Facebook, Inc. (FB) shares are down $1.79 to $82.84 in after-hours trading Wednesday after the company reported its first quarter earnings results.

The social media company reported earnings of $0.42 per share on revenues of $3.54 billion, up 41.6% from a year ago. Analysts were expecting EPS of $0.40 on revenues of $3.56 billion. For the current quarter, net income was $509 million, or $1.18 per share, down 20% compared to $642 million, or $0.25 per diluted share, in the first quarter of 2014.

“This was a strong start to the year,” said Mark Zuckerberg, Facebook founder and CEO. “We continue to focus on serving our community and connecting the world.”

On valuation measures, Facebook Inc. Cl A shares, which currently have an average 3-month trading volume of 24.14 million shares, trade at a trailing-12 P/E of 76.11, a forward P/E of 32.67 and a P/E to growth ratio of 1.53. The median Wall Street price target on the name is $92.00 with a high target of $107.00. Currently ticker boasts 39 ‘Buy’ endorsements, compared to 6 ’Holds’ and 1 ‘Sell’.

Profitability-wise, FB has a t-12 profit and operating margin of 23.58% and 39.97%, respectively. The $236.88 billion market cap company reported $12.41 billion in cash in its most recent quarter. Capex were $502 million.

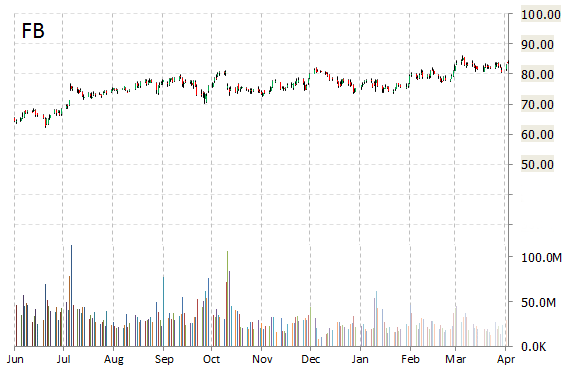

FB currently prints a one year return of 36.54% and a year-to-date return of around 7.18%.

The chart below shows where the equity has traded over the last 52 weeks.

eBay Inc. (EBAY) reported first quarter non-GAAP EPS of $0.77 after the closing bell Wednesday, compared to the consensus estimate of $0.70. Revenues increased 4.4% from last year to $4.45 billion. Analysts expected revenues of $4.42 billion. Gaap net income rose to $626 million, or 51 cents per share, in the first quarter ended March 31, from a loss of $2.32 billion, or $1.82 per share, a year earlier. The stock is currently up $2.53 to $59.28 on 9.45 million shares.

“We had a strong first quarter, with eBay and PayPal off to a good start for the full year,” said in a statement eBay Inc. President and CEO John Donahoe. “I feel very good about the performance of our teams at eBay and PayPal. Each business is executing well with greater focus and operating discipline as we prepare to separate eBay and PayPal into independent publicly traded companies. We are moving forward with clarity and speed, with a smooth separation expected in the third quarter.

PayPal net total payment volume grew 18% in the first quarter to $61 billion. Revenue increased $2.1 billion.

For Q2/15, EBAY provided EPS guidance of $0.71 – $0.73 versus consensus of $0.71 per share. The company also issued revenue projection of $4.4 – $4.5 billion, compared to the consensus revenue estimate of $4.58 billion.

Profitability-wise, EBAY has a t-12 profit and operating margin of 0.26% and 19.83%, respectively. The $68.67 billion market cap company reported $14.1 billion in cash in its most recent quarter.

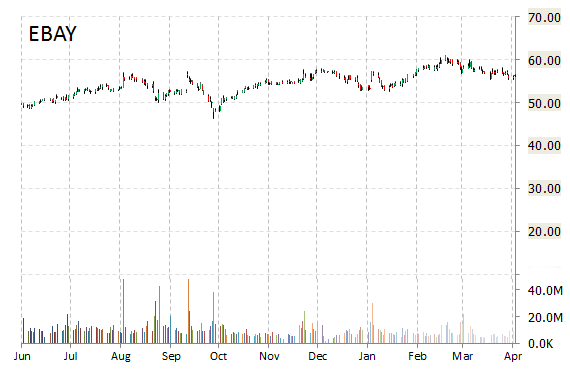

EBAY currently prints a one year return of 2.71% and a year-to-date return of 0.53%.

Shares of Qualcomm Incorporated (QCOM) are down $1.49 to $67.45 after the company released its earnings results on Wednesday. The chipmaker reported Q2’15 EPS of $1.40 per share vs. $1.33 consensus on $6.89 billion in revenue, up 8.2% from a year ago. Q2 net income attributable to Qualcomm fell to $1.05 billion, or $0.63 per share, compared to $1.96 billion, or $1.14 per share, a year earlier.

For the fiscal third quarter, the company guided revenues of $5.4 – $6.2 billion, as compared to analysts’ expectations of $6.47 billion. The management also gave its bottom line range of $0.85 – $1.00 per share, against projections of $1.14 per share.

Qualcomm said the lower forecast is due to reduced sales of its Snapdragon mobile processors. The company also cited an “increased impact of customer share shifts within the premium tier and a decline in our share at a large customer.”

On valuation measures, Qualcomm Inc. shares, which currently have an average 3-month trading volume of 13.65 million shares, trade at a trailing-12 P/E of 14.57, a forward P/E of 12.72 and a P/E to growth ratio of 1.31. The median Wall Street price target on the name is $76.00 with a high target of $88.00. Currently ticker boasts 18 ‘Buy’ endorsements, compared to 16 ’Holds’ and 1 ‘Sell’.

Profitability-wise, QCOM has a t-12 profit and operating margin of 29.91% and 30.47%, respectively. The $113.72 billion market cap company reported $29.6 billion in cash in its most recent quarter.

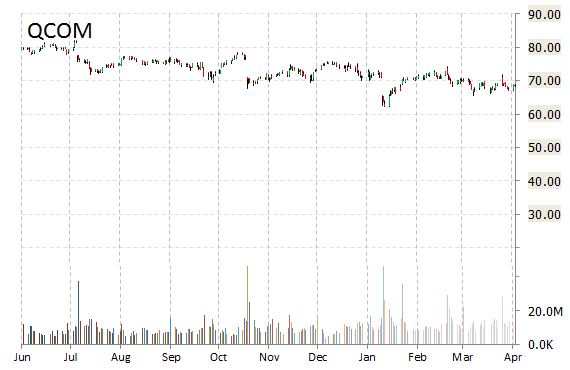

QCOM currently prints a one year loss of about 14% and a year-to-date loss of around 7%.

O’Reilly Automotive Inc. (ORLY) rallied $8.83 to $225.50 in after-hours trading after it reported fiscal-first quarter earnings.

The automotive aftermarket parts retailer handed in earnings of $2.06 per share on revenue of $1.90 billion, beating Wall Street estimates of $1.93 per share on revenue of $1.85 billion. Q1/15 GAAP net income increased 22% to $213 million, or $2.06 per share, from $174 million, or $1.61/shr for the same period one year ago.

Commenting on the company’s first quarter results, President and CEO Greg Henslee stated, “We are extremely proud to once again report another profitable quarter and a very successful start to 2015. Demand in our industry remained strong throughout the quarter, and our relentless focus on providing unsurpassed levels of service to our customers yielded a very strong 7.2% increase in comparable store sales, which was on top of an increase of 6.3% in the first quarter of 2014.

For Q2/15, ORLY provided EPS guidance of $2.17 – $2.21 versus consensus of $2.25 per share.

On valuation measures, O’Reilly Automotive Inc. shares, which currently have an average 3-month trading volume of 539K shares, trade at a trailing-12 P/E of 29.52, a forward P/E of 22.34 and a P/E to growth ratio of 1.63. The median Wall Street price target on the name is $220 with a high target of $245. Currently ticker boasts 11 ‘Buy’ endorsements, compared to 12 ’Holds’ and 1 ‘Sell’.

Profitability-wise, ORLY has a t-12 profit and operating margin of 10.78% and 17.61%, respectively. The $22 billion market cap company reported $473.64 million in cash vs. $1.39 billion in debt in its most recent quarter.

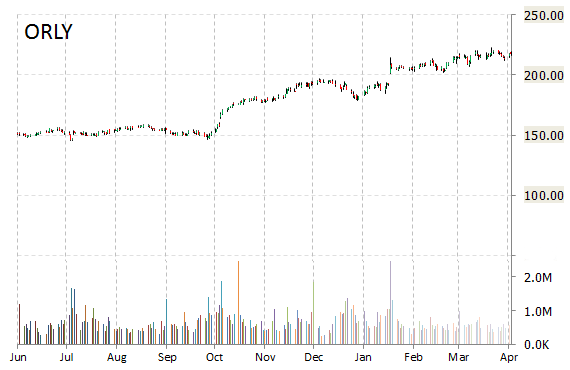

ORLY currently prints a one year return of about 47% and a year-to-date return of around 13%.

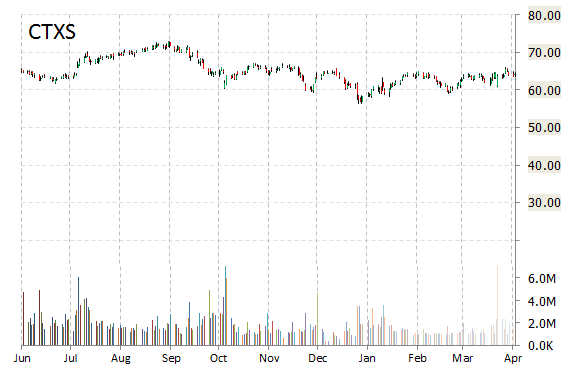

Shares of Citrix Systems, Inc. (CTXS) gained $0.29 to $65.06 after the company reported first-quarter earnings of $760.8 million, or $0.65 per share. Analysts had been modeling $757.38 million and $0.64 per share. For the current quarter, net income was $28.9 million, or $0.18 per share, compared to $56 million, or $0.30 per share, for the first quarter of fiscal year 2014.

For Q2/15, the cloud computing company provided EPS guidance of $0.80 – $0.83 versus consensus of $0.85 per share. The company also issued revenue projection of $785 – $795 million, compared to the consensus revenue estimate of $805.73 million.

“While I’m disappointed in our Q1 results, our confidence in the financial, operational and strategic initiatives that we announced last quarter remains strong,” said in a statement Mark Templeton, president and CEO for Citrix. “While these changes position us for our next phase of growth, they had a greater near-term impact on our execution than we anticipated. Our commitment to margin expansion, however, remains unchanged.”

Profitability-wise, CTXS has a t-12 profit and operating margin of 8.01% and 12.83%, respectively. The $10.35 billion market cap company reported $402.93 million in cash in its most recent quarter.

CTXS currently prints a one year return of 13.54% and a year-to-date return of less than one percent.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply