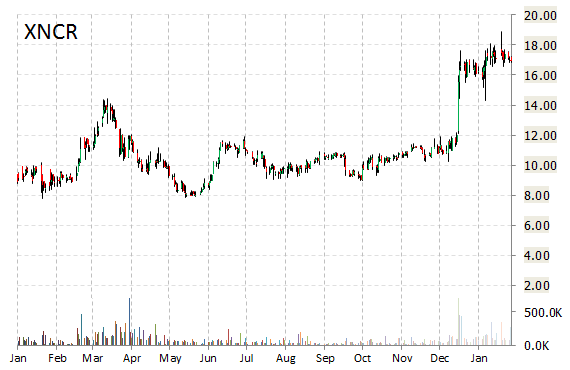

Shares of Xencor, Inc. (XNCR) are spiking over 13% in early market trading Thursday, after the company developing engineered monoclonal antibodies for the treatment of autoimmune diseases, asthma and allergic diseases and cancer, today reported top-line results from a Phase 1b/2a study for XmAb5871. Xencor said the study showed promising activity in patients with rheumatoid arthritis (RA), including multiple DAS28-CRP remissions and ACR50 and ACR70 responses.

“XmAb5871’s reduction of RA disease activity demonstrates for the first time that its unique mechanism of action targeting FcγRIIb can be effective at treating an autoimmune disease, and builds on the potent, reversible B-cell inhibition we observed in our Phase 1a clinical trial,” said Paul Foster, M.D., chief medical officer of Xencor.

XNCR shares recently gained $2.28 to $19.23. The stock is up more than 87% year-over-year and has gained roughly 5.50% year-to-date. In the past 52 weeks, shares of Monrovia, California-based biopharmaceutical company have traded between a low of $7.82 and a high of $19.50.

Xencor, Inc. closed Wednesday at $16.92. The name has a total market cap of $586.14M.

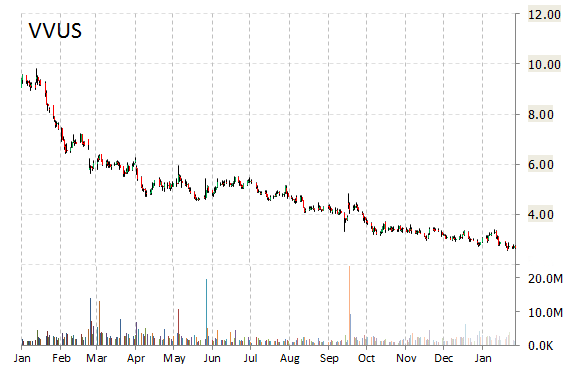

Shares of Vivus Inc. (VVUS) are up almost 5% in early trade Thursday after the company announced that the European Commission has adopted the commission implementing decision amending the marketing authorization for SPEDRA (avanafil). SPEDRA is now the first and only erectile dysfunction (ED) medication approved in Europe that is indicated to be taken as needed approximately 15 to 30 minutes before sexual activity.

On valuation measures, Vivus Inc, currently valued at $284.07M, has a median Wall Street price target of $3.00 with a high target of $6.00. In the past 52 weeks, shares of Mountain View, California-based biopharmaceutical firm have traded between a low of $2.56 and a high of $7.72 with the 50-day MA and 200-day MA located at $2.97 and $3.67 levels, respectively. Additionally, shares of VVUS trade at a P/E ratio of -0.19 and have a Relative Strength Index (RSI) and MACD indicator of 37.93 and -0.20, respectively.

Vivus currently prints a one year loss of about 66%, and a year-to-date loss of 8.33%. Ticker recently gained 9c to $2.73.

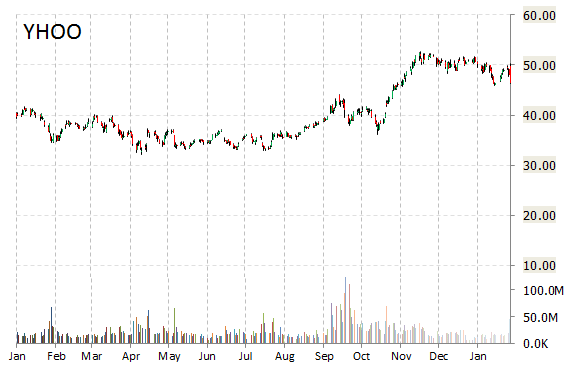

Yahoo! Inc. (YHOO) shares are currently printing a large downtick, loosing nearly 9% from the previous close, following Alibaba Group‘s (BABA) earnings. Yahoo owns a stake in Alibaba worth $40 billion. The Hong Kong-based e-commerce giant beat estimates for the December quarter by 6 cents with adjusted quarterly profit of 81 cents per share, but revenue came in below estimates, disappointing investors. For the quarter, Alibaba reported revs of $4.22 billion vs. Street forecasts of $4.45 billion.

Along with Yahoo shares, Alibaba’s stock plunged more than 10%.

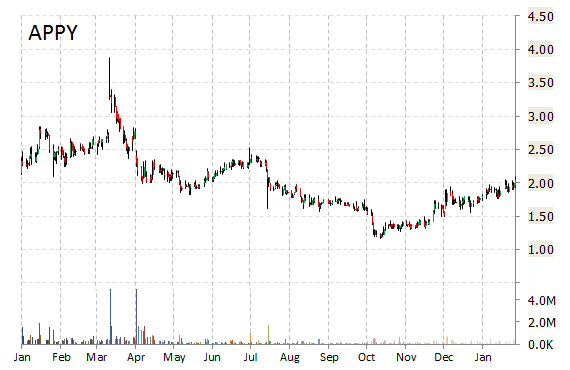

Venaxis, Inc. (APPY) shares nosedived a staggering 250% in early trade Thursday, after unfavorable FDA ruling. The company said its APPY1 Test, a rapid blood test for aiding in identifying patients in the emergency room who are at low risk for appendicitis, did not meet the FDA’s criteria “for substantial equivalence based upon data and information submitted by Venaxis in its 510(k) submission.”

Steve Lundy, President and CEO of Venaxis, stated, “This FDA decision is very disappointing. The FDA provided us with a comprehensive description of the issues that led to its decision. We are in the process of reviewing all aspects of the FDA letter communication and evaluating, with our advisors, alternatives available to us..”

APPY currently prints a one year loss of about 75%. Shares have decreased 67% since the beginning of the year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply