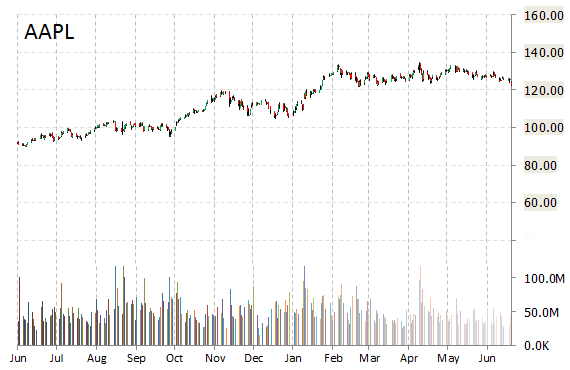

Analysts at Societe Generale are out with a report this morning upgrading shares of Apple Inc. (AAPL) with a ‘Buy‘ from ‘Hold‘ rating. The firm said it made the upgrade on recent share weakness and optimism about the launch of new iPhone versions in the fall. Price target is set at $140.

Apple Inc. shares are currently priced at 15.57x this year’s forecasted earnings, compared to the industry’s 14.82x earnings multiple. Ticker has a forward P/E of 12.87 and t-12 price-to-sales ratio of 3.35. EPS for the same period is $8.05.

In the past 52 weeks, shares of Cupertino, California-based iPhone maker have traded between a low of $92.57 and a high of $134.54 and are now at $125.27. Shares are up 31.99% year-over-year and 12.60% year-to-date.

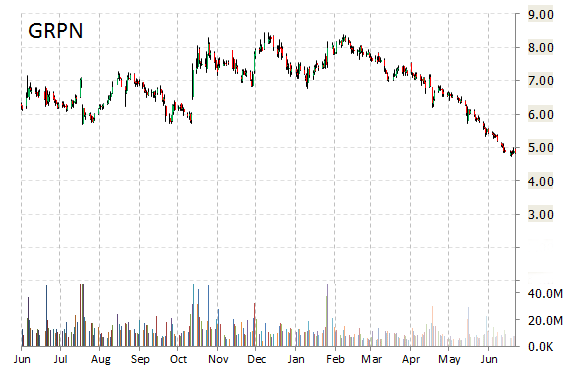

Analysts at Macquarie upgraded their rating on the shares of Groupon, Inc. (GRPN). In a research note published on Monday, the firm lifted the name with a ‘Outperform‘ from ‘Neutral‘ rating.

On valuation measures, Groupon Inc. shares have a PEG and forward P/E ratio of 1.04 and 23.27, respectively. Price/Sales for the same period is 1.02 while EPS is ($0.07). Currently there are 7 analysts that rate GRPN a ‘Buy‘, 14 rate it a ‘Hold‘. No analyst rates it a ‘Sell‘. GRPN has a median Wall Street price target of $8.00 with a high target of $12.00.

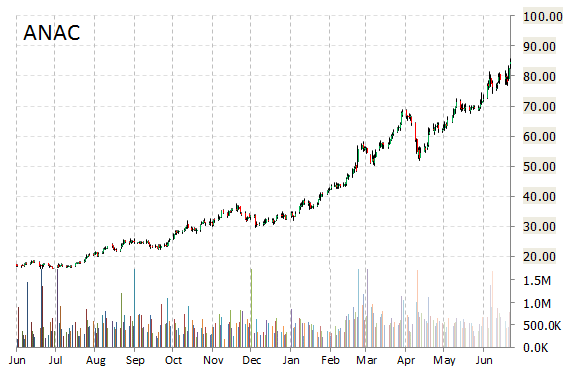

Anacor Pharmaceuticals, Inc. (ANAC) was reiterated a ‘Outperform’ by Wedbush analysts on Monday. The broker also raised its price target on the stock to $190 from $85, implying 45% expected upside from ticker’s current price.

ANAC is up $46.39 at $131.00 on heavy volume. Midway through trading Monday, 5.07 million shares of Anacor Pharmaceuticals Inc. have exchanged hands as compared to its average daily volume of 645K shares. The stock has ranged in a price between $112.72 to $134.75 after having opened the day at $113.57 as compared to the previous trading day’s close of $84.61.

Over the past year, shares of Palo Alto, California-based biopharmaceutical company have traded between a low of $15.11 and a high of $134.75. Shares are up 389% year-over-year and 162.36% year-to-date.

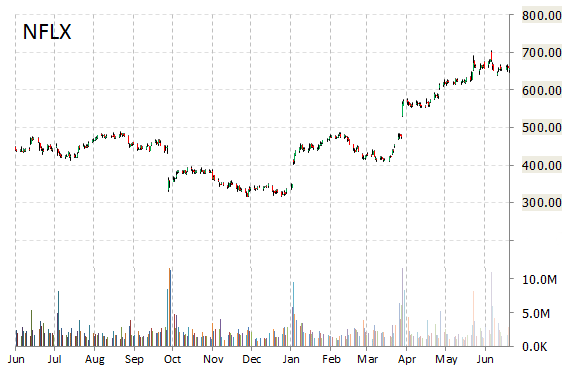

Netflix, Inc. (NFLX) was reiterated as ‘Buy’ with a $780 from $620 price target on Monday by Goldman (GS).

Netflix, Inc., currently valued at $43.28 billion, has a median Wall Street price target of $671.50 with a high target of $950. Approximately 2.80 million shares have changed hands, compared to the stock’s average daily volume of 2.86 million.

In the past 52 weeks, shares of the online video streaming provider have traded between a low of $315.54 and a high of $715.80 with the 50-day MA and 200-day MA located at $650.31 and $507.23 levels, respectively. Additionally, shares of NFLX trade at a P/E ratio of 22.33 and have a Relative Strength Index (RSI) and MACD indicator of 74.19 and +21.46, respectively.

NFLX currently prints a one year return of about 55% and a year-to-date return of around 99%.

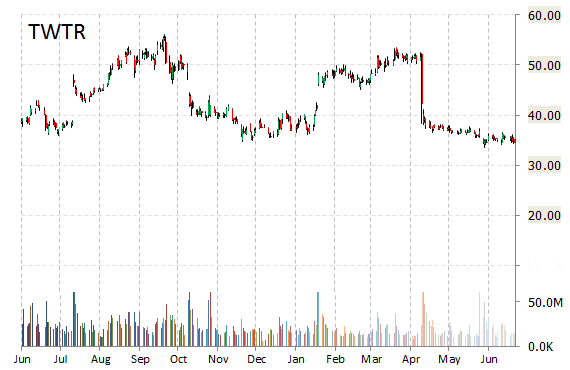

Twitter, Inc. (TWTR) rating of ‘Buy’ was reiterated today at Pivotal Research Group. Firm notes however, that while it remains positively predisposed towards Twitter’s business, its new 12-month case base estimate on the name is now $41 versus $50 previously. Twitter is certainly having have a hard time stabilizing its user metrics in the right direction and generating the ad dollars investors are looking for.

Twitter shares have declined 2.62% in the last 4 weeks and 32.79% in the past three months. Over the past 5 trading sessions the stock has lost 2.27%. The San Francisco, Calif.-based company, which is currently valued at $24.26 billion, has a median Wall Street price target of $44.00 with a high target of $60.00. Shares of Twitter, Inc. are down 7.74% year-over-year and 2.68% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply