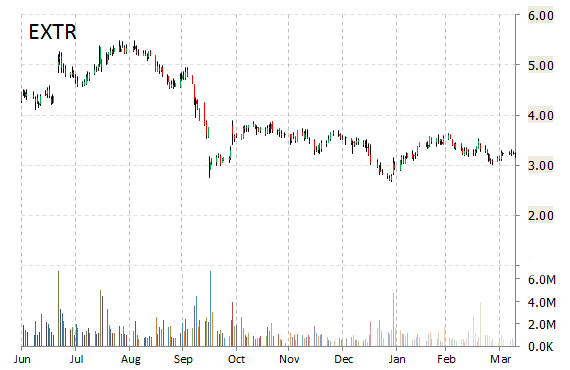

Analysts at DA Davidson downgraded Extreme Networks Inc. (EXTR) from ‘Buy‘ to ‘Neutral‘ in a research report issued to clients on Friday.

On valuation measures, Extreme Networks Inc. stock it’s trading at a forward P/E multiple of 9.48x. The t-12-month revenue at Extreme Networks is $580.54 million. EXTR ‘s ROE for the same period is (46.29%).

Shares of the $245.83 million market cap company are down 44.71% year-over-year and 8.22% year-to-date.

Extreme Networks Inc., currently with a median Wall Street price target of $5.00 and a high target of $6.00, dropped $0.77 to $2.475 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

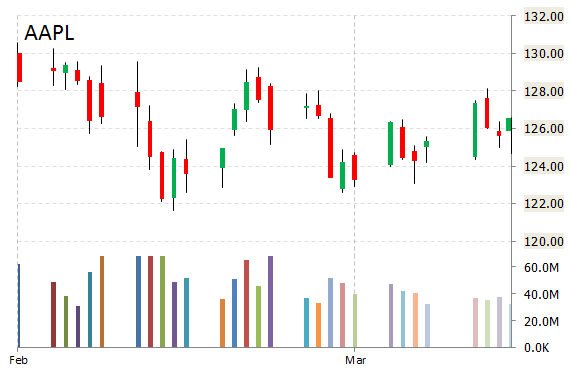

Apple Inc. (AAPL) was downgraded from ‘Outperform‘ to ‘Market Perform‘ at Raymond James.

Shares have traded today between $125.26 and $127.09 with the price of the stock fluctuating between $73.05 to $133.60 over the last 52 weeks.

Apple Inc. shares are currently changing hands at 17.18x this year’s forecasted earnings, compared to the industry’s 26.29x earnings multiple. Ticker has a t-12 price/sales ratio of 3.69. EPS for the same period registers at $7.39.

Shares of AAPL have gained $0.33 to $126.89 in mid-day trading on Friday, giving it a market cap of $739.10 billion. The stock traded as high as $133.60 in Feb. 24, 2015.

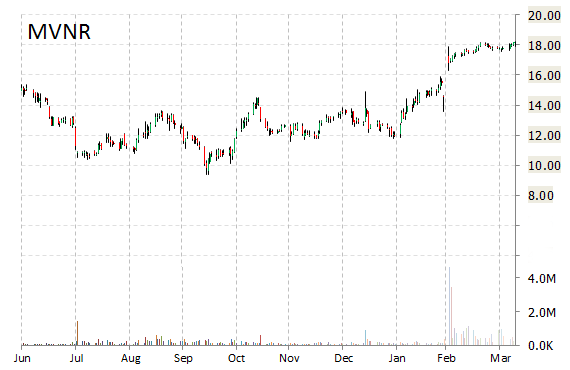

Wunderlich reported on Friday that they have lowered their rating for Mavenir Systems, Inc. (MVNR). The firm has downgraded MVNR from ‘Hold‘ to ‘Sell‘ and set its price target to $17.

Mavenir Systems Inc. recently traded at $17.59, a loss of $0.60 over Thursday’s closing price. The name has a current market capitalization of $509.67 million.

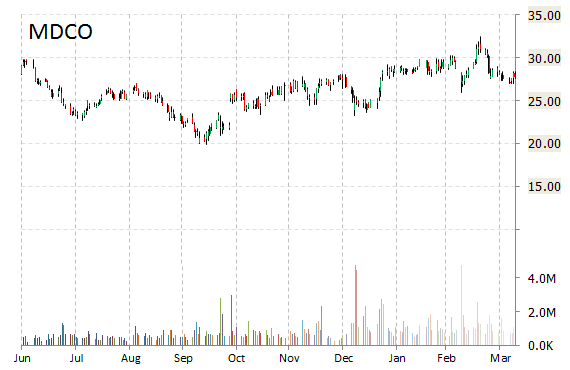

The Medicines Company (MDCO) was reiterated a ‘Neutral’ by Mizuho analysts on Friday. The broker also cut its price target on the stock to $27.50 from $30.

MDCO shares recently gained $0.65 to $28.47. In the past 52 weeks, shares of Parsippany, New Jersey-based company have traded between a low of $19.92 and a high of $32.44. Shares are up 11.28% year-over-year and 0.54% year-to-date.

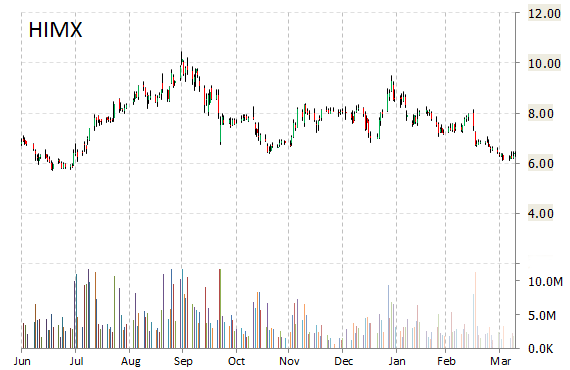

Himax Technologies, Inc. (HIMX) was reiterated as ‘Outperform’ with a $9 from $11 price target on Friday by Northland Capital.

On trading measures, Himax Technologies shares are trading lower by nearly 1.09% to $6.33. Approximately 1.25 million shares have already changed hands, compared to the stock’s average daily volume of 2.83 million shares.

Fundamentally, HIMX shows the following financial data:

- $187.84 million in cash in most recent quarter

- $818.61 million t-12 total assets

- $460.21 million total equity

- $840.54 million t-12 revenue

- $66.13 million annual net income

- $82.21 million free cash flow

On valuation measures, Himax Technologies Inc. ADS shares have a T-12 price/sales ratio of 1.30 and a price/book for the same period of 2.32. EPS is $0.59. The name has a market cap of $1.11 billion and a median Wall Street price target of $7.80 with a high target of $11.00. Currently there are 3 analysts that rate HIMX a ‘Buy’, 6 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’.

In terms of share statistics, Himax Technologies Inc. has a total of 171.21 million shares outstanding with 41.71% held by insiders and 25.50% held by institutions. The total number of shares sold short is 3.99 million.

Offering a dividend yield of 4.27%, shares of the Taiwan-based company are down 41.12% year-over-year and 20.60% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply