E-commerce giant Amazon.com (AMZN) is testing one-hour deliveries via bicycle messenger in New York City, according to a Wall Street Journal report. The superfast service, dubbed “Amazon Prime Now,” is based on the idea of getting certain purchases to Manhattan-based folks within a few hours of ordering. The retail giant has been holding time trials involving messengers from three courier services, claims the publication.

In other Amazon news this morning, the retail giant today introduced a service called “Make An Offer,” which allows customers to negotiate lower prices on thousands of items. If agreed upon, customers can then purchase the items at a savings from the listed price. Additionally, Engadget details news that Amazon may take its delivery drone testing overseas. In a letter to the US Federal Aviation Administration, Amazon said that “Without approval of our testing in the United States, we will be forced to continue expanding our Prime Air R&D footprint abroad.” Amazon has run into legislative difficulty with regard to the use of drones over American soil. The FAA has effectively banned for the moment the use of drones for commercial purposes.

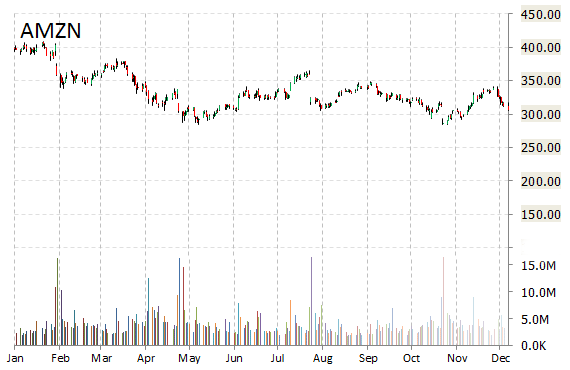

AMZN shares recently lost $3.64 to $303.00. The stock is down more than 20.75% year-over-year and has lost roughly 23.11% year-to-date. In the past 52 weeks, shares of Seattle, Washington-based company have traded between a low of $284.00 and a high of $408.06.

Amazon.com Inc. closed Monday at $306.64. The name has a total market cap of $141.98B.

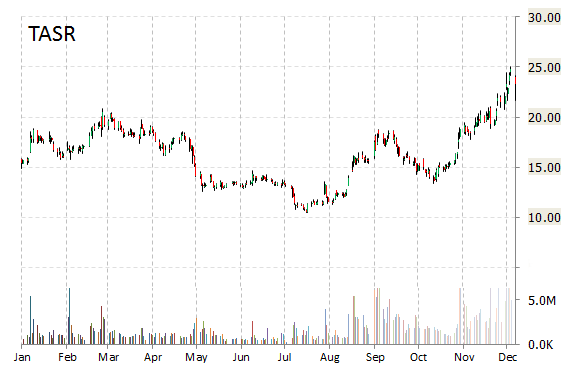

Taser International Inc. (TASR) – During the “Mad Money- Lightning Round” Monday evening Jim Cramer made an unfavorable TASR mention, saying “There is a lot of good news in the stock but I’d like to see you take some profits.”

In other TASR news this morning, the company disclosed the elimination of the position of Chief Operating Officer and resignation of President Jeffrey Kukowski who held that position, effective January 5, 2015.

TASR recently lost 7.03% to $21.68. The name is currently priced at 63.03x this year’s forecasted earnings compared to the industry’s -5.64x earnings multiple. Taser shares have a PEG and forward P/E ratio of 2.05 and 49.62, respectively. Price/Sales for the same period is 8.26, while EPS is $0.37. Currently there are 2 analysts that rate TASR a ‘Buy’, 2 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. TASR has a median Wall Street price target of $22.00 with a high target of $24.00.

In the past 12 months, shares of Scottsdale, Arizona-based company have traded between a low of $10.46 and a high of $25.02. Shares are up 38.81% year-over-year and 46.85% year-to-date.

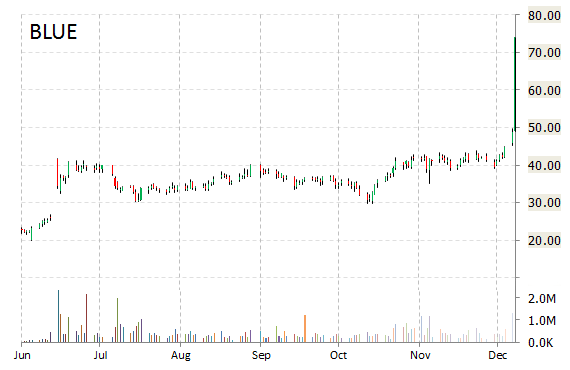

bluebird bio, Inc. (BLUE) is a big mover this pre-market session, as its shares are up a staggering 54 percent. The surge came after the company’s price target was raised from to $112 from $52 by Piper Jaffray analysts, according to a research note published on Tuesday. The firm’s analysts also maintained their ‘Overweight’ rating on the name. Piper Jaffray’s new PTt represents a potential upside of 129% from ticker’s previous $48.89 p/sh close. Separately, bluebird bio’s price target was also raised to $90 from $50 at ROTH Capital. Additionally, the company today announced data demonstrating first four patients with beta-thalassemia major treated with LentiGlobin are transfusion-free.

BLUE shares recently gained $27.01 to $75.90. In the past 52 weeks, shares of Cambridge, Massachusetts-based clinical-stage biotech firm, have traded between a low of $17.40 and a high of $49.83. Shares are up 125.72% year-over-year and 133.03% year-to-date.

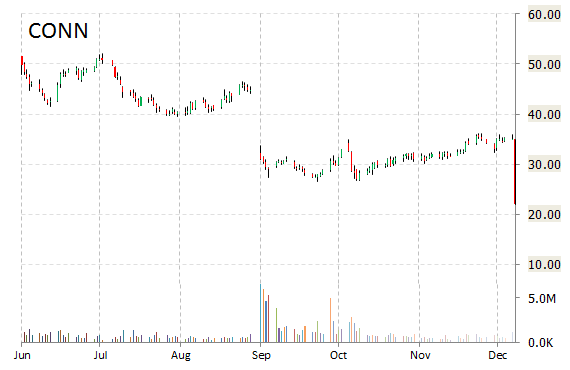

Conns Inc. (CONN) shares tumbled 36% in early trade Tuesday after the company reported an unexpected 3Q loss (misses by $0.76) and withdrew its earnings guidance for fiscal year 2015. Additionally, the specialty retailer is not currently providing earnings guidance with respect to fiscal 2016. Conns also announced a transition of its chairman and chief executive officer.

CONN shares recently lost $12.59 to $22.50. The name is currently priced at 13.20x this year’s forecasted earnings compared to the industry’s 12.00x earnings multiple. CONN has a median Wall Street price target of $40.00 with a high target of $62.00.

In the past 12 months, shares of The Woodlands, Texas-based company have traded between a low of $26.60 and a high of $80.34. Shares are down 51.92% year-over-year and 55.41% year-to-date.

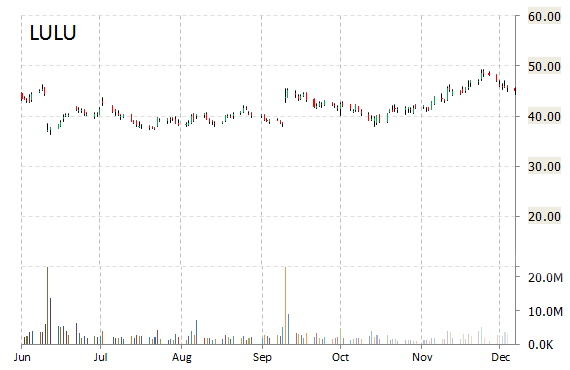

Shares of yoga apparel maker Lululemon Athletica Inc. (LULU) are up 2.27% to $45.95 in early trade after the name was upgraded to ‘Outperform’ from ‘Market perform’ at Wells Fargo (WFC). According to Wells, the company has now addressed its supply chain issues and that profit margins are reaching a turning point.

On valuation-measures, shares of Lululemon Athletica Inc. have a trailing-12 and forward P/E of 27.79 and 22.24, respectively. P/E to growth ratio is 1.73, while t-12 profit margin is 14.53%. EPS registers at $1.66. The company has a market cap of $6.62B and a median Wall Street price target of $45.00 with a high target of $57.00.

On trading-measure, LULU has a beta of 1.32 and a short float of 20.81%. In the past 12 months, ticker has traded between a low of $36.26 and a high of $71.88 with the 50-day MA and 200-day MA located at $44.05 and $41.60 levels, respectively.

LULU currently prints a one year loss of about 36% and a year-to-date loss of around 23.89%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply