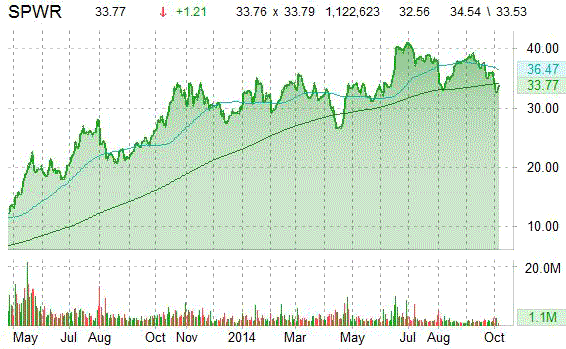

Shares of SunPower Corporation (SPWR) were upgraded to an ‘Overweight’ rating from ‘Neutral’ by JPMorgan (JPM) on Friday. The firm cited an attractive risk/reward following the recent pullback in shares. JPM kept its 12-month base case estimate to $43 implying 22.39% expected return.

SunPower Corporation gained $1.00 to $33.56 in morning trading today. Approximately 1,23M shares have already changed hands, compared to the stock’s average daily volume of 1,971,940 shares.

On valuation-measures, shares of SunPower Corp have a trailing-12 P/E and price/book ratio of 24.73 and 3.17, respectively. EPS is $1.36. The company has a market cap of $4.40B and a median Wall Street price target of $40.00 with a high target of $50.00.

On trading-measure, SPWR has a beta of 2.61 and a short float of 20.34%. In the past 52 weeks, shares of San Jose, California-based energy services company have traded between a low of $25.38 and a high of $42.07 with the 50-day MA and 200-day MA located at $36.88 and $35.06 levels, respectively.

SPWR currently prints a one year return of about 16.24% and a year-to-date return of around 9.23%.

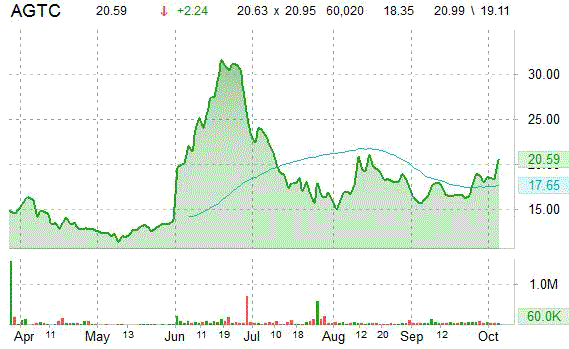

Investment analysts at Stifel initiated coverage on shares of Applied Genetic Technologies Corporation (AGTC) in a note issued to investors on Friday. The firm set a ‘Buy’ rating and a 12-month target price of $29 on the stock. Stifel’s price target would suggest a potential upside of 38.49% from the stock’s current price.

On valuation measures, Applied Genetic Technologies, currently valued at $339.54M, has a median Wall Street price target of $25.00 with a high target of $36.00. Approximately 98,739 shares have already changed hands, compared to the stock’s average daily volume of 68,086.

In the past 52 weeks, shares of Alachua, Florida-based clinical-stage biotechnology company have traded between a low of $11.10 and a high of $34.37 with the 50-day MA and 200-day MA located at $17.72 and $17.80 levels, respectively. Additionally, shares of AGTC trade at a price/book ratio of 3.45 and have a Relative Strength Index (RSI) and MACD indicator of 66.64 and +1.32, respectively.

AGTC currently prints a one year return of 41.06%.

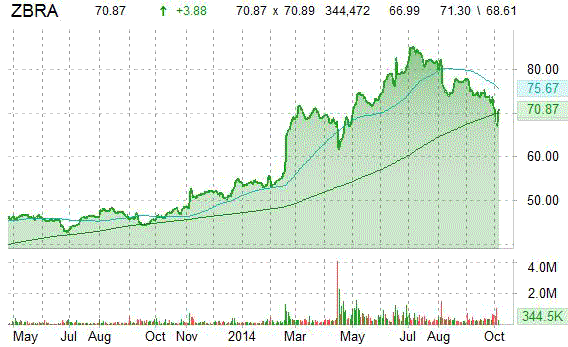

Shares of Zebra Technologies (ZBRA) climbed over 6% Friday, boosted by Northcoast analysts who upgraded the stock with a ‘Buy’ from a ‘Neutral’ rating.

Zebra Technologies Corp. shares are currently priced at 24.14x this year’s forecasted earnings compared to the industry’s -4.26x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.68 and 17.79, respectively. Price/Sales for the same period is 3.02 while EPS is $2.93. Currently ZBRA has a median Wall Street price target of $85.00 with a high target of $85.00.

In the past 52 weeks, shares of Lincolnshire, Illinois-based company have traded between a low of $45.43 and a high of $87.53 and are now at $70.84. Shares are up 43.76% year-over-year and 23.87% year-to-date.

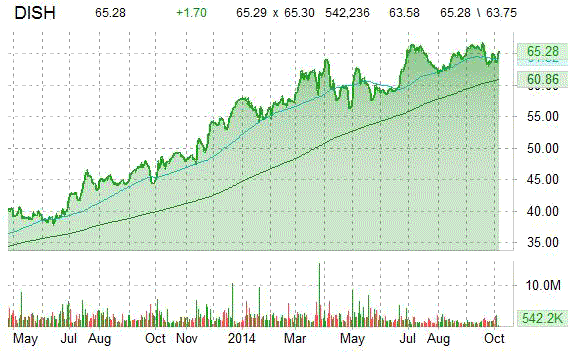

Dish Network Corp. (DISH) shares gained almost 3% Friday, after the company’s stock was upgraded by analysts at BTIG to a ‘Buy’ from ‘Neutral’ rating. The firm said it believes the pay-tv services provider offers wireless operators incremental capacity they need for future revenue growth.

DISH shares recently gained $1.73 to $65.31. In the past 52 weeks, shares of Englewood, Colorado-based company have traded between a low of $46.62 and a high of $67.50. Shares are up 32.51% year-over-year and 9.77% year-to-date.

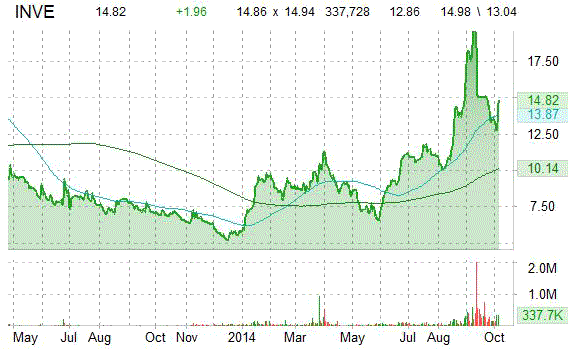

Identiv, Inc. (INVE), a security technology company, had its stock’s price target raised to $24 from $12.50 by Cowen analysts Friday. Identiv shares were up 16.95% at $15.04 in early trade, moving within a 52-week range of $4.90 to $21.31. Ticker is trading at unusually high volume with 377K shares changing hands compared to the stock’s average daily volume of 190,112 shares.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply