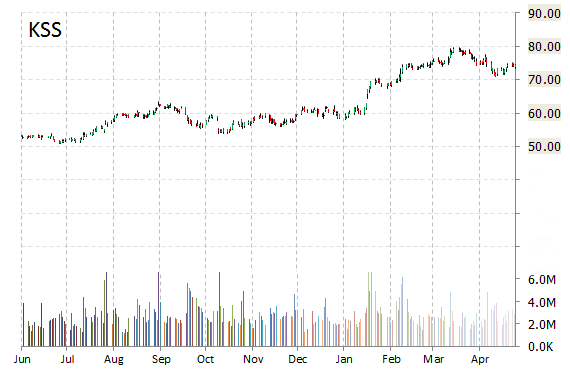

Kohl’s Corp. (KSS) shares are down $7.38 to $67.13 in pre-market trading Thursday after the company reported its first quarter earnings results.

The department store operator posted earnings of $0.63 per share on revenues of $4.12 billion, up 1.3% from a year ago. Analysts were expecting EPS of $0.55 on revenues of $4.20 billion. Q1/15 gross margin was 36.9%, fractionally higher from 36.8% a year earlier. The company’s net income for the period came in at $127 million, or $0.63 per diluted share, from $125 million, or $0.60 per diluted share, a year earlier.

Kevin Mansell, Kohl’s chairman, CEO and president, said, “Sales were modestly below our original expectations for the quarter, but accelerated in the March/April combined period after a weak February. We are very pleased with our earnings results, with a more balanced promotional calendar driving merchandise margin combined with strong expense control.”

Kohl’s opened two new stores during Q1/15. The Miami, Florida-based company now operates 1,164 stores in 49 states, compared with 1,160 stores at the same time last year.

Cash – As of May 2, 2015, Kohl’s cash and cash equivalents were $1.19 billion, compared to $717 million as of May 3, 2014. The $15.11 billion market cap company reported $2.8 billion in debt in its most recent quarter. Separately, on May 13 Kohl’s Board of Directors declared a quarterly cash dividend of $0.45 per share. The dividend is payable June 24, 2015 to shareholders of record at the close of business on June 10, 2015.

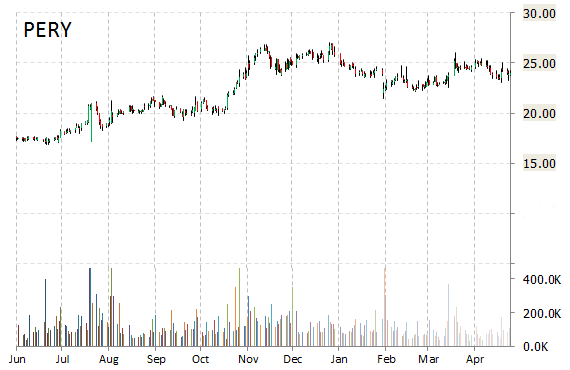

Perry Ellis International Inc. (PERY) reported fiscal 2016 first-quarter non-GAAP EPS of $0.99 before the opening bell Thursday, compared to the consensus estimate of $0.63. Revenues increased 3.4% from last year to $258.3 million. Analysts expected revenues of $263 million. GAAP net income for Q1/16 was $9.4 million, or $0.62 per share (diluted), compared to GAAP net income of $7.8 million, or $0.52 per share in the first quarter of 2014. Adjusted gross margin expanded to 34.9% as compared to 34.1% in the same period of the prior year.

Oscar Feldenkreis, President and Chief Operating Officer of Perry Ellis, commented, “We had a strong start to the year highlighted by growth in net revenues, expansion in gross margin and a significant increase in adjusted earnings per share, as compared to the first quarter last year. Our results reflect the success of our strategy to expand core brands and higher margin businesses.”

For full year 2016, the clothing maker provided EPS guidance of $1.68 – $1.75 versus consensus of $1.49 per share. The company also issued revenue projection of $925 – $935 million, compared to the consensus revenue estimate of $930.67 million.

The stock is currently up $3.05 to $27.12 on more than 2,400 shares.

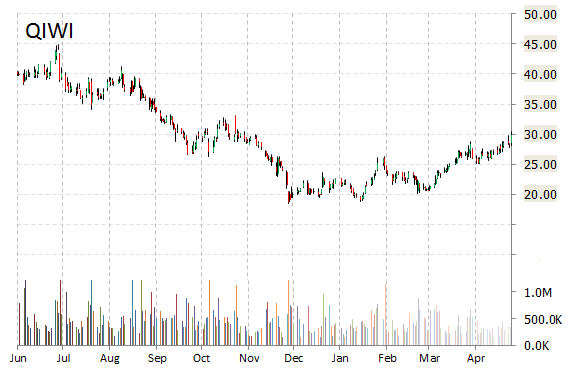

Qiwi plc (QIWI) shares are up $1.18 to $31.06 in pre-market trading Thursday after the company reported its first quarter earnings results.

The electronic online payment systems operator posted earnings of $20.29 per share on revenues of $2.52 billion, up 34.0% from a year ago. Analysts were expecting EPS of $16.73 on revenues of $2.30 billion.

“I am very pleased with our solid first-quarter results,” said in a press release Sergey Solonin, QIWI’s chief executive officer. “Despite the general macroeconomic slowdown, we continued to deliver strong financial and operational results. We see plenty of opportunities ahead, especially in gaining market share in the key verticals, and will continue to focus on our core market verticals and execute our strategy.”

On valuation measures, Qiwi plc ADS shares, which currently have an average 3-month trading volume of 402K shares, trade at a trailing-12 P/E of 9.99, a forward P/E of 0.36 and a P/E to growth ratio of 0.98. The median Wall Street price target on the name is $28.70 with a high target of $42.00. Currently ticker boasts 9 ‘Buy’ endorsements, compared to 4 ’Holds’ and 1 ‘Sell’.

Profitability-wise, Qiwi has a t-12 profit and operating margin of 34.13% and 27.25%, respectively. The $1.63 billion market cap company reported $198.6 million in cash vs. $39.5 million in long-term debt instruments in its most recent quarter.

QIWI currently prints a one year loss of 6.32% and a year-to-date return of around 48%.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply