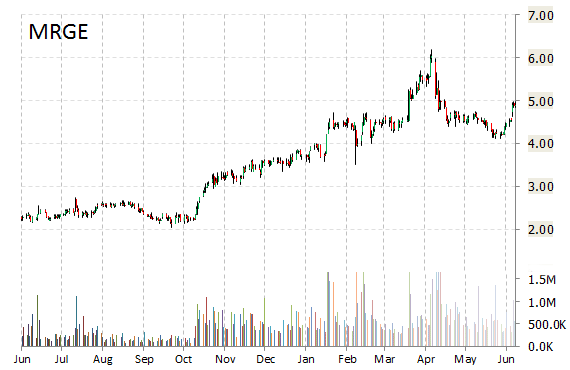

Shares of Merge Healthcare (MRGE) are up slighly ahead of the open following reports of a strategic partnership with Toshiba (TOSBF). Under the new agreement, Toshiba will offer its customers a turnkey solution, combining Merge’s cardiology PACS and hemodynamic monitoring solutions with the Toshiba portfolio of vascular x-ray systems.

“Through this partnership, our customers will get a complete solution for accessing imaging information faster to improve the patient experience and our customers’ overall business,” commented Satrajit Misra, vice president, marketing, Toshiba America Medical Systems.

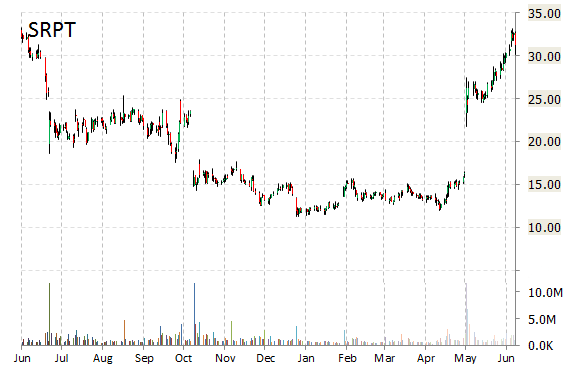

Shares of Sarepta Therapeutics, Inc. (SRPT) are up 1.54% in pre-market hours on news of NDA Submission to FDA for Eteplirsen on June 26, 2015. Eteplirsen is Serepta’s lead drug candidate that targets the underlying cause of Duchenne muscular dystrophy.

Separately, Sarepta today announced that it has entered into a credit and security agreement with Midcap Financial to establish a new $40 million senior secured term loan facility. The annual borrowing rate is set 7.75%, with a maturity of June 2018.

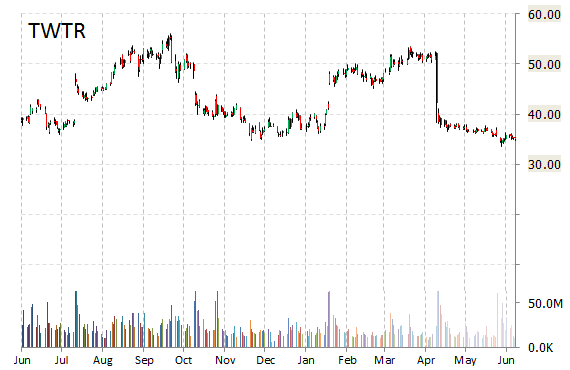

Shares of Twitter, Inc. (TWTR) lost 2.41% to $34.41 in recent trade Monday following a Re/code report that said VP of Corporate Development and Strategy Rishi Garg, who joined Twitter in May 2014, has resigned to pursue other interests. Garg announced in a tweet Friday afternoon that he was leaving, but didn’t specify where he’s headed next.

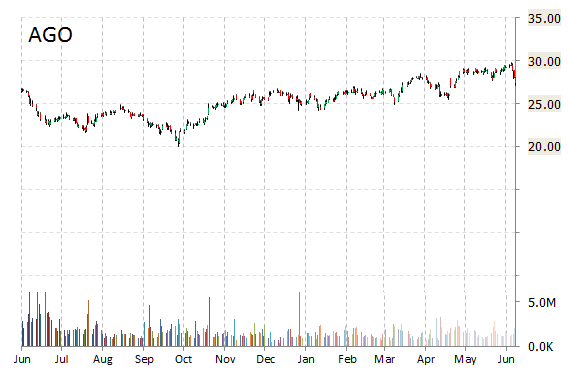

Shares of Assured Guaranty Ltd. (AGO) are down by 12.47% to $24 in pre-market trading on Monday, as the stock continues to see losses following a DealBook report that says Puerto Rico cannot pay its roughly $72 billion in debts.

Puerto Rico’s governor, Alejandro García Padilla, said in an interview last week that “The debt is not payable. There is no other option. I would love to have an easier option. This is not politics, this is math.” Separately, Assured Guaranty this morning was downgraded to ‘Neutral’ from ‘Buy’ at BTIG Research.

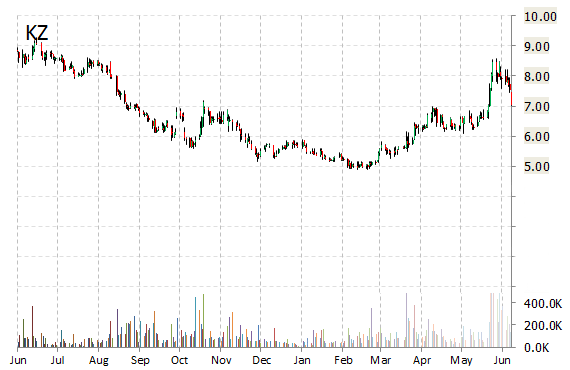

Shares of Kongzhong Corp. (KZ) are higher by nearly 10% to $7.69 in pre-market trading on Monday after the company said it has received a ‘going private’ offer from a group led by the company’s Chairman/CEO for $8.56 a share.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply