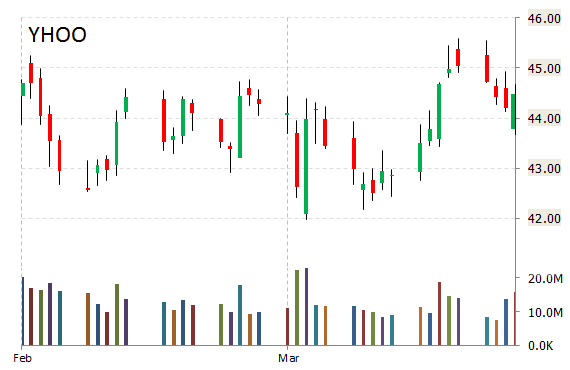

Yahoo (YHOO) had a potent break out within a two month consolidation period this morning, reaching an intraday high of $45.67. The name is currently logging a nice gain of 2.47%. The surge came after the web portal approved a new $2 billion stock buyback initiative, using the proceeds from the public offering of Chinese online retailer Alibaba (BABA). Yahoo said the new program, which comes as the company prepares to spin off its stake in the Chinese e-commerce giant, was in addition to the $726 million in buybacks still active under its previous plan. A break and close above $46 could send ticker higher and towards a retest of the $48 level.

On valuation mesures, YHOO shares are currently priced at 6.08x this year’s forecasted earnings, which makes them extremely inexpensive compared to the industry’s 35.53x earnings multiple. The company’s current year and next year EPS growth estimates stand at -43.30% and 2.20% compared to the industry growth rates of 18.90% and 21.80%, respectively. YHOO has a t-12 price/sales ratio of 9.01. EPS for the same period registers at $7.45.

Yahoo’s shares have advanced 0.09% in the last 4 weeks while declining 11.10% in the past three months. Over the past 5 trading sessions the stock has lost 1.13%. Shares of the $42.39 billion market cap company are down 11.96% this year, compared with an 10.69% gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply