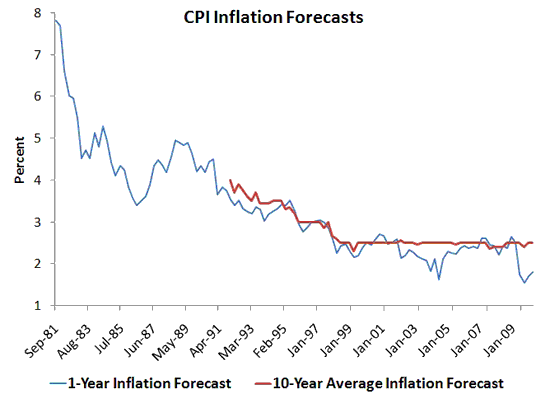

I was looking at the Philadelphia Federal Reserve Bank’s Survey of Professional Forecasters and found the CPI inflation forecasts tell some interesting stories. Below is a plot of the 1-year forecast and the 10-year average inflation forecast:

Unfortunately, the 10-year forecast data only goes back to 1991, but based on the similarities in the two forecasted series we can infer the 10-year forecast was probably elevated in the early 1980s as well. Not a terribly surprising result given the upward-trending inflation experience of the 1960s and 1970s.

What is surprising to me is that relative to where it is today, the Fed’s inflation-fighting credibility was still being earned as late as 1998. I was under the impression that Paul Volker came in and with one fell swoop earned the Fed the inflation-fighting credibility that it has today. The figure above suggests it was more of journey with inflation-fighting credibility being gradually earned over the next 17 years or so.

What is even more amazing to me is that the Fed’s inflation-fighting credibility has not been harmed by recent developments. The forecasters continue to predict a stable long-term trend inflation rate of 2.5%, roughly the same value that it has been since 1998. Given all the talk about the Fed blowing up its balance sheet and the potential of monetizing the debt this result is nothing less than amazing. It should also give pause to those inflation hawks who only see trouble on the horizon.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

They were all taught in university that government mastery of money was a feature of modern civilization. Why wouldn’t they, considering themselves intelligent socially conscious people, swallow the narrative hole?

That says nothing as to whether the Fed’s plans will work or not. That depends on their performance in a real physical world that is not as easily manipulated as the public’s awe of institutional consensus.