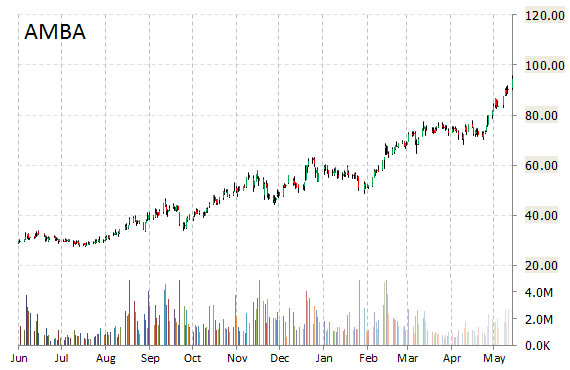

Ambarella, Inc. (AMBA) shares are up $0.44 to $92.65 in after-hours trading Tuesday after the company reported its first quarter 2016 earnings results.

The video-compression chipmaker reported earnings of $0.71 per share on revenues of $71 million, up 73.6% from $40.9 million a year ago. Analysts were expecting EPS of $0.58 on revenues of $67.1 million. Q1 gross margin on a non-GAAP basis was 64.8%, up from 62.7% a year earlier. The company’s net income for the period ended April 30, 2016 came in at $18.85 million, or $0.56 per diluted share, from $5.26 million, or $0.17 per diluted/ shr, for the same period in fiscal 2015.

“We enjoyed a strong first quarter with revenue up 73.5 percent from the same period last year,” said in a press release Fermi Wang, president and CEO of Ambarella. “In addition to continued growth from our existing wearable, IP security and automotive video recorder camera markets, we see increased activity across a wide range of home monitoring cameras including models by U.S. service providers, as well as from quadcopters or flying cameras. We look forward to continued success, as we enable the next generation of intelligent HD and Ultra HD cameras.”

Cash Position: The $2.89 billion market cap company reported $235.2 million in cash vs. $48.5 million in debt in its most recent quarter.

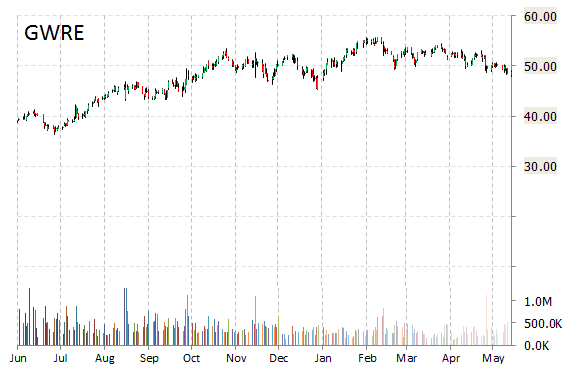

Guidewire Software, Inc. (GWRE) reported third quarter EPS of $0.04 after the closing bell Tuesday, compared to the consensus estimate of $0.05. Revenues increased 4.1% from last year to $85.4 million. Analysts expected revenues of $81.83 million. The company’s GAAP net loss for the period ended April 30, 2015 was $2.98 million, or ($0.04) per share (diluted), compared with a net loss of $1.91 million, or $0.03 per share for the comparable period in fiscal 2014.

“Our third quarter results were at or above the high end of our outlook due to the continued adoption of Guidewire InsuranceSuite and momentum for our newer products,” stated Marcus Ryu, chief executive officer, Guidewire Software. “Our results reflect our continuing efforts to leverage our system integrator partners, who are successfully scaling our implementation capacity and delivering customer success, as demonstrated by the numerous production go-lives achieved in the quarter.”

Cash – As of April 30, 2015, Guidewire’s cash, cash equivalents were $643.8 million, compared to $647.8 million as of July 31, 2014

The stock is currently down $2.35 to $45.05 on 729K shares.

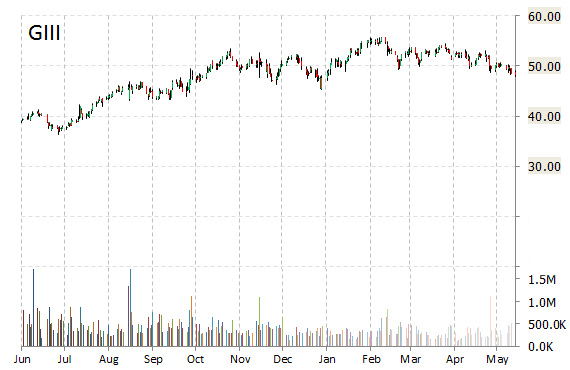

G-III Apparel Group, Ltd. (GIII) rose $3.31 to $63.40 in after-hours trading after it reported fiscal results for the first quarter of 2016.

In its quarterly report, the clothing and accessories maker said it earned $0.15 per share, well above the $0.07 per share analysts were expecting. Revenue rose 18.2% to $433 million, above views for $405.8 million. Net income came in at $6.8 million, or $0.15 per diluted share, as compared to $1.3 million, or $0.03 per diluted share, in the prior year’s comparable period.

Looking ahead, the company guided Q2/16 revenues of $470 million, as compared to analysts’ expectations of $467.77 million. The management also gave its bottom line range of $0.15 – $0.20 per share, against projections of $0.19 per share. For full fiscal 2016, EPS is expected to be in the range of $2.66 – $2.76 per share, with revenue forecasted to be $2.4 billion.

On valuation measures, G-III Apparel Group Ltd. shares, which currently have an average 3-month trading volume of 264K shares, trade at a trailing-12 P/E of 24.18, a forward P/E of 19.32 and a P/E to growth ratio of 1.25. The median Wall Street price target on the name is $64.00 with a high target of $67.00. Currently ticker boasts 6 ‘Buy’ endorsements, compared to 2 ‘Holds’ and no ‘Sell’.

Profitability-wise, GIII has a t-12 profit and operating margin of 5.21% and 7.79%, respectively. The $2.70 billion market cap company reported $85.7 million in cash vs. $0 in debt in its most recent quarter.

GIII currently prints a one year return of about 59% and a year-to-date return of 15.18%.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply