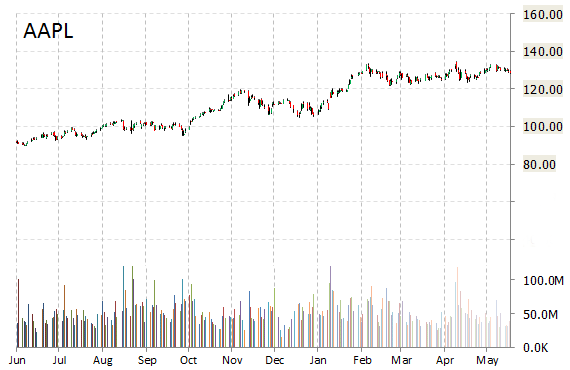

FBR Capital analysts remain postive on Apple (AAPL) following its presentations so far at WWDC. The firm notes the tech giant remains laser-focused on strong iPhone 6/China hyper growth in the near term. Separately, RBC notes that while a lot of hope was placed into AAPL launching streaming TV services, there was a lot of innovation to show how Cupertino is further extending the reach of its software across its user base. RBC sees several levers that should enable AAPL to outperform the broader markets. Price target set at $150.

AAPL shares recently lost $0.10 to $127.70. In the past 52 weeks, shares of the tech giant have traded between a low of $89.65 and a high of $134.54. Shares are up 41.01% year-over-year and 16.72% year-to-date.

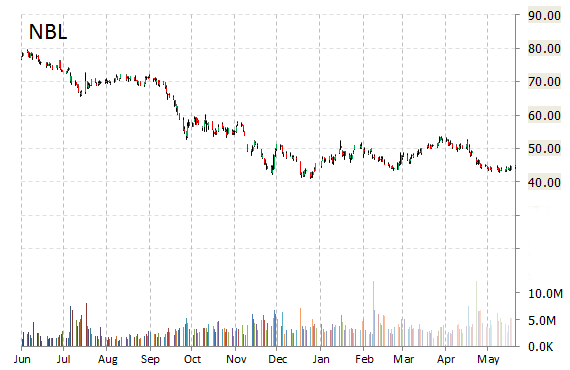

Analysts at Nomura are out with a report this morning upgrading shares of Noble Energy, Inc. (NBL) with a ‘Neutral‘ from ‘Reduce‘ rating.

Noble Energy Inc. shares are currently priced at 17.40x this year’s forecasted earnings, which makes them quite expensive compared to the industry’s 2.73x earnings multiple. Ticker has a forward P/E of 70.68 and t-12 price-to-sales ratio of 3.81. EPS for the same period is $2.65.

In the past 52 weeks, shares of Houston, Texas-based company have traded between a low of $41.01 and a high of $79.63 and are now at $46.03. Shares are down 38.80% year-over-year and 5.07% year-to-date

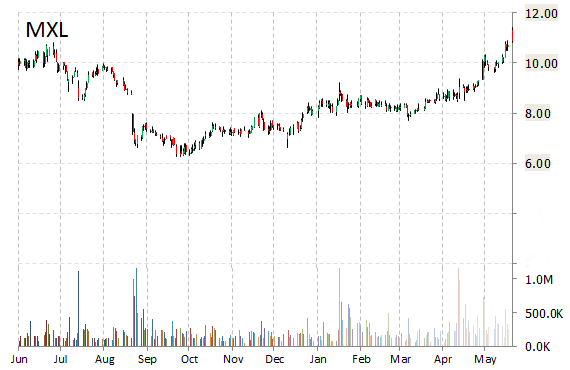

MaxLinear, Inc. (MXL) was reiterated a ‘Buy’ by Stifel analysts on Tuesday. The broker also raised its price target on the stock to $16 from $14.

On valuation measures, MaxLinear Inc. shares have a PEG and forward P/E ratio of 1.02 and 16.15, respectively. Price/Sales for the same period is 3.07 while EPS is ($0.29). Currently there are 5 analysts that rate MXL a ‘Buy‘, 2 rate it a ‘Hold‘. No analyst rates it a ‘Sell‘. MXL has a median Wall Street price target of $13.00 with a high target of $14.00.

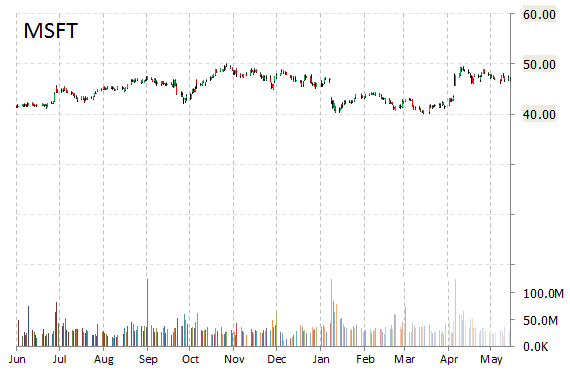

In a report published Tuesday, Wunderlich analysts initiated coverage on Microsoft Corporation (MSFT) with a ‘Hold‘ rating and $52 price target.

MSFT shares recently gained $0.10 to $45.83. The stock is up more than 13% year-over-year and has lost 0.21% year-to-date. In the past 52 weeks, shares of the software giant have traded between a low of $40.12 and a high of $50.05.

Microsoft Corporation closed Monday at $45.73. The name has a current market cap of $371.82 billion.

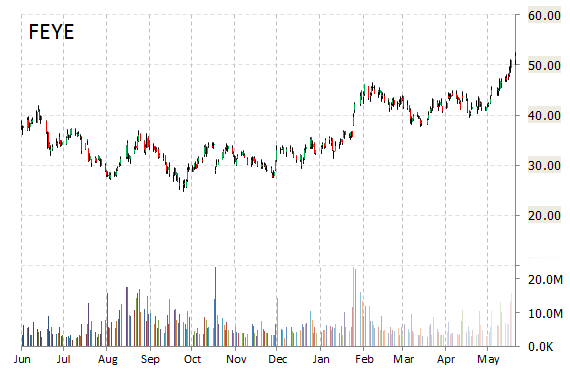

Investment analysts at Wunderlich initiated coverage on shares of FireEye, Inc. (FEYE) in a note issued to investors on Tuesday. The firm set a ‘Buy‘ rating and a $62 price target on the stock. Wunderlich’s price target would suggest a potential upside of 23% from the stock’s current price of $50.51.

FireEye Inc., currently valued at $7.90 billion, has a median Wall Street price target of $48.50 with a high target of $60.00. Approximately 4.50 million shares have changed hands, compared to the stock’s average daily volume of 6.94 million.

In the past 52 weeks, shares of Milpitas, California-based company have traded between a low of $24.81 and a high of $52.48 with the 50-day MA and 200-day MA located at $43.91 and $38.68 levels, respectively. Additionally, shares of FEYE have a Relative Strength Index (RSI) and MACD indicator of 72.80 and +3.90, respectively.

FireEye Inc. currently prints a year-to-date return of around 61%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply