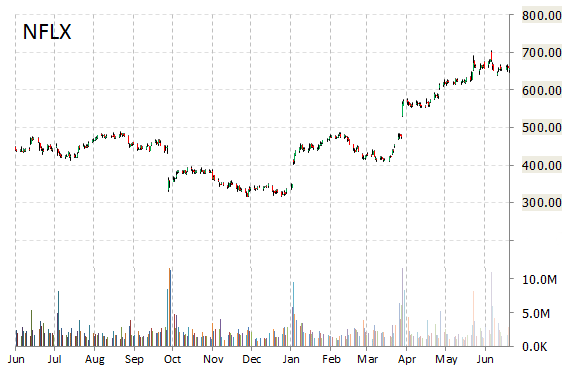

Netflix, Inc. (NFLX) price target has been raised from $600 to $750 by Nomura analysts, according to a research note published on Thursday. Nomura analysts said they forecast stronger than expected worldwide subscriber growth for the on-demand internet streaming media provider. The broker’s new price target represents a potential upside of 13% from the current share price.

NFLX shares recently gained $10.10 to $664.65. The stock is up more than 47% this year and has gained roughly 92% year-to-date. In the past 52 weeks, shares of Los Gatos, California-based company have traded between a low of $315.54 and a high of $706.24.

Netflix, Inc. closed Wednesday at $654.55. The name has a current market cap of $40.29 billion.

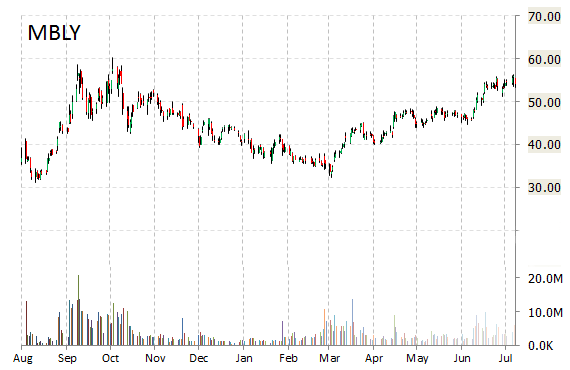

Analysts at Robert W. Baird are out with a report today upgrading shares of Mobileye N.V. (MBLY) with an ‘Outperform‘ from ‘Neutral‘ rating. The firm raised its price target for the company to $73 from $47.

In the past 52 weeks, shares of Mobileye have traded between a low of $31.11 and a high of $60.28 and are now at $57.37. Shares are up 33.43% year-to-date.

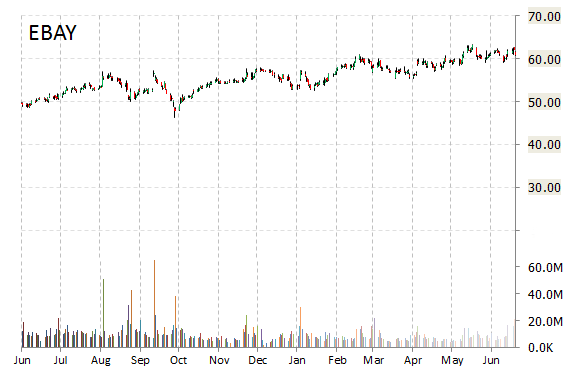

eBay Inc. (EBAY) was reiterated a ‘Buy’ by Monness Crespi & Hardt analysts on Thursday. The broker also raised its price target on the stock to $70 from $63.

EBAY shares recently gained $0.76 to $61.75. The stock is up 21.54% year-over-year and has gained roughly 9% year-to-date. In the past 52 weeks, shares of San Jose, California-based company have traded between a low of $46.34 and a high of $63.30.

eBay Inc. has a current market cap of $75.02 billion.

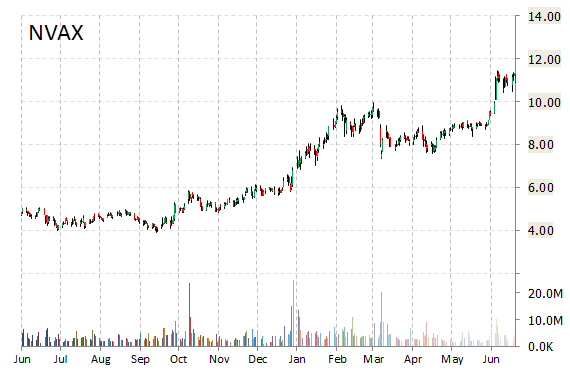

Novavax, Inc. (NVAX) was reiterated as ‘Buy’ with a $18 from $10 price target on Thursday by Citigroup (C).

NVAX shares recently gained $0.93 to $11.84. Citi’s target price suggests a potential upside of about 52% from the company’s current stock price.

In the past 52 weeks, shares of Gaithersburg, Maryland-based clinical-stage vaccine company have traded between a low of $3.92 and a high of $11.94. Shares are up 151.38% year-over-year and 83.98% year-to-date.

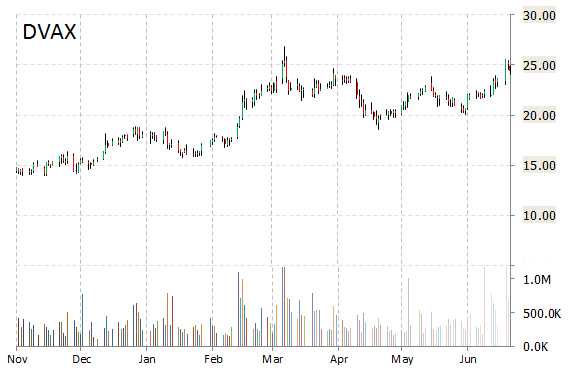

Dynavax Technologies Corporation (DVAX) had its price target raised to $35 from $25 at MLV & Co. The broker raised its price target on the stock following the company’s third independent Data and Safety Monitoring Board [DSMB] recommendation to continue phase 3 study of HEPLISAV-B(TM), an ongoing Ph 3 trial of its investigational adult hepatitis B vaccine, HEPLISAV-B.

DVAX is currently printing a higher than average trading volume with the issue trading 1.31 million shares, compared to the average volume of 454K. The stock began trading this morning at $24.69 to currently trade 10.16% higher from the prior days close of $24.42. On an intraday basis it has gotten as low as $24.69 and as high as $26.98.

The Berkeley California-based company, which is currently valued at $788.10 million, has a median Wall Street price target of $39.00 with a high target of $60.00. Dynavax Technologies Corp. is up 59.61% year-over-year, compared with a 4.17% gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply