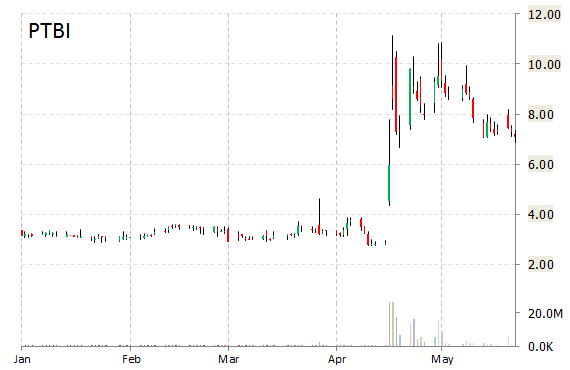

In a report published Thursday, ROTH Capital analysts initiated coverage on PlasmaTech Biopharmaceuticals, Inc. (PTBI) with a ‘Buy‘ rating and $16 price target.

On valuation measures, PlasmaTech Biopharmaceuticals Inc. shares have a t-12 price/sales ratio of 175.97. EPS is ($4.42). Currently there is only one analyst rating PTBI a ‘Buy’. No analyst rates it a ‘Hold’ or a ‘Sell’. Ticker has a median Wall Street price target of $15.00 with a high target of $15.00.

In the past 52 weeks, shares of Dallas, Texas-based company have traded between a low of $2.75 and a high of $17.50 and are now at $7.55. Shares are down 55.81% year-over-year ; up 104.93% year-to-date.

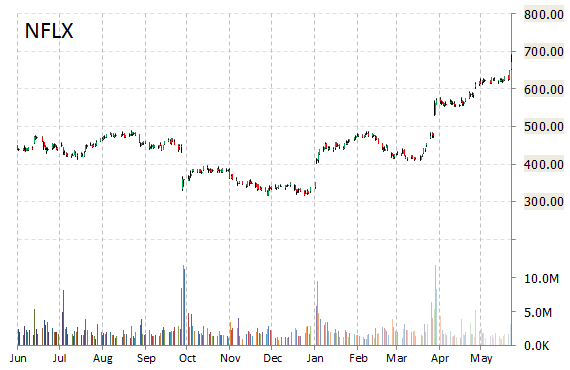

Netflix, Inc. (NFLX) was reiterated a ‘Buy’ by Topeka Capital Markets analysts on Thursday. The broker also raised its price target on the stock to $746 from $723.

Netflix Inc., currently valued at $40.16 billion, has a median Wall Street price target of $600.00 with a high target of $900.00. Approximately 2.9 million shares have already changed hands, compared to the stock’s average daily volume of 2.08 million.

In the past 52 weeks, shares of the streaming video company have traded between a low of $315.54 and a high of $692.79 with the 50-day MA and 200-day MA located at $597.84 and $458.81 levels, respectively. Additionally, shares of NFLX trade at a P/E ratio of 172.66 and have a Relative Strength Index (RSI) and MACD indicator of 75.76 and +27.51, respectively.

Netflix Inc. currently prints a year-to-date return of around 97%.

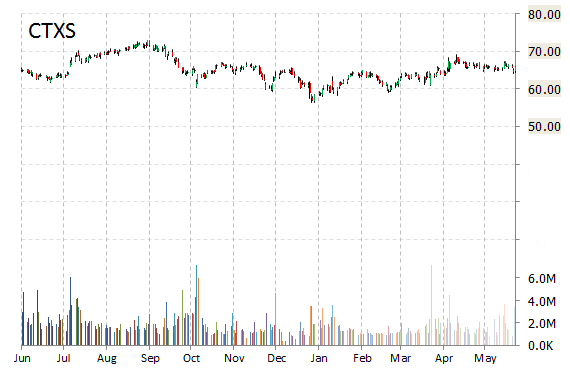

Citrix Systems, Inc. (CTXS) rating of ‘Buy’ was reiterated today at Mizuho with a price target increase of $80 from $72 (versus a $65.97 previous close). Shares of enterprise software vendor are currently up more than 7%, at $70.58, after activist investors Elliott Management, which owns a 7.1% stake in the tech company, this morning said it believes Citrix can push its stock up to $100 a share.

On valuation measures, CTXS shares are currently priced at 51.83x this year’s forecasted earnings, which makes them expensive compared to the industry’s $17.30x earnings multiple. Ticker has a forward P/E of 17.89 and t-12 price-to-sales ratio of 3.35. EPS for the same period is $1.36.

In the past 52 weeks, shares of Fort Lauderdale, Florida-based firm have traded between a low of $56.47 and a high of $72.89. Shares are up 2.84% year-over-year and 3.40% year-to-date.

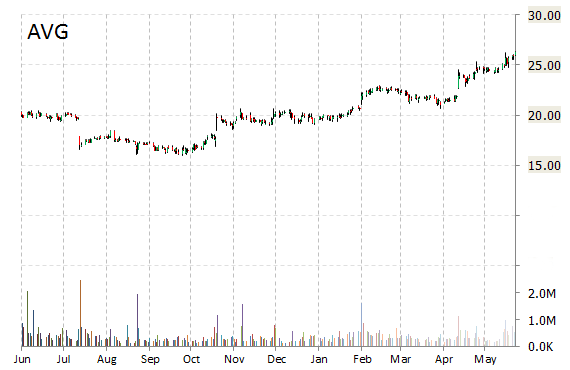

Shares of AVG Technologies N.V. (AVG) are up $1.48 to $27.73 in mid-day trading after JMP Securities reiterated its ‘Market Outperform’ rating and increased its 12-month base case estimate on the name by 14 points to $47 a share.

Over the past 12 months, shares of AVG have traded between a low of $16.00 and a high of $28.39 and are now trading at $27.67. Shares are up 34.51% year-over-year and 40.58% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply