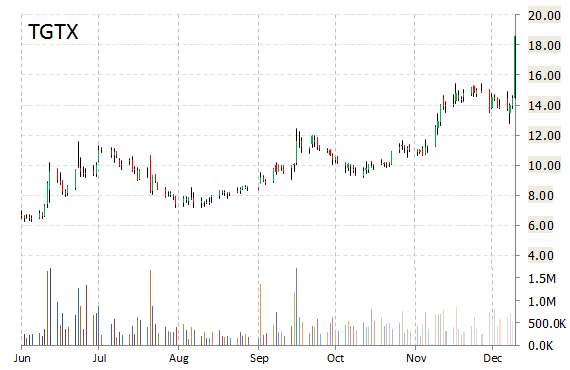

In a report issued to clients Thursday, ROTH Capital raised its price target for TG Therapeutics, Inc. (TGTX) to $33 from $25. ROTH said it boosted its 12-month base case estimate on company’s strong ASH showing and buyout prospects. The equity firm maintains a Buy/Focus pick.

TG Therapeutics, Inc., currently valued at $765.41M, has a median Wall Street price target of $22.00 with a high target of $33.00. Approximately 1.22M shares have already changed hands, compared to the stock’s average daily volume of 519.49K.

In the past 52 weeks, shares of the New York-based biopharmaceutical company have traded between a low of $3.50 and a high of $18.59 with the 50-day MA and 200-day MA located at $12.96 and $10.03 levels, respectively. Additionally, shares of TGTX trade at a P/E ratio of N/A and have a Relative Strength Index (RSI) and MACD indicator of 77.96 and +0.76, respectively.

TGTX currently prints a one year return of about 314.04% and a year-to-date return of around 270.51%. Ticker was up 19.79% to $17.31 at 12:17 p.m. est.

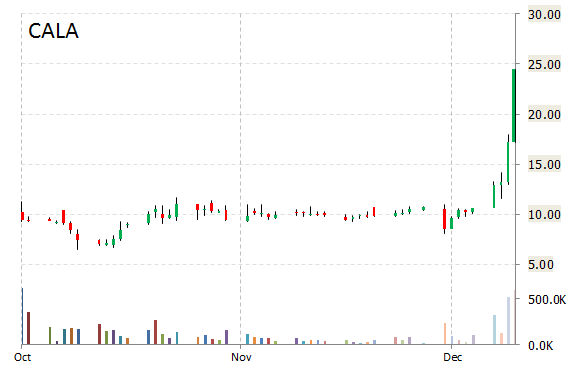

Calithera Biosciences, Inc. (CALA) stock is up more than 41% in mid-day trading following results of studies with primary human breast tumors that support glutaminase as a potential target in triple negative breast cancer.

CALA shares recently gained $7.19 to $24.36. The stock is trading at unusually high volume Thursday with 620K shares changing hands. It is currently at 3x its average daily volume.

In the past 52 weeks, shares of South San Francisco, California-based biopharmaceutical firm have traded between a low of $6.51 and a high of $25.30.

Calithera Biosciences, Inc., which closed Wednesday at $17.17, has a total market cap of $425.30M.

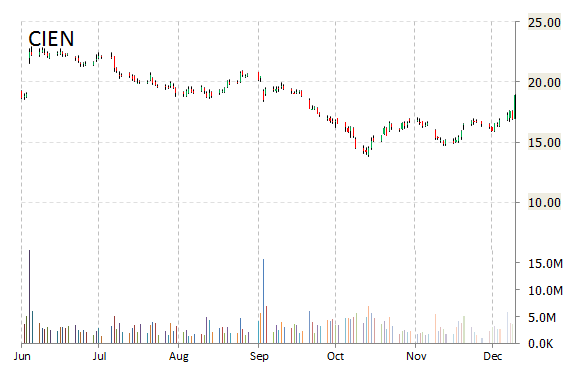

Shares of Ciena Corporation (CIEN) surged over 9% despite the company’s unexpected Q4 loss of 8 cents per share, which was worse than expected. The Street had forecast EPS of 12 cents a share. The wireless network equipment maker also guided Q1 revs about in-line with expectations.

Ciena Corporation gained $1.50 to $18.46 in mid-day trading today. Approximately 7.22M shares have already changed hands, which dwarfs the average volume of 3.34M shares.

On valuation-measures, shares of Ciena have a forward P/E of 17.26. P/E to growth ratio is 1.34, while t-12 profit margin is (0.87%). EPS registers at ($0.19). The company has a market cap of $1.97B and a median Wall Street price target of $24.50 with a high target of $31.00.

On trading-measure, CIEN has a beta of 1.84 and a short float of 19.47%. In the past 52 weeks, shares of Hanover, Maryland-based firm have traded between a low of $13.77 and a high of $27.16 with the 50-day MA and 200-day MA located at $16.22 and $18.64 levels, respectively.

CIEN currently prints a year-to-date loss of around 29.13%, compared with an 14.12% gain in the S&P 500.

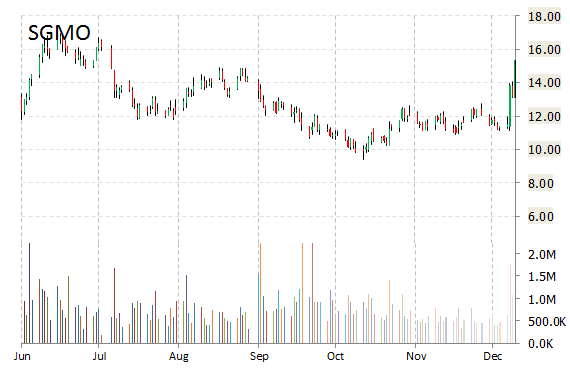

Shares of Sangamo Biosciences Inc. (SGMO) surged over 14% to $14.98 in mid-day trading Thursday. Approximately 1.4M shares have already changed hands, compared to the stock’s average daily volume of 788K. Not seeing any news to account for the move.

Fundamentally, SGMO shows the following financial data:

· $162.42 million in cash

· $97.274 million total current assets

· $37.79 million t-12 total revenue

· Profitability/Profit Margin (80.03%)

On valuation measures, Sangamo Bioscience shares have a t-12 price/sales ratio of 23.77 and a price/book for the same period of 4.27. EPS is ($0.46). SGMO has a market cap of $1.02 billion and a median Wall Street price target of $27.

Shares of Richmond, Californiad-based firm are up 7.85% year-over-year, and 24% year-to-date. On an intraday basis the name has gotten as low as $13.30 and as high as $15.38.

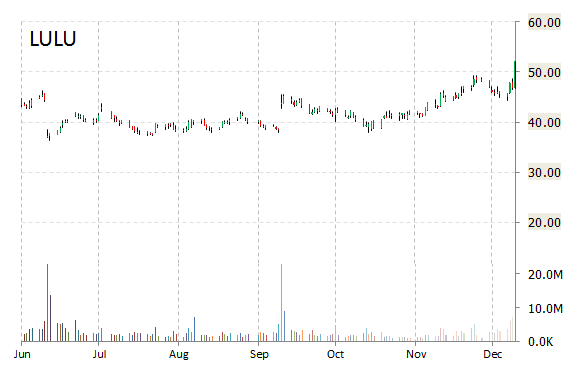

Shares of Lululemon Athletica (LULU) soared more than 9% in early trading Thursday after the yoga apparel maker reported better-than-expected Q3 earnings. The Vancouver, Canada-based companys said its saw a quarterly profit of $60.5 million, or $0.42 p/sh, versus a year-ago profit of $66.1 million, or $0.45 p/sh. Net revs for the quarter increased 10% to $419.4 million from $379.9 million in Q3’13.

For the fourth quarter, Lululemon expects net revenue to be in the range of $570 million to $585 million. Diluted EPS are expected to be in the range of $0.65 to $0.69 for the quarter. Analysts expected EPS of $0.72 p/sh on sales of $594.8 million.

Lululemon Athletica Inc. gained $4.29 to $50.99 in mid-day trading today. Approximately 11.85M shares have already changed hands, which is nearly 4x the stock’s average daily volume of 2.85M shares.

On valuation-measures, shares of Lululemon have a trailing-12 and forward P/E of 30.70 and 25.15, respectively. P/E to growth ratio is 1.80, while t-12 profit margin is 14.53%. EPS registers at $1.66. The company has a market cap of $7.31B and a median Wall Street price target of $45.00 with a high target of $57.00.

LULU currently prints a one year loss of about 32.44% and a year-to-date loss of around 20.89%. The name was upgraded earlier to ‘Buy’ from ‘Outperform’ at Credit Agricole.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply