Shares of biopharmaceutical firm Repros Therapeutics Inc (RPRX) are up $1.34, or 13.74%, at $10.30, in pre-market trading Friday after the company reported it has been granted a Type B Pre-NDA meeting with the FDA in the first half of November. In this meeting Repros will seek guidance on its planned New Drug Application for Androxal for the treatment of secondary hypogonadism with preservation of testicular function. The company believes that the NDA for Androxal® will be filed around the end of 2014.

Repros Therapeutics currently has a PEG and price-to-book ratio of 0.27 and 3.53, respectively. EPS is ($1.32). Currently there are 3 analysts that rate RPRX a ‘Strong Buy’, 2 rate it a ‘Buy’ and 1 rates it a ‘Hold’. No analysts rate it a sell. RPRX has a median Wall Street price target of $25.00 with a high target of $41.00.

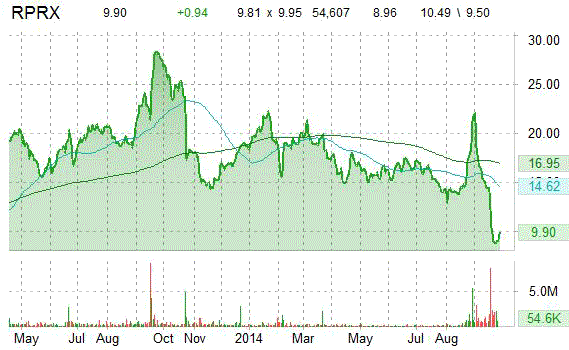

In the past 52 weeks, shares of the Woodlands, Texas-based firm have traded between a low of $8.46 and a high of $28.99. Shares are down 68.14% year-over-year and 51.04% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shares of Nike, Inc. (NKE) are up more than 7% in pre-market trading Friday after the company was upgraded from a ‘Buy’ rating to a ‘Neutral’ rating at Janney Capital. The name had also its price target raised to $100 from $90 by analysts at Barclays who cited the company’s strong Q1 report.

Nike, Inc. shares are currently priced at 26.85x this year’s forecasted earnings compared to the industry’s 19.57x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.76 and 20.40, respectively. Price/Sales for the same period is 2.53 while EPS is $2.97. Currently there are 7 analysts that rate NKE a ‘Strong Buy’, 12 rate it a ‘Buy’ and 9 rate it a ‘Hold’. No analysts rate it a sell. NKE has a median Wall Street price target of $88.00 with a high target of $100.00.

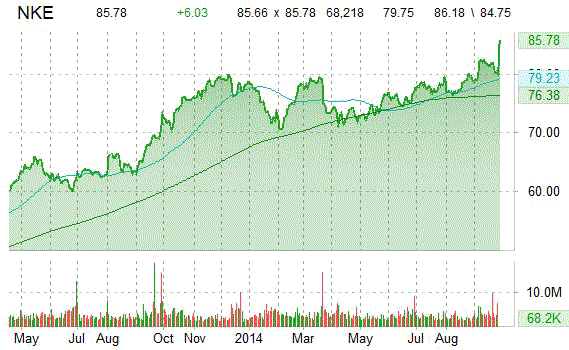

In the past 52 weeks, shares of Beaverton, Oregon-based company have traded between a low of $69.15 and a high of $82.79 and are now at $85.50. Shares are up 14.96% year-over-year and 1.41% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Micron Technology, Inc. (MU) shares jumped 5% in pre-market trading Friday after the stock of the semiconductor solutions’ manufacturer was raised to $43 from $41 at Piper Jaffray, implying 35.64% expected return from ticker’s Thursday closing pps. The name had also its price target raised to $45 a share at Raymond James following solid Q4 report. In the three months ended in August MU saw it revs jump almost 50% on a y/y-basis, to $4.23 billion, yielding non-GAAP EPS of $0.82.

Micron Technology, Inc. shares are currently priced at 10.46x this year’s forecasted earnings compared to the industry’s 17.82x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.57 and 7.93, respectively. Price/Sales for the same period is 2.30 while EPS is $3.03. Currently there are 11 analysts that rate MU a ‘Strong Buy’, 12 rate it a ‘Buy’ and 8 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. MU has a median Wall Street price target of $40.00 with a high target of $50.00.

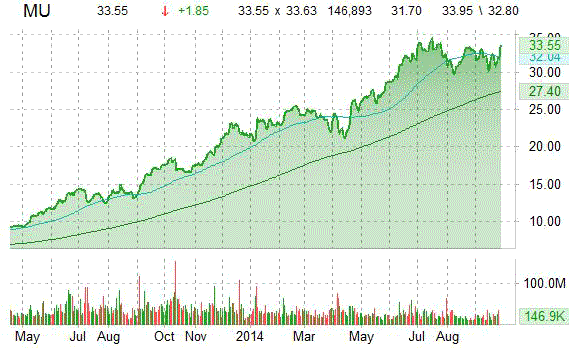

In the past 52 weeks, shares of Boise, Idaho-based company have traded between a low of $16.17 and a high of $34.85 and are now at $33.50. Shares are up 86.80% year-over-year and 45.75% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Aixtron SE (AIXG) is up 6% in pre-market trading today following the company’s upgrade to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley (MS).

On valuation-measures, shares of Aixtron SE have a price/book and forward P/E ratio of 2.47 and 479.33, respectively. P/E to growth ratio is (0.49), while t-12 profit margin is (19.57%). EPS registers at ($0.44). The company has a market cap of $1.60B and a median Wall Street price target of $10.98 with a high target of $12.44.

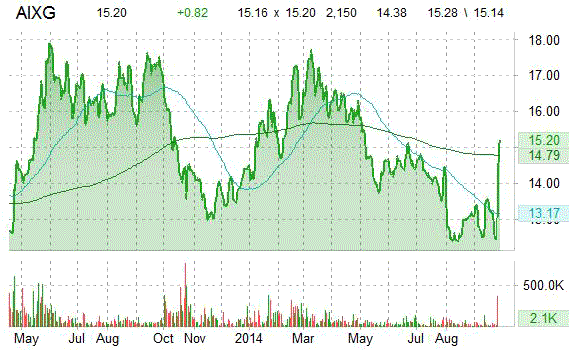

On trading-measure, AIXG has a beta of 1.61 and a short float of 0.72%. In the past 52 weeks, shares of the deposition equipment provider to the semiconductor industry have traded between a low of $12.25 and a high of $17.84 with the 50-day MA and 200-day MA located at $12.93 and $14.52 levels, respectively.

AIXG currently prints a one year loss of about 16% and a year-to-date loss of less than 1 percent.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply