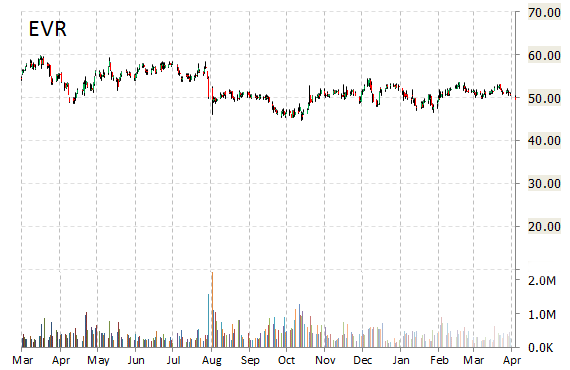

Analysts at UBS downgraded Evercore Partners Inc. (EVR) from ‘Buy‘ to ‘Neutral‘ in a research report issued to clients on Tuesday.

The target price for EVR is lowered from $58 to $49.

On valuation measures, Evercore Partners Inc. Cl A stock it’s trading at a forward P/E multiple of 12.32x, and at a multiple of 23.01x this year’s estimated earnings. The t-12-month revenue at Evercore Partners is $915.86 million. EVR ‘s ROE for the same period is 16.32%.

Shares of the $1.77 billion market cap company are down 8.51% year-over-year and 4.88% year-to-date.

Evercore Partners Inc., currently with a median Wall Street price target of $59.00 and a high target of $64.00, dropped $1.68 to $47.87 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

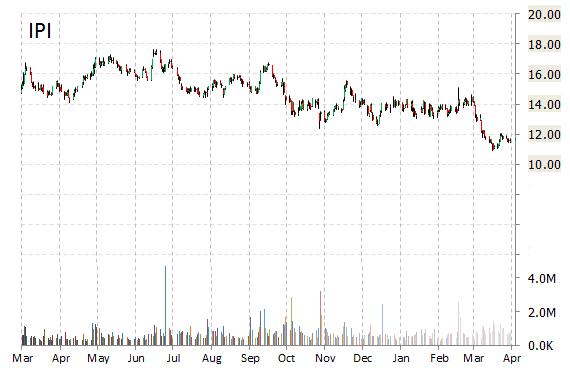

Intrepid Potash, Inc. (IPI) was downgraded from ‘Overweight‘ to ‘Neutral‘ at Piper Jaffray.

Shares have traded today between $11.25 and $11.54 with the price of the stock fluctuating between $10.92 to $17.64 over the last 52 weeks.

Intrepid Potash Inc. shares are currently changing hands at 88.45x this year’s forecasted earnings, compared to the industry’s 14.94x earnings multiple. Ticker has a t-12 price/sales ratio of 2.49. EPS for the same period registers at $0.13.

Shares of IPI have lost $0.28 to $11.41 in mid-day trading on Tuesday, giving it a market cap of roughly $862 million. The stock traded as high as $17.64 in June 18, 2014.

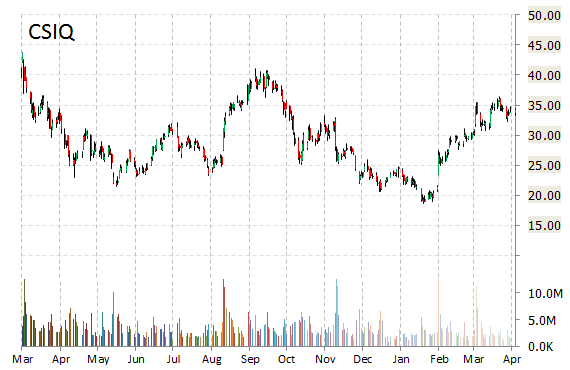

Canadian Solar Inc. (CSIQ) was reiterated a ‘Buy’ by Canaccord Genuity analysts on Tuesday. The broker however, cut its price target on the stock to $45 from $46.

CSIQ shares are currently priced at 8.31x this year’s forecasted earnings, which makes them inexpensive compared to the industry’s 19.32x earnings multiple. Ticker has a forward P/E of 7.35 and t-12 price-to-sales ratio of 0.64. EPS for the same period is $4.11.

In the past 52 weeks, shares of the West Guelph, Canada-based firm have traded between a low of $18.68 and a high of $41.12 and are now at $34.16. Shares are up 5.49% year-over-year and 41.34% year-to-date.

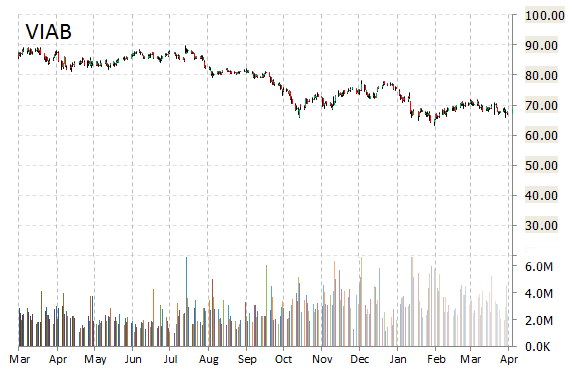

Viacom, Inc. (VIAB) was reiterated as ‘Neutral’ with a $77 from $83 price target on Tuesday by Wedbush.

Viacom, Inc is printing a higher than average trading volume with the issue trading 4.06 million shares, compared to the average volume of 3.67 million. The stock began trading this morning at $67.91 to currently trade 1.60% lower from the prior days close of $68.60. On an intraday basis it has gotten as low as $67.00 and as high as $68.72.

VIAB shares have declined 2.01% in the last 4 weeks and 8.58% in the past three months. Over the past 5 trading sessions the stock has gained 1.11%. Shares of the $27.38 billion market company are down 19.93% year-over-year and 8.40% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply