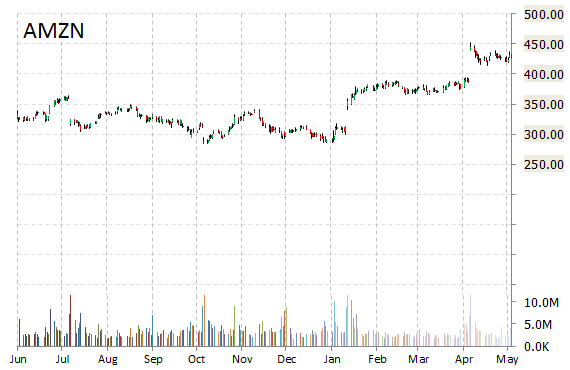

Shares of Seattle, Washington-based Amazon.com Inc. (AMZN) are up in after-hours trading Tuesday after the e-commerce giant said it is hiring more than 6,000 full-time jobs across its U.S. fulfillment network to meet growing customer demand.

“We’re proud to be creating more than 6,000 full-time positions where employees will interact with state-of-the-art technology as part of their day-to-day roles,” commented Mike Roth, Amazon’s VP of North America operations. Employees will pick, pack and ship customer orders.

Shares in the $198.13 billion market cap company are up 40.25% year-over-year and off about 6% from their April 24, 2015, $452.65 52-week high.

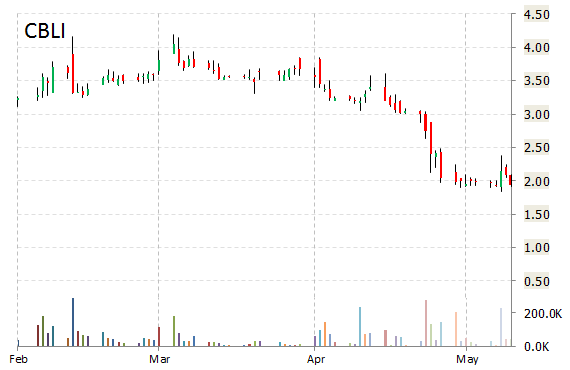

Shares of Cleveland BioLabs, Inc. (CBLI) continue to surge in the extended session Tuesday, up 7.08% at $3.48. Strength being attributed to a positive story ahead of the company’s poster presentation Saturday, May 30 on entolimod at the American Society of Clinical Oncology in Chicago, Ill.

CBLI shares are currently priced at 5.39x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.79. EPS for the same period registers at $0.60.

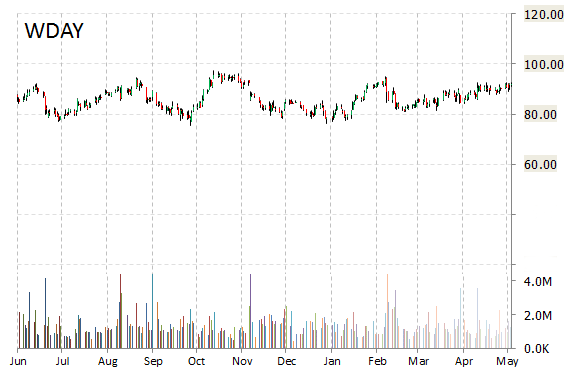

Workday, Inc. (WDAY) reported first quarter 2016 EPS of ($0.02) after the closing bell Tuesday, compared to the consensus estimate of ($0.08). Revenues increased 57.2% from last year to $251 million. Analysts expected revenues of $244.70 million. The maker of human resources software reported a net loss of $61.6 million, or $0.33 per share (basic and diluted) for the fiscal first quarter ended April 30, 2015 compared to $59.3 million, or $0.32/shr a year earlier

“We are very pleased with our solid first quarter results,” stated Mark Peek, chief financial officer, Workday. “We generated record quarterly revenues and [$174.4 million] trailing twelve month operating cash flows.”

Looking ahead, the company anticipates total revs for 2Q of $270 – $274 million, compared to the consensus revenue estimate of $272.1 million.

Cash Position: The $17.52 billion market cap company reported $1.9 billion in cash as of April 30, 2015.

The stock is currently down $5.37 to $87.12 on 3.88 million shares.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply