day MA and 200-day MA located at $21.74 and $19.52 levels, respectively. Additionally, shares of AMAT trade at a P/E ratio of 22.26 and have a Relative Strength Index (RSI) and MACD indicator of 67.72 and +0.19, respectively. Applied Materials Inc. currently prints a year-to-date return of around 32.08%.

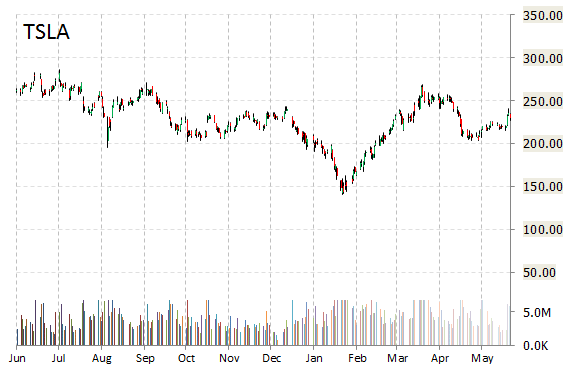

In a report published Friday, Piper Jaffray analysts initiated coverage on Tesla Motors, Inc. (TSLA) with a ‘Neutral’ rating and $223 price target.

On valuation measures, Tesla Motors Inc. shares currently have a PEG and forward P/E ratio of 5.86 and 66.33, respectively. Price/sales for the same period is 7.22 while EPS is ($7.83). Currently there are 8 analysts that rate TSLA a ‘Buy’, 4 rate it a ‘Hold’. 3 analyst rates it a ‘Sell’. TSLA has a median Wall Street price target of $279.50 with a high target of $500.00.

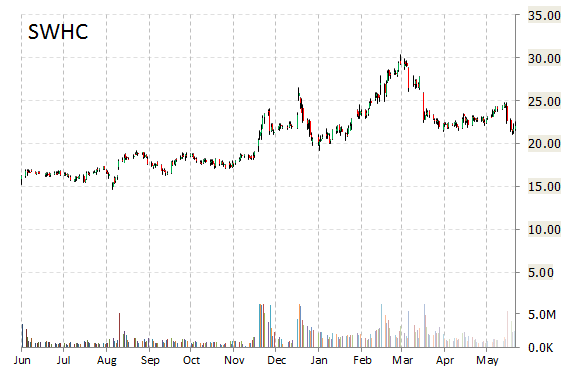

Smith & Wesson Holding Corporation (SWHC) rating of ‘Neutral’ was reiterated today at Wedbush with a price target decrease of $23 from $26 (versus a $22.01 previous close).

Right now, the stock is sitting at $21.42, a 2.68% loss, and is 0.14% higher year-to-date, compared with an 1.02% gain in the S&P 500. SWHC closed Thursday at $22.01. The company has a total market cap of 1.18B.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply