Pacira Pharmaceuticals, Inc. (PCRX) announced that it has received a Warning Letter from the U.S. Food and Drug Administration’s Office of Prescription Drug Promotion (OPDP) referencing certain promotional materials on EXPAREL® (bupivacaine liposome injectable suspension).

“We take regulatory compliance very seriously and believe that our current labeling supports the claims being challenged by the FDA,” Dave Stack, president, CEO and chairman of Pacira said in a statement. “We plan to explain our position to the FDA and will provide an update upon resolution of these issues.”

Pacira Pharmaceuticals, Inc. shares are currently priced at 42.01x next year’s forecasted earnings. Ticker has a price-to-book and and T-12 price/sales ratio of 24.21 and 25.82, respectively. EPS for the same period is ($1.56). Currently there are 5 analysts that rate PCRX a ‘Strong Buy’, 3 rate it a ‘Buy’ and 1 rates it a ‘Hold’. No analysts rate it a sell. PCRX has a median Wall Street price target of $110.50 with a high target of $117.00.

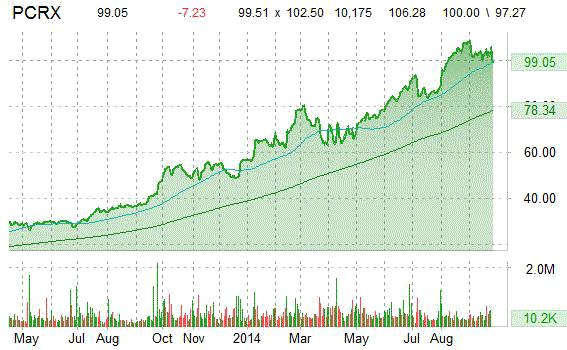

In the past 52 weeks, shares of Parsippany, New Jersey-based company have traded between a low of $45.68 and a high of $109.94 and are now at $99.85. Shares are up 153.58% year-over-year and 84.87% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Shares of LipoScience Inc (LPDX) are up almost 63% in pre-market trading Thursday after the company said it has agreed to be acquired by Laboratory Corp. of America Holdings (LH) for a purchase price of $5.25 per share in cash, a 65% premium over Wednesday’s close. The Board of Directors of LipoScience said it has unanimously approved the agreement and recommended approval of the transaction by LipoScience’s stockholders.

The acquisition is expected to be accretive to Laboratory Corp’s earnings in year one, and to earn its cost of capital by year three, Lab Corp said. The deal is expected to close in Q4’14.

LipoScience, currently valued at $48.43M, has a median Wall Street price target of $3.63 with a high target of $4.00.

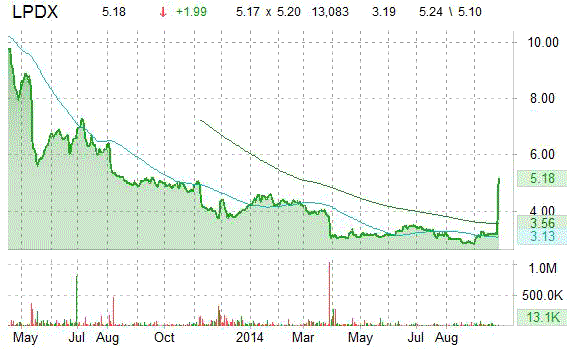

In the past 52 weeks, shares of Raleigh, North Carolina-based provider of specialized cardiovascular diagnostic laboratory tests have traded between a low of $2.80 and a high of $5.19 with the 50-day MA and 200-day MA located at $3.05 and $3.25 levels, respectively. Additionally, shares of LipoScience trade at a price/book ratio of 1.14 and have a Relative Strength Index (RSI) and MACD indicator of 54.89 and 0.039, respectively.

LPDX currently prints a negative one year return of about 36% and a year-to-date return of around 25%.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

Aixtron SE (AIXG), currently valued at $1.41B, is up more than 13% this morning after the company announced that San’an Optoelectronics Co., Ltd. has ordered 50 Next Generation Showerhead® MOCVD tools from AIXTRON. This is one of the largest orders Aixtron has ever received and is growing evidence that LED manufacturers are beginning to expand production capacity to meet the constantly increasing demand for LEDs.

Aixtron SE shares are currently priced at 420x next year’s forecasted earnings. Ticker has a PEG and price/book ratio of -0.49 and 2.44, respectively. Price/Sales for the same period is 5.76 while EPS is ($0.48). Currently, there are 4 analysts that rate AIXG it a ‘Hold’. No analyst rates it a ‘Strong Buy’ a ‘Buy’ or a ‘Sell’. AIXG has a median Wall Street price target of $10.98 with a high target of $12.44.

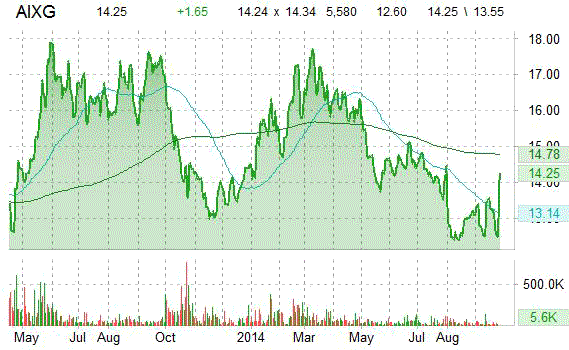

In the past 52 weeks, shares of Herzogenrath, Germany-based company have traded between a low of $12.25 and a high of $17.84 and are now at $14.25. Shares are down 27.08% year-over-year and 13.22% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply