American Express Company (AXP) reported first quarter EPS of $1.48 after the closing bell Thursday, compared to the consensus estimate of $1.36. Revenues decreased 2.7% from last year to $7.95 billion. Analysts expected revenues of $8.18 billion. The stock is currently down $0.51 to $80.40 on 6.27 million shares.

The credit card company said net income came in at $1.5 billion, up 6% from $1.4 billion a year ago.

“First quarter results showed solid core performance and continued progress in expanding the American Express franchise despite an impact from several of the headwinds we’re confronting,” said CEO Kenneth I. Chenault in a statement.

As previously reported, the company expects full year 2015 earnings to be flat to modestly down year-over-year.

On valuation measures, American Express Co. shares, which currently have an average 3-month trading volume of 6.41 million shares, trade at a trailing-12 P/E of 14.55, a forward P/E of 14.07 and a P/E to growth ratio of 1.65. The median Wall Street price target on the name is $90.00 with a high target of $100.00. Currently ticker boasts 16 ‘Buy’ endorsements, compared to 11 ’Holds’ and 4 ‘Sell’.

Profitability-wise, AXP has a t-12 profit and operating margin of 18.25% and 26.57%, respectively. The $82.46 billion market cap company reported $24.00 billion in cash vs. $55 billion in debt in its most recent quarter.

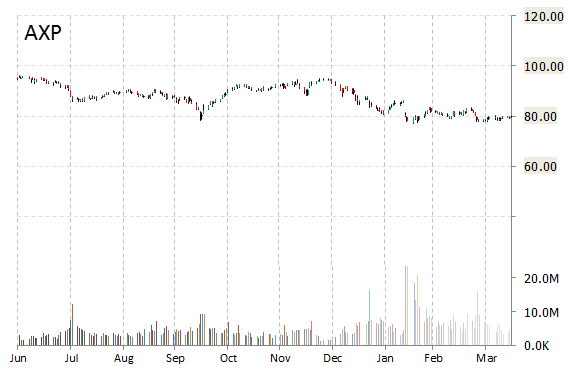

AXP currently prints a one year loss of about 5.60% and a year-to-date loss of around 14%.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply