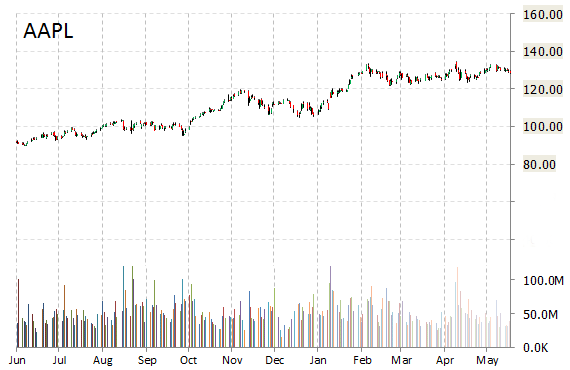

Apple Inc. (AAPL) was up $0.44, or 0.35%, to $127.86 as of 8:53 a.m. ET on news the newly announced Apple Music service is facing inquiries from the attorneys general of New York and Connecticut. The probe will center on Apple’s negotiations with music companies on its paid subscription service and whether or not music labels conspired or were pressured into favoring Apple’s paid music service.

“Competition has recently led to new and different ways for consumers to listen to music,” Matt Mittenthal, a spokesman for New York Attorney General Eric Schneiderman, said in an e-mailed statement to Bloomberg. “To preserve these benefits, it’s important to ensure that the market continues to develop free from collusion and other anticompetitive practices.”

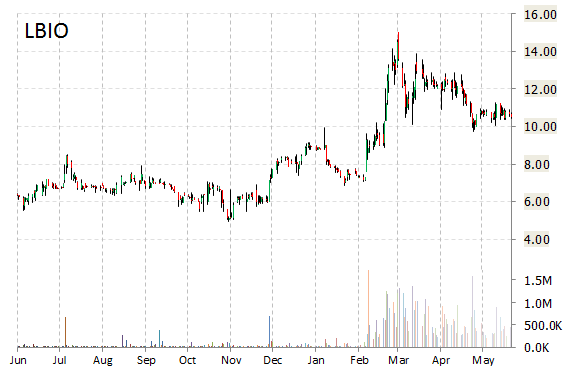

Shares of Lion Biotechnologies, Inc. (LBIO) were climbing, up 3.23% to $10.86 in pre-market trading Wednesday, after the FDA granted the company orphan status for treatment of malignant melanoma stages IIb to IV.

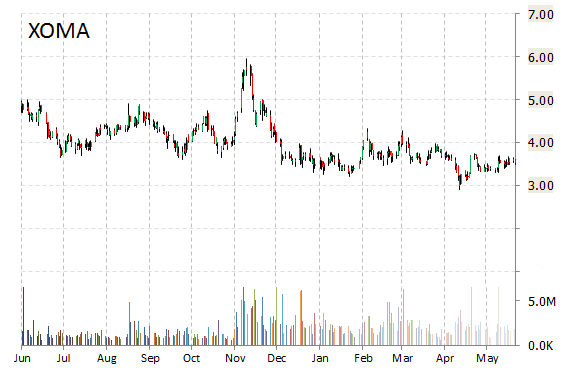

Shares of XOMA Corporation (XOMA) are higher by more than 3% to $3.65 in pre-market trading on Wednesday after the company announced that its treatment of congenital hyperinsulinism (fully human IgG2 monoclonal antibody that binds insulin receptors) was granted FDA Orphan Drug Designation.

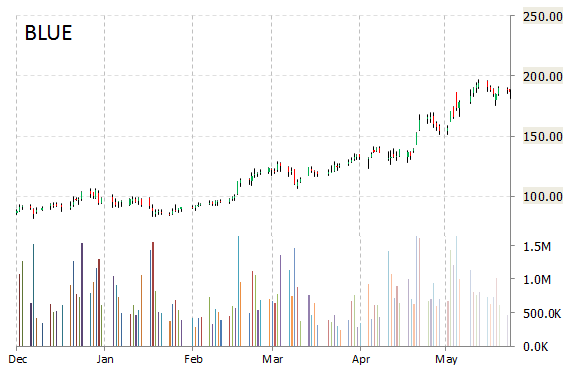

bluebird bio, Inc. (BLUE) is falling more than 3 percent to $181 as the company announced today the completion of the National Institutes of Health (NIH) Recombinant DNA Advisory Committee’s (RAC) public review of the HGB-208 pediatric study protocol for bluebird bio’s LentiGlobin BB305 product candidate in beta-thalassemia major. Recommendation was to delay the study in the U.S. for one to two years.

“We appreciate the recommendations from the RAC members regarding the HGB-208 pediatric study protocol,” stated David Davidson, M.D., chief medical officer. “We will take the RAC feedback on the timing of initiating HGB-208 under advisement as we advance the clinical development of our LentiGlobin BB305 product candidate for patients with beta-thalassemia major.

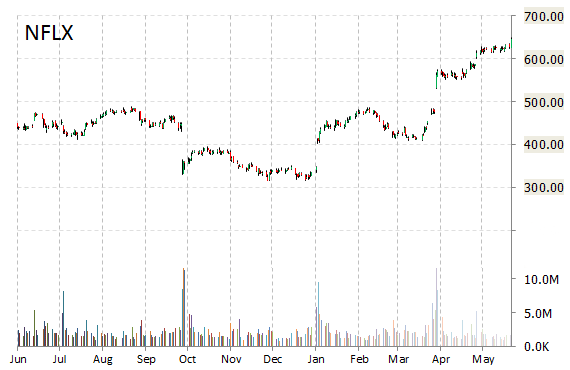

Shares of Netflix, Inc. (NFLX) are up $6.85, or over 1.06%, at $654 following the approval of a massive increase in the company’s share authorization, the precursor to a stock split. The video-streaming service won approval to raise its share authorization by nearly 30x to 5 billion from 170 million. There’s no indication yet for an exact ratio for the split of the best-performing stock in the Standard & Poor’s 500 Index.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply