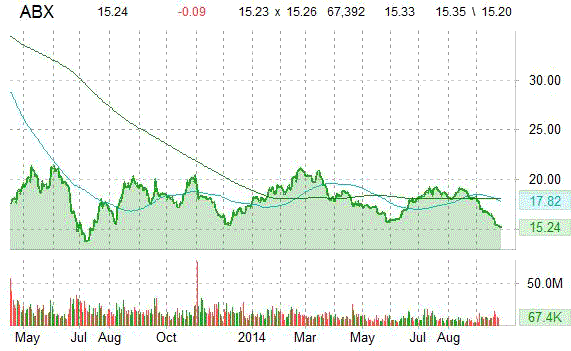

Barrick Gold Corporation (ABX) had its rating upgraded to ‘Overweight’ from ‘Neutral’ by analysts at HSBC on Thursday.

Barrick Gold Corporation shares are currently priced at 13.33x next year’s forecasted earnings. Ticker has a PEG and price-to-book ratio of (0.63) and 1.35, respectively. Price/Sales for the same period is 1.63 while EPS is ($2.58). Currently there are 2 analysts that rate ABX a ‘Strong Buy’, 4 rate it a ‘Buy’ and 20 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. ABX has a median Wall Street price target of $20.00 with a high target of $25.00.

In the past 52 weeks, shares of Toronto, Canada-based company have traded between a low of $15.26 and a high of $21.45 and are now at $15.33. Shares are down 17.62% year-over-year and 13.05% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

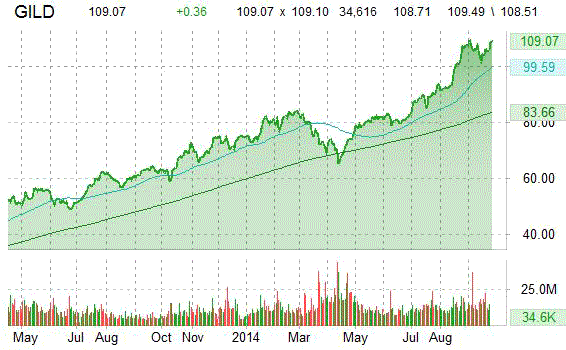

Gilead Sciences Inc. (GILD) had its price target raised to $130 from $120 by analysts at Bernstein this morning. Bernstein’s new PT represents expected upside of 19.26% from the stock’s current price-per-share.

Gilead Sciences Inc. shares are currently priced at 24.63x this year’s forecasted earnings compared to the industry’s 6.75x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.55 and 11.44, respectively. Price/Sales for the same period is 9.42 while EPS is $4.41. Currently there are 10 analysts that rate GILD a ‘Strong Buy’, 13 rate it a ‘Buy’ and 3 rate it a ‘Hold’. No analysts rate it a ‘Sell’. GILD has a median Wall Street price target of $118.00 with a high target of $165.00.

In the past 52 weeks, shares of Foster City, California-based company have traded between a low of $58.81 and a high of $110.64 and are now at $109.05. Shares are up 70.23% year-over-year and 44.75% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

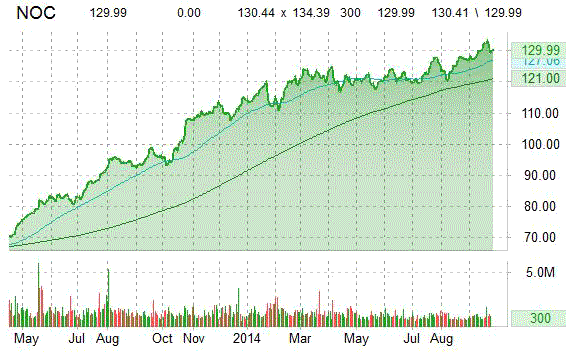

Northrop Grumman Corporation (NOC) had its rating upgraded to ‘Buy’ from ‘Hold’ with a $145 price target by analysts at Argus in a research note issued on Thursday. The firm believes Northrop is financially strong and positioned to deliver EPS upside. Argus new PT points to a potential upside of 11.54% from the stock’s current price-per-share.

Northrop Grumman Corporation shares are currently priced at 14.03x this year’s forecasted earnings compared to the industry’s 16.03x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.82 and 12.97, respectively. Price/Sales for the same period is 1.11 while EPS is $9.27. Currently there are 2 analysts that rate NOC a ‘Strong Buy’, 3 rate it a ‘Buy’ and 16 rate it a ‘Hold’. No analysts rate it a ‘Sell’. NOC has a median Wall Street price target of $135.00 with a high target of $150.00.

In the past 52 weeks, shares of Falls Church, Virginia-based company have traded between a low of $92.51 and a high of $134.24 and are now at $129.99. Shares are up 34.98% year-over-year and 13.420% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

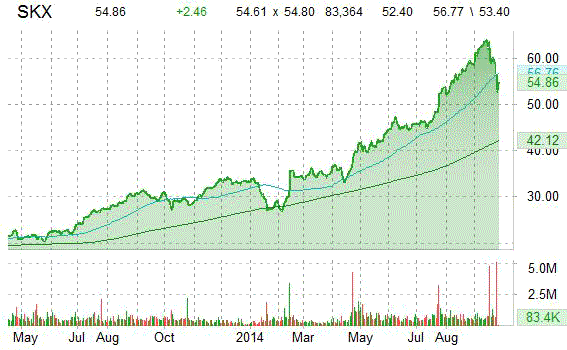

Skechers USA Inc (SKX), currently valued at $2.68B, is up more than 4% this morning after the company said Q3 bookings are up more than 50% from last year. The company was also reiterated as a top pick at Sterne Agee, who says the business of the global leader in the high performance footwear industry remains robust and outlook promising.

Skechers USA Inc. shares are currently priced at 24.95x this year’s forecasted earnings compared to the industry’s 19.71x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.17 and 16.43, respectively. Price/Sales for the same period is 1.27 while EPS is $2.10. Currently there is only one analyst that rates SKX a ‘Strong Buy’, 4 rate it a ‘Buy’ and one rates it a ‘Sell’. SKX has a median Wall Street price target of $65.50 with a high target of $70.00.

In the past 52 weeks, shares of Manhattan Beach, California-based company have traded between a low of $26.46 and a high of $64.69 and are now at $54.77. Shares are up 80.19% year-over-year and 58.16% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply