Shares of Chesapeake Energy Corporation (CHK) are higher by 3.76% to $14.64 in the pre-market session on Tuesday following Carl Icahn’s increased stake in the company to almost 11%.

The activist investor bought 6.6 million Chesapeake shares on March 11 at $14.15 each, increasing his stake to 10.98% from 9.98% with a total of 73.05 million shares held in the company, according to a regulatory filing on Monday

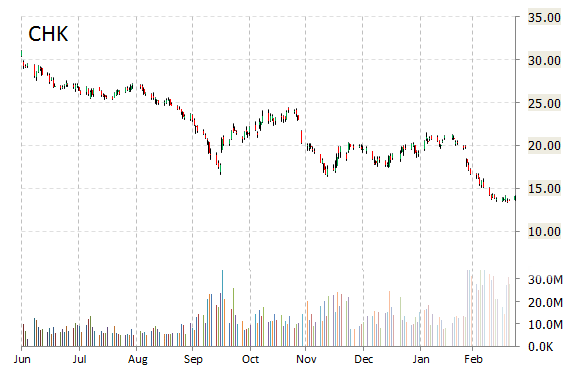

Shares of Chesapeake Energy, the nation’s second-biggest shale gas producer, lost 40% of their value last year, and 28% since the end of December, which is part of the reason Icahn’s investment fund lost 7.4% in 2014. Icahn is currently the company’s second-biggest shareholder.

On valuation measures, Chesapeake Energy Corp. shares are currently priced at 7.55x this year’s forecasted earnings compared to the industry’s 11.35x earnings multiple. Ticker has a PEG and forward P/E ratio of -4.74 and 35.27, respectively. Price/Sales for the same period is 0.45 while EPS is $1.87. Currently there are 8 analysts that rate CHK a ‘Buy’, 18 rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. CHK has a median Wall Street price target of $20.50 with a high target of $27.00.

In the past 52 weeks, shares of Oklahoma City, Oklahoma-based company have traded between a low of $13.38 and a high of $29.92.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply