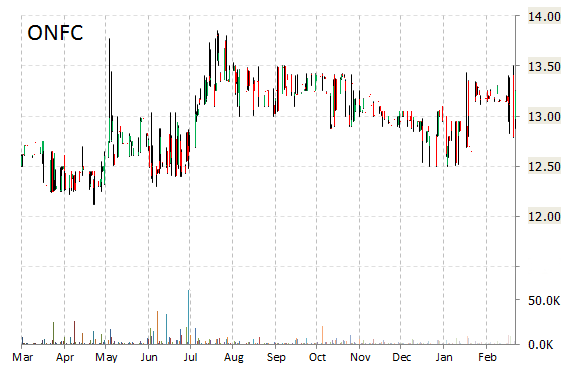

Oneida Financial Corp. (ONFC) is a big mover this session, as its shares are up nearly 47%. The surge came after Community Bank System Inc (CBU) announced the signing of a merger deal with Oneida Financial.

Under the terms of the agreement, shareholders of Oneida Financial Corp. can elect to receive either 0.5635 shares of CBU common stock or $20.00 in cash for each share of ONFC common stock they hold, subject to an overall 60% stock and 40% cash split.

The merger agreement has been unanimously approved by the board of directors of both companies.

ONFC shares recently gained $6.15 to $19.40. In the past 52 weeks, shares of Oneida, New York-based bank have traded between a low of $12.12 and a high of $19.49. Shares are up 10.05% year-over-year, and 2.87% year-to-date.

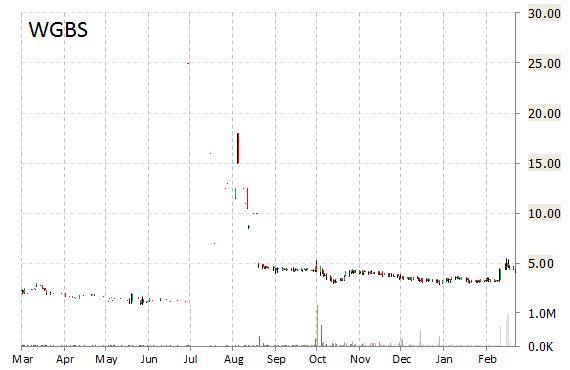

Shares of WaferGen Bio-systems, Inc. (WGBS) jumped nearly 25% in early trade Wednesday after the developer of systems for gene expression quantification reported positive results from Single Cell Study using its SmartChip Technology. WaferGen said the study was conducted in collaboration with the Broad Institute, and the findings will be presented at the 2015 Advances in Genome Biology & Technology meeting to be held February 25-28 in Marco Island, Florida.

WGBS shares recently gained $1.01 to $5.22. The stock is down more than 80% year-over-year and has gained roughly 40.33% year-to-date. In the past 52 weeks, shares of Fremont, California-based firm have traded between a low of $2.85 and a high of $30.00.

WaferGen Bio-systems, Inc. closed Tuesday at $4.21. The name has a total market cap of $30.64 million.

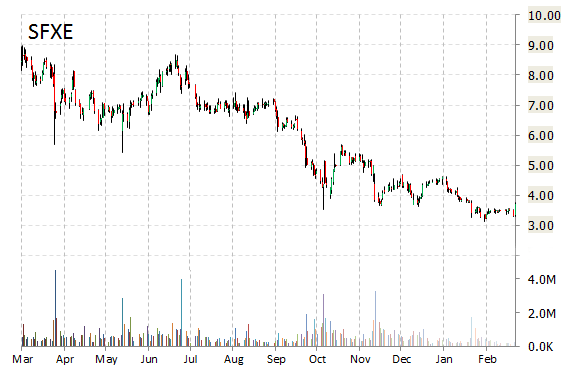

Shares of SFX Entertainment Inc. (SFXE) are spiking 25% in early market trading Wednesday, after Robert F.X. Sillerman, CEO and Chairman of the Board of Directors of SFX proposed a going-private transaction. Sillerman has proposed to acquire all the outstanding shares of SFX that he does not already own for $4.75 per share in cash.

The proposed cash consideration represents a 44% premium to the closing pps of the name’s common stock on Feb.y 23, 2015, the day before Mr. Sillerman submitted his proposal.

SFXE shares recently gained $0.94 to $4.64. In the past 52 weeks, shares of the New York-based firm have traded between a low of $3.13 and a high of $8.99. Shares are down 57.57% year-over-year, and 18.32% year-to-date.

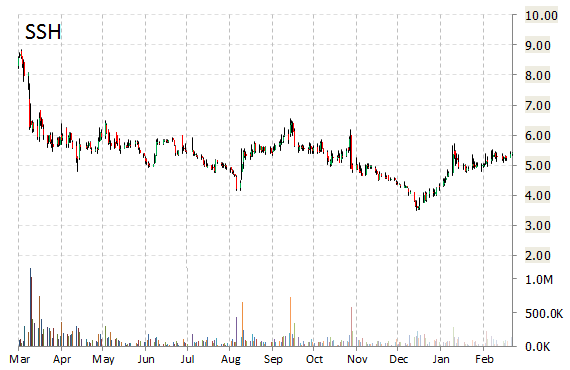

Sunshine Heart Inc. (SSH) gained nearly 15% to $6.21 after the company announced that it has received an unconditional approval from the FDA for an interim analysis of COUNTER HF, the company’s U.S. pivotal study.

“Today’s announcement is a significant achievement for the company as it offers the potential to dramatically reduce the development timeline for this important solution for heart failure. The FDA decision to approve this interim analysis is not only unconditional but also arrives earlier than the originally anticipated timeframe of end Q1 2015..”, commented Dave Rosa, President and CEO of Sunshine Heart.

In the past 52 weeks, shares of Eden Prairie, Minnesota-based early-stage medical device company have traded between a low of $3.49 and a high of $9.00. Shares are down 35.21% year-over-year ; up 27.59% year-to-date.

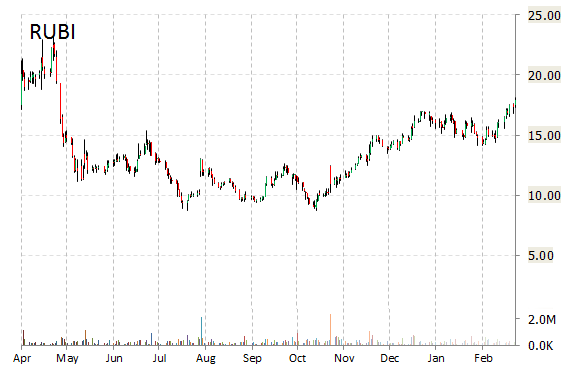

The Rubicon Project Inc (RUBI) shares are up 10% to $19.65 in early trade after the company reported upbeat quarterly results and issued a strong guidance. The Los Angeles-based technology company said 4Q non-GAAP EPS came in at of $0.25, an increase of 79% year-over-year.

For Q1’15, RUBI provided EPS guidance of ($0.13)-($0.10) versus consensus of ($0.11) per share. The company also issued revenue projection of $34-$35 million, compared to the consensus revenue estimate of $31.72 million.

On valuation measures, Rubicon Project Inc. shares, which currently have an average 3-month trading volume of 272,425 shares, trade at a forward P/E of 70.14 and a P/E to growth ratio of (3.43). The median Wall Street price target on the name is $20.00 with a high target of $23.00. Currently ticker boasts 4 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, RUBI has a t-12 profit and operating margin of (18.05%) and (14.87%), respectively. The $704.73 million market cap company reported $97.2 million in cash vs. $157.00K in debt in its most recent quarter.

RUBI currently prints year-to-date return of around 11%.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply