Recent short interest data for the 10/31/2014 settlement date shows an increase in short interest for shares of Cisco Systems, Inc. (CSCO). As of October 31, the short interest for the networking equipment provider totaled 72,730,657 shares, as compared to 60,645,444 shares since October 15, a jump of 19.93%. Average daily volume [AVM] for the same period fell by 8,339,620 to 25,875,610 shares from 34,215,230 shares. It is worth mentioning that ticker’s short interest has jumped by more than 18.6M shares, or 34%, from the 9/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 2.81 days. Days-to-cover for CSCO increased to 2.81 for the October 31 settlement date, as compared to 1.77 days at the October 15 report.

Recently, a number of Wall Street firms have assigned a rating to the stock. Analysts at Citigroup (C) maintained their ‘Sell’ rating and a $22 price target in a research note on October 8th. Atlantic Equities analysts initiated coverage of the stock with an ‘Overweight’ rating and $31 price target in a research note to clients on October 1st. Finally, analysts at Barclays maintained their ‘Equal-weight’ rating and $26 price target on Cisco in a research note on August 14th. Overall, there are 16 analysts that rate CSCO a ‘Buy’, while 11 rate it a ‘Hold’. No analyst rates it a ‘Sell’. CSCO has a median Wall Street price target of $28.00 with a high target of $33.00.

In other Cisco news, the company reported Q3 adjusted EPS of $0.54 per share beating estimates by $0.02. Revenue was also above estimates. However, the company warned that sluggish demand from EMs and telecom service providers would affect its revs and profit outlook for the current quarter. The company also said that CFO frank Calderoni would step down at the end of the year. Cisco plans to appoint Kelly A. Kramer to succeed Mr. Calderoni. She is currently senior VP, Business Technology and Operations Finance of Cisco.

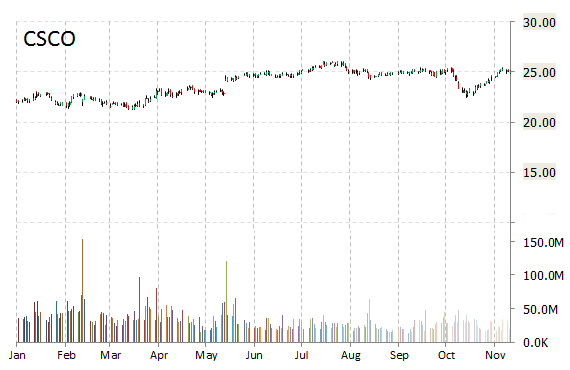

Cisco Systems, Inc. has a beta of 1.30 and a short float of 1.43%. In the past 52 weeks, shares of San Jose, California-based networking giant have traded between a low of $20.22 and a high of $26.08 and are now at $24.83. Shares are up 9.17% year-over-year, and 15.50% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply