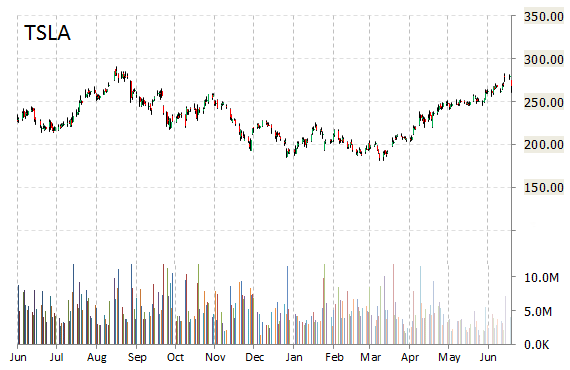

Tesla Motors, Inc. (TSLA) shares are surging 2.37% to $273.00 in pre-market trading, ahead of a press conference scheduled for 2:00 pm ET today. While topic of the call has not yet been announced, there is some speculation it could have to do with the timing of Model X, which was expected to begin delivering by the end of Q3.

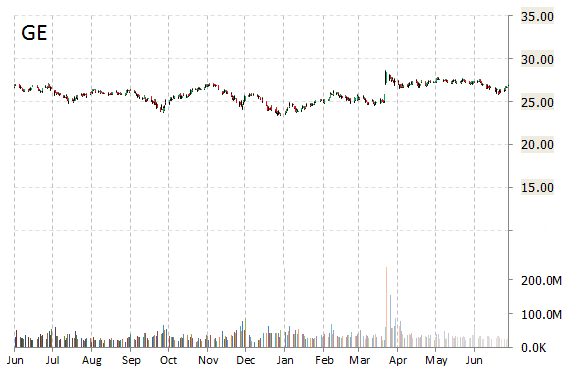

General Electric Company (GE) shares are up $0.56 to $27.60 in pre-market trading Friday after the company reported its 2015 second quarter earnings results.

The conglomerate reported earnings of $0.28 per share, in-line with analysts’ estimates, on revenues of $27.29 billion, down 1.4% from a year ago. Analysts were expecting revenues of $28.45 billion. For the three months ended June 30, GE reported a net loss of $1.36 billion, or $0.13 per share, from a profit of $3.54 billion, or $0.35 per share, a year earlier. GE said results were negatively affected by charges related to a massive pullback from its financial services businesses announced in April.

GE’s industrial profit — the core of the company that investors closely watch — edged up 5% in 2Q15 to $4.36 billion. Operating profit margin in the industrial segment also rose 0.07% to 16.2%.

For full fiscal year 2015, GE provided EPS guidance of $1.28 to $1.35 versus consensus of $1.29 per share.

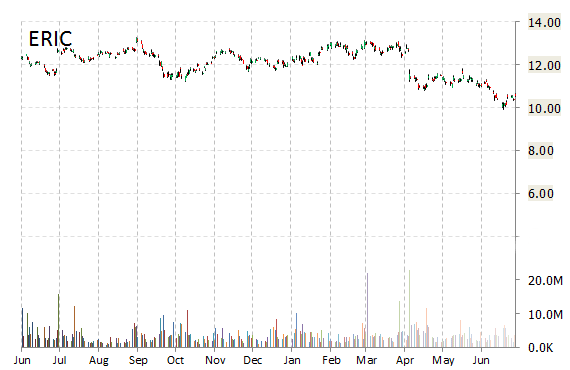

Ericsson (ERIC) reported second quarter EPS of 1.45 kronor ($0.17) before the opening bell Friday, compared to the consensus estimate of 1.53 kronor ($0.18). Revenues increased 10.8% from last year to 60.7 billion kronor ($7.1 billion). Analysts expected revenues of 57.77 billion kronor ($6.77 billion). The stock is currently up $0.56 to $11.11 on 92K shares.

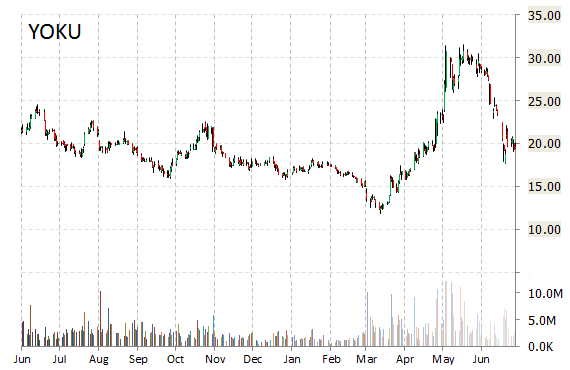

Youku Tudou Inc. (YOKU) shares are up 11.34% to $21.89 in Friday’s pre-market session. The move comes on a strong volume too with the issue currently trading more than 109K shares, compared to the average volume of 422,665 shares. Not seeing any news or rumors to account for the move.

Fundamentally, YOKU shows the following financial data:

– $1.16 billion in cash in most recent quarter

– $2.75 billion t-12 total assets

– $2.27 billion total equity

– $739.02 million t-12 revenue

– ($135.73) million annual net income

– ($85.98) million free cash flow

On valuation measures, Youku Tudou Inc. ADR shares have a T-12 price/sales ratio of 5.05 and a price/book for the same period of 1.69. EPS is ($0.98). The name has a current market cap of $3.83 billion and a median Street price target of $25.00 with a high target of $34.00. Currently there are 4 analysts that rate YOKU a ‘Buy’, 10 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’.

In terms of share statistics, Youku Tudou Inc. ADR has a total of 158.12 million shares outstanding with 8.46% held by insiders and 74.70% held by institutions. The stock’s short interest currently stands at 6.08%, bringing the total number of shares sold short to 9.27 million.

Shares of the Beijing, China-based company are down 4.33% year-over-year ; up 10.39% year-to-date.

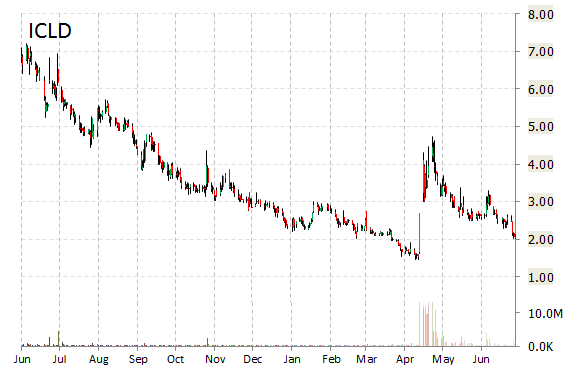

Shares of InterCloud Systems, Inc. (ICLD) are higher by nearly 9% to $2.24 in pre-market trading on Friday after announcing that it was recently awarded over $2.3 million in next-generation WiFi and DAS networks from existing and new clients. InterCloud said the work on these projects is expected to be completed between Q-3 and Q-4 of 2015.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply