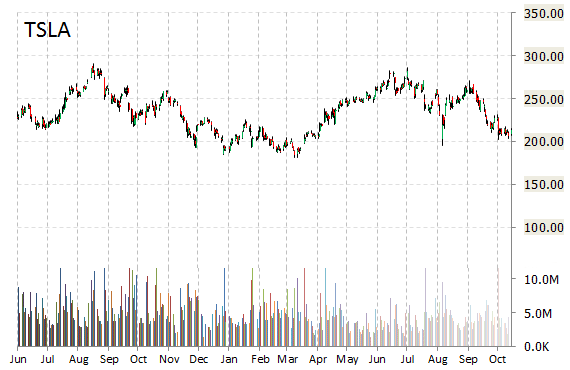

All eyes will be on Tesla Motors, Inc. (TSLA) after today’s close. Wall Street analysts are on average expecting the electric car maker to post $1.25 billion in sales during the quarter. This would show a $430 million increase from the Q215 revenue of $955 million and an increase of about $326 million from the same period in Q214. EPS in Q315 are expected to come in at a loss of ($0.60), compared to a profit of $0.02 per share a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of ($0.59) per share.

As a quick reminder, TSLA reported Q2/15 EPS of ($0.48), $0.12 better than the Street’s consensus estimate of ($0.60).

On valuation measures, Tesla Motors Inc. shares have a PEG and forward P/E ratio of -2.35 and 95.87, respectively. Price/Sales for the same period is 7.10 while EPS is ($4.14). Currently there are 7 analysts that rate TSLA a ‘Buy’, 8 rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. TSLA has a median Wall Street price target of $280 with a high target of $450.

Shares of Tesla are marginally lower to $213.25 in pre-market trading on Tuesday.

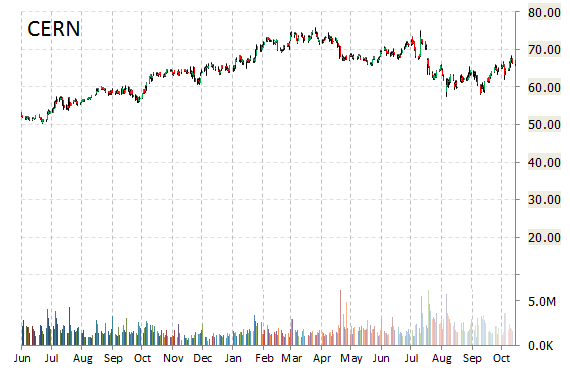

Cerner Corporation (CERN) is set to announce its Q315 earnings today after the market close. Analysts expect the healthcare IT company to report EPS of $0.55 and revenue of $1.17 billion. That would be $0.03 higher the $0.52 per share posted last quarter and $0.13 higher the $0.42 posted in the Q314. Revenue is projected to be $330 million higher than the $840 million posted in the same period a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.56 per share.

As a quick reminder, CERN reported in-line Q215 EPS of $0.52 Revenue increased 51.44% year-over-year to $1.29 billion versus the $1.2 billion consensus.

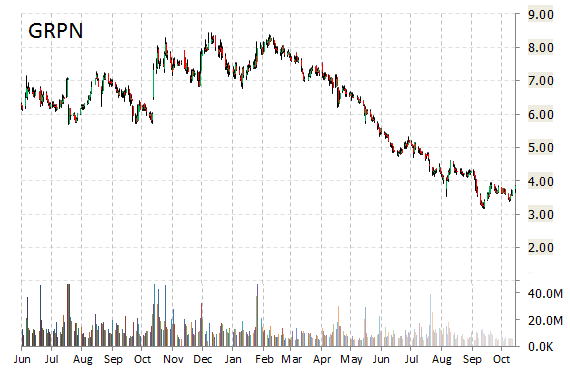

Groupon, Inc. (GRPN) is scheduled to release Q315 earnings after the close today. The Street is looking for EPS of $0.02 and revenue of $732.56 million. Last quarter, the company posted a significant negative earnings surprise of 33.33%, reporting EPS of $0.02, $0.01 lower than the Street’s consensus estimate of $0.03. Revs fell 1.76% year-over-year to $738.4 million vs the $751.6 million reported. Meanwhile, EarningsWhisper.com reports a whisper number of $0.03 per share.

Groupon shares surged 2.35% to $3.92 in early morning trading.

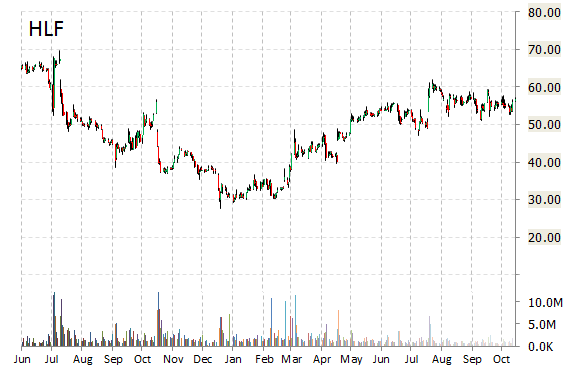

Herbalife Ltd. (HLF) is scheduled to report Q315 results after the market close today. The Street has consensus estimates of $1.06 in earnings per share and $1.16 billion in revenue. In the Q3 of the previous year, the nutrition company posted $1.45 in EPS and $1.26 billion in revenue. Meanwhile, EarningsWhisper.com reports a whisper number of $1.15 per share.

As a quick reminder, HLF reported Q215 EPS of $1.24, $0.13 better than the Street’s consensus estimate of $1.11. Revs decreased 8.40% on a YoY- basis to $1.2 billion versus the $1.14 billion consensus.

HLF was down 0.90% at $56.40 in early trade, moving within a 52-week range of $27.60 to $61.95. The name is currently valued at $5.26 billion.

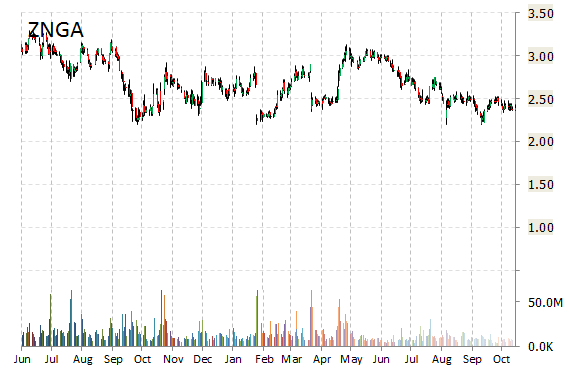

Zynga, Inc. (ZNGA) is set to announce its Q315 earnings after the market close on Tuesday. Analysts expect the operator of online social games to report earnings per share of ($0.01) and revenue of $186.45 million. Revenue is projected to be $9.85 million higher than the $176.6 million posted in the same period a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $0.01 per share.

As a quick reminder, ZNGA reported Q215 EPS of ($0.01), 1c better than the Street’s consensus estimate of ($0.02). Revs increased 30.48% year-over-year to $153.2 million versus the $156.84 million consensus.

ZNGA closed at $2.39 on Monday and is currently trading 3.77% higher at $2.48.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply