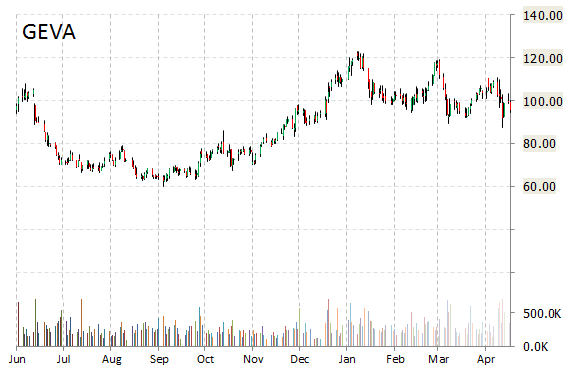

Shares of Synageva BioPharma Corp. (GEVA) are surging $119, or 125%, to $215.16 in early trading on Wednesday after the company announced its $8.4-billion acquisition by Alexion Pharmaceuticals (ALXN). Alexion said it will pay $115 in cash and a portion of its stock for each Synageva share. That puts the total per-share price at $230 a share, based on Alexion’s average closing price for the past nine days, and is more than twice Synageva’s closing price of $95.87 on Tuesday.

The transaction, which is expected to be accretive to Alexion’s non-GAAP EPS in FY/18, has been unanimously approved by both companies’ Boards of Directors.

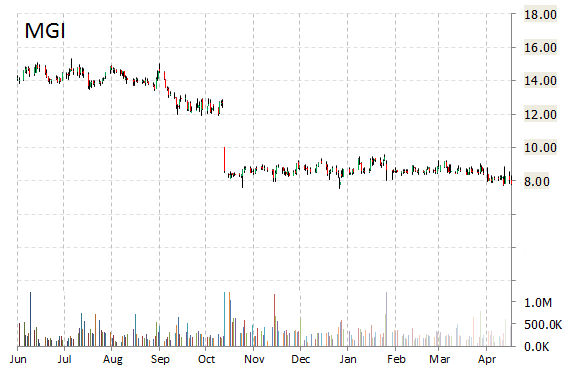

Moneygram International Inc. (MGI) shares are up 23% to $9.54 after Wednesday’s open following news Western Union (WU) is in early talks to buy the company.

MoneyGram has a currently a market cap of $519 million. According to Bloomberg, in an acquisition Western Union would also have to take on about $960 million of debt. The report notes however, that talks may still fall apart.

Update: Western Union today issued the following statement:

“Although our policy is not to comment on market rumors or speculation, and that continues to be our policy on a going forward basis, in view of the high level of market activity in our stock today, Western Union states that current news reports indicating that our company is in discussions to acquire MoneyGram International, Inc. are not accurate.”

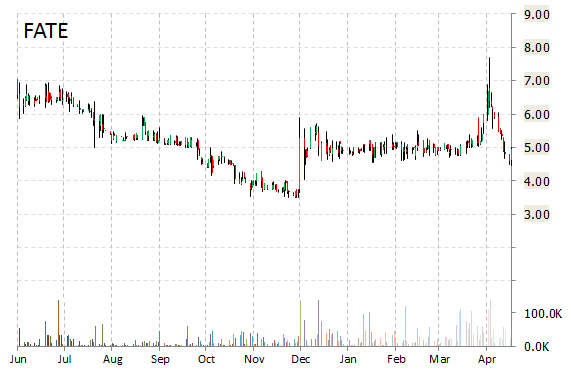

Fate Therapeutics, Inc. (FATE) shares spiked 39% to $6.94 in early trading. Juno Therapeutics (JUNO) and Fate announced today a strategic research collaboration to improve the therapeutic profile of engineered T cell Immunotherapies.

“A deep understanding of T cell biology is the basis of Juno’s approach to creating best-in-class cellular immunotherapies,” said in a press release Hans Bishop, Chief Executive Officer of Juno Therapeutics. “Partnering with Fate Therapeutics, and accessing its strong science and leading platform for modulating the properties of immunological cells, enables interrogation of new avenues of T cell manipulation and provides an opportunity to enhance the therapeutic profile of our genetically-engineered T cell product candidates.”

Financial terms of the agreement include an upfront payment to Fate of $5 million and the purchase by Juno of one million shares of Fate common stock at $8.00 per share. Juno will fund all mutual collaboration activities for an exclusive four-year research term.

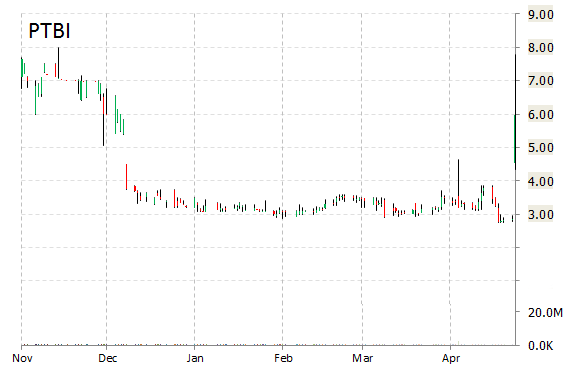

PlasmaTech Biopharmaceuticals, Inc. (PTBI) stock was exploding higher by more than 66% Wednesday after the company announced agreement to acquire Abeona Therapeutics LLC, a company engaged in the development and commercialization of therapies for patients with lysosomal storage diseases. Under the terms of the deal, PlasmaTech will issue to Abeona Therapeutic members a total of 3,979,761 common shares upon closing of the transaction, and up to an additional $9 million in performance milestones, in common stock or cash, at the company’s option.

PlasmaTech’s trading volume jumped on the news with the issue currently trading more than 17 million shares, compared to the average volume of 1.1 million.

PTBI’s shares have advanced 87.15% in the last 4 weeks and 89.52% in the past three months. Over the past 5 trading sessions the stock has gained 84.26%. Shares of PlasmaTech Biopharmaceuticals, Inc. are up 73.04% this year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply