SolarCity Corporation (SCTY) shares are down more than 5% to $54.25 in after-hours trading Wednesday after the company reported its fourth quarter earnings results.

The solar energy systems provider reported adjusted for one-time items an EPS loss of $1.47 vs. an expected adjusted loss of $1.18 a share. Q4 revs came in at $71.8 million, nearly in line with Wall Street expectations and compared with $43.7 million on a yoy basis. SolarCity said it added 21,318 new customers in the fourth quarter and 96,659 in all of 2014. Energy contracts (which exclude system sales) rose by 21,406. As of the end of 2014, the company said it had 190,000 customers, $2.8 billion of solar energy systems assets capitalized on its balance sheet.

For Q1’15, SCTY provided EPS guidance of ($1.75) to ($1.65) versus consensus of ($1.28) per share.

On valuation measures, SolarCity Corp. shares, which currently have an average 3-month trading volume of 2.24 million shares, trade at a P/E to growth ratio of 0.39. The median Wall Street price target on the name is $79.00 with a high target of $98.00. Currently ticker boasts 7 ‘Buy’ endorsements, compared to 4 ’Holds’ and no ‘Sell’.

Profitability-wise, SCTY has a t-12 profit and operating margin of (11.19%) and (116.79%), respectively. The $5.48B market cap company reported $733.46M in cash vs. $1.45B in debt in its most recent quarter.

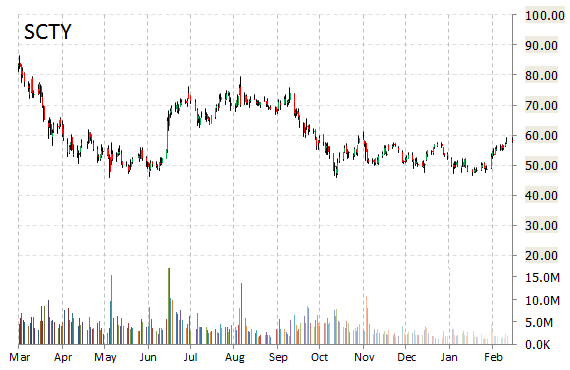

SCTY currently prints a one year loss of about 22%, and a year-to-date return of around 8.70%.

The chart below shows where the equity has traded over the last 52 weeks.

SolarCity Corp. designs, installs, and sells or leases solar energy systems to residential and commercial customers, and government entities in the United States. The company was founded in 2006 and is headquartered in San Mateo, California.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply