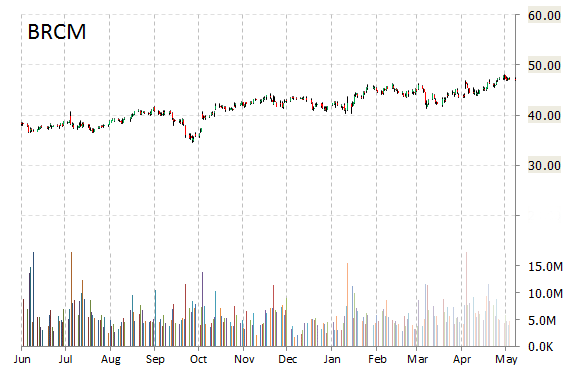

Shares of Broadcom Corp. (BRCM) are up $10.09, or 21.45%, at $57.15, after the company this morning said it will be acquired by Avago Tech (AVGO) for $37 billion. Avago is offering Broadcom shareholders $17 billion in cash and AVGO shares valued at $20 billion. The transaction is expected to be immediately accretive to Avago’s non-GAAP EPS and free cash flow.

“This transaction benefits all of Broadcom’s key stakeholders,” stated Scott McGregor, President and CEO of Broadcom. “Our customers will gain access to a greater breadth of technology and product capability. For our shareholders, the transaction provides both compelling up-front value as well as the opportunity to participate in the future upside of the combined business.”

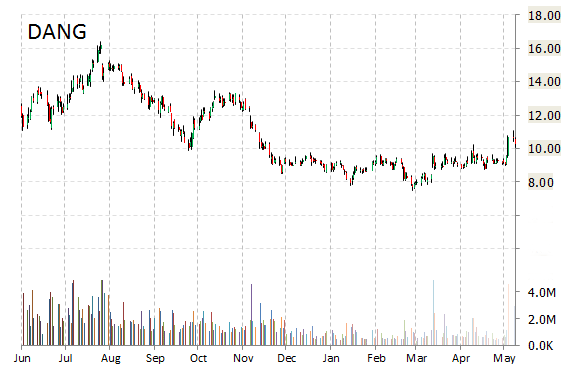

E-Commerce China Dangdang Inc. (DANG) shares are down more than 12% to $9.00 in pre-market trading Thursday after the company reported its first quarter earnings results.

The business-to-consumer e-commerce firm reported earnings of ($0.12) per share on revenues of $357.7 million, up 28.1% from a year ago. Analysts were expecting EPS of $0.03 on revenues of $356.06 million. Q1/15 gross margin was 15.2%, down from 18.2% a year earlier.

Dangdang said it had over 10 million active customers including approximately 4.1 million new customers in the first quarter of 2015, representing increases of 18% and 46%, respectively, from the corresponding period in 2014.

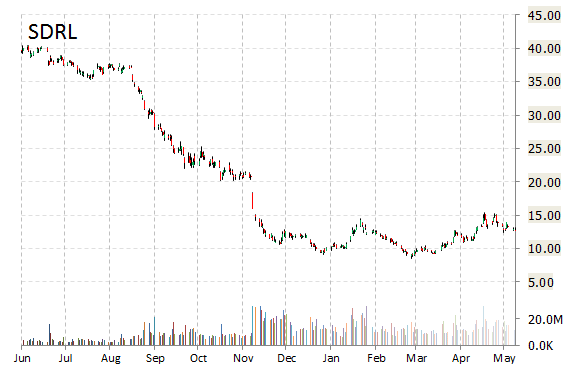

SeaDrill Limited (SDRL) reported first quarter EPS of $0.86 before the opening bell Thursday, compared to the consensus estimate of $0.64. Revenues increased 1.9% from last year to $1.24 billion. Analysts expected revenues of $1.26 billion. Net income came in at $448 million, or $0.86 per share (basic & diluted).

Balance sheet/Cash flow: As of March 31, 2015, the company reported total assets of $25.8 billion, a decrease of $687 million compared to the previous quarter. Cash and cash equivalents were $903 million, an increase of $72 million year-over-year.

Separately, the Board of SeaDrill announced that Mark Morris will be joining the company as Chief Financial Officer (CFO) commencing September 1, 2015. Mr. Morris was most recently CFO for Rolls-Royce Group plc.

The stock is currently down $0.43 to $12.30 on 72K shares.

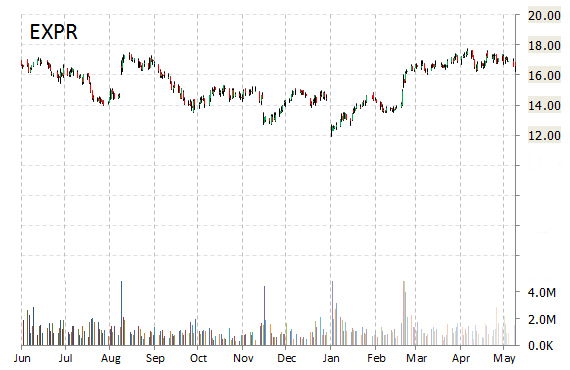

Express Inc. (EXPR) rallied $1.58, or 8.60%, to $18.20 in pre-market trading after it reported fiscal-first quarter earnings.

The clothing and accessories chain handed in earnings of $0.15 per share on revenue of $502.4 million, up 9% from $460.7 million yoy, beating Wall Street estimates of $0.14 per share on revenue of $487.8 million. Q1/15 earnings came in at $13.1 million.

David Kornberg, the company’s President and CEO, stated that, “2015 is off to a strong start. In the first quarter, comparable sales rose by 7% and our merchandise margin expanded by 200 basis points, driving earnings above our initial expectations.”

For Q2/15, EXPR provided EPS guidance of $0.13-$0.16 versus consensus of $0.12 per share.

On valuation measures, Express Inc. shares, which currently have an average 3-month trading volume of 1.3 million shares, trade at a trailing-12 P/E of 20.52, a forward P/E of 13.85 and a P/E to growth ratio of 0.83. The median Wall Street price target on the name is $18.00 with a high target of $21.00. Currently ticker boasts 9 ‘Buy’ endorsements, compared to 7 ‘Holds’ and 1 ‘Sell’.

Profitability-wise, EXPR has a t-12 profit and operating margin of 3.16% and 6.81%, respectively. The $1.40 billion market cap company reported $127.7 million in cash vs. $511 million in total liabilities in its most recent quarter.

EXPR currently prints a one year return of 18.38% and a year-to-date return of 13.14%.

The chart below shows where the equity has traded over the last 52 weeks.

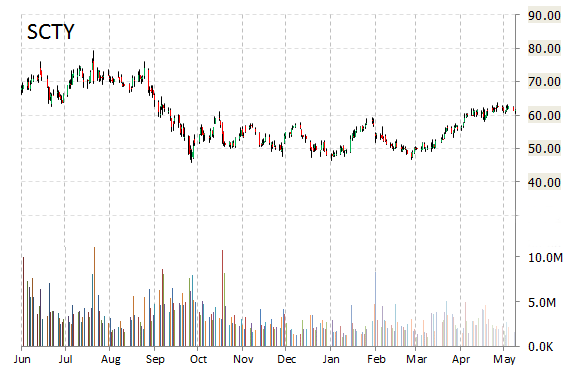

SolarCity Corp (SCTY) today announced the creation of a renewable energy tax equity investment program with Bank of America (BAC) and the closing of the first financing in the program. The company said the tax equity investment program will facilitate first-time and smaller investors entering the renewable energy tax equity credit market and offer investment tranches of $20-$25 million.

The stock is down $0.04 pre-market to $61.40.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply