Radcom Ltd. (RDCM) soared nearly 30% in mid-day trading on Wednesday after the company reported Q3 2014 results above estimates. Radcom said it earned Q3 EPS of $0.11 versus $0.03 single estimate. Revenues came in at $6.007 million versus $5.4 million forecasts. Q3 revs were up 26% compared with Q3 2013 and 21% compared with Q2 2014.

“We feel well positioned to grow in step with the LTE build-out, a trend we believe has the power to continue driving our results throughout 2015,” David Ripstein, Radcom’s President and CEO said in statement.

Radcom Ltd. gained $2.01 to $8.22 in recent trading. Approximately 676,891 shares have already changed hands, compared to the stock’s average daily volume of 12,200 shares.

On valuation-measures, shares of Radcom have a forward P/E of 18.56. T-12 profit margin is (3.41%), while EPS registers at (0.09). The company has a market cap of $66.01M and a median Wall Street price target of $7.50.

On trading-measure, RDCM has a beta of 2.73 and a short float of 0.12%. In the past 52 weeks, shares of Tel-Aviv, Israel-based customer experience management solutions provider have traded between a low of $4.00 and a high of $8.84 with the 50-day MA and 200-day MA located at $6.40 and $5.42 levels, respectively.

RDCM currently prints a one year return of about 40.18% and a year-to-date return of around 17.17%.

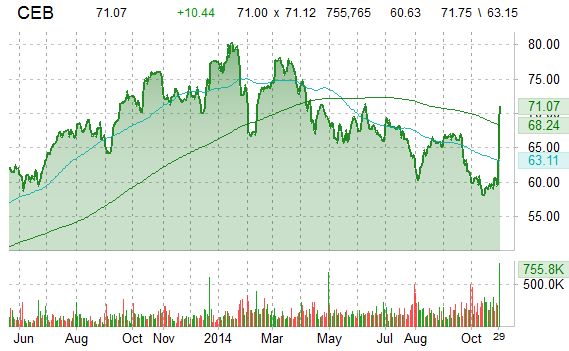

Corporate Executive Board Co. (CEB) is a big mover this session with its shares surging nearly 17% on the day. The move comes on solid volume too with the issue trading 654K shares compared to the average volume of 221,318. CEB today announced financial results for the third quarter ended September 30, 2014. Non-GAAP diluted EPS came in at $1.05, or $0.19 better than consensus estimates of $0.86. The company also updated its guidance for fiscal 2014, saying it sees EPS of $3.25 to $3.45 versus $3.25 consensus, and revenues of $915 to $925 million versus $916.76 million consensus.

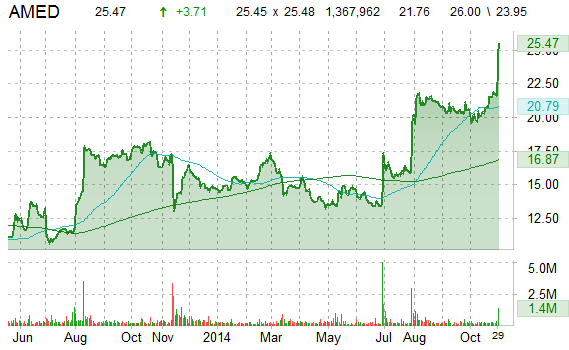

Following the company’s earnings results, Robert W. Baird upgraded AMED to ‘Neutral’ from ‘Underperform’ and raised its price target to $25 from $15.

On valuation measures, CEB shares are currently priced at 282.20x this year’s forecasted earnings, which makes them expensive compared to the industry’s 20.13x earnings multiple. The company’s current year and next year EPS growth estimates stand at 4.80% and 14.20% compared to the industry growth rates of 2.50% and 16.80%, respectively. CEB has a t-12 price/sales ratio of 2.36. EPS for the same period registers at $0.25.

CEB’s shares have declined 0.77% in the last 4 weeks and declined 5.01% in the past three months. Over the past 5 trading sessions the stock has gained 1.29%. Shares of Corporate Executive Board Co. are down 20.83% this year, and 18.99% year-over-year.

The Arlington, Virginia-based company, which is currently valued at $2.38B, has a median Wall Street price target of $82.00 with a high target of $89.00.

Amedisys Inc. (AMED) shares are currently printing a large uptick, gaining 16% from the previous close. The company today reported Q3 EPS of $0.28 per share versus a profit of $0.15 per share. Amedisys said its adjusted net service revenue fell 0.3% on a year-over-year basis to $300.3 million in the quarter, but still beat the average analyst estimate of $299.3 million.

Amedisys Inc., currently valued at $843.31M, has a median Wall Street price target of $17.00 with a high target of $23.00. Approximately 1,256,744 shares have already changed hands, compared to the stock’s average daily volume of 374,894.

In the past 52 weeks, shares of Baton Rouge, Louisiana-based home health company have traded between a low of $12.60 and a high of $26.00 with the 50-day MA and 200-day MA located at $20.63 and $17.46 levels, respectively. Additionally, shares of AMED trade at a P/E ratio of -1.05 and have a Relative Strength Index (RSI) and MACD indicator of 78.45 and +1.33, respectively.

AMED currently prints a one year return of about 32.28%, and a year-to-date return of around 48.74%.

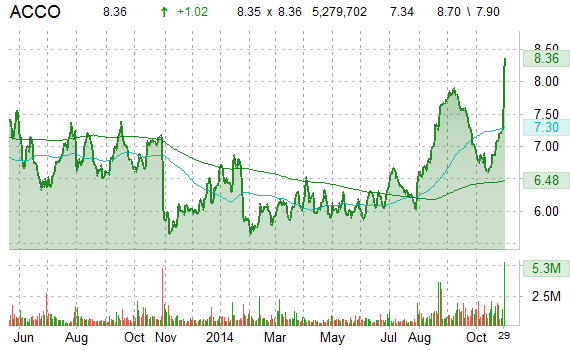

Shares of ACCO Brands Corp. (ACCO) are trading higher by 13% after the company reported EPS of $0.29 per share, compared to $0.23 per share for the year ago quarter. Net sales for the maker of office supplies increased 1% to $472.2 million in the period, also exceeding Street forecasts of $451.3 million.

ACCO shares recently gained $0.97 to $8.31. In the past 52 weeks, shares of the Lake Zurich, Illinois-based company have traded between a low of $5.47 and a high of $8.70. Shares are up 2.09% year-over-year and 9.23% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Adeptus Health Inc. (ADPT) shares gained more than 15% on Wednesday after the company reported Q3 (Sep) earnings of $0.01 per share, $0.09 better than the Street estimates of ($0.08). For the quarter, ADPT said it generated net patient service revenue of $57.6 million, an increase of 143.7%.

“We are pleased that we achieved our expectations for the quarter while executing on our robust growth plan. During the quarter, we opened 13 new sites, further expanding access to the highest quality emergency care and surpassing the key milestone of our 50th First Choice Emergency Room,” Thomas S. Hall, President and CEO said in a statement.

Adeptus has a price/sales ratio of 1.93. EPS is ($0.44). Currently there are 5 analysts that rate ADPT a ‘Buy’, while 1 rates it a ‘Hold’. No analyst rates it a ‘Sell’. ADPT has a median Wall Street price target of $33.00 with a high target of $40.00.

ADPT gained $4.16 to $31.83 in recent trading. Approximately 404,441 shares have already changed hands, compared to the stock’s average daily volume of 88,383 shares.

In the past 52 weeks, shares of Lewisville, Texas-based company have traded between a low of $23.35 and a high of $33.10.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply