Facebook (FB) – Analysts at JPMorgan (JPM) say that engagement metrics for the online social networking service remain strong.

FB shares are currently priced at 98.69x this year’s forecasted earnings compared to the industry’s 15.20x earnings multiple. Ticker has a forward P/E of 37.50 and t-12 price-to-sales ratio of 19.37. EPS for the same period is $0.77.

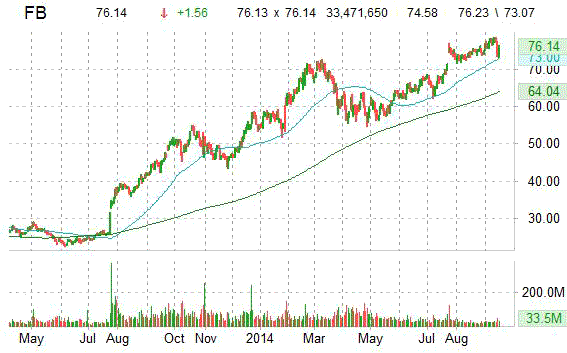

In the past 52 weeks, shares of Menlo Park, California-based company have traded between a low of $42.43 and a high of $78.36 and are now at 76.09. Shares are up 79.09% year-over-year and 39.31% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Twitter (TWTR) – MKM Partners says it continues to see signs of a mass-market use case for the social networking microblogging service. According to the firm, there is great promise in TWTR shares as ad monetization continues to ramp.

Twitter is currently priced at 136.89x next year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of 4.77 and 136.86, respectively. Price/Sales for the same period is 30.76 while EPS is ($2.50). Currently there are 3 analysts that rate TWTR a ‘Strong Buy’, 12 rate it a ‘Buy’ and 16 rate it a ‘Hold’. 2 analysts rate it a sell. TWTR has a median Wall Street price target of $55.00 with a high target of $65.00.

In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $29.51 and a high of $74.73 and are now at $50.81. Shares are up 12.98% year-over-year ; down 20.30% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Gilead Sciences (GILD) – FBR Capital increases their worldwide Sovaldi Q3 revenue estimate to $2.97B.

“We raise our U.S. Sovaldi sales estimate for 3Q14 to $2.24 billion, from $1.94 billion, assuming no change to the net pricing and a continued decline in the daily rate of prescriptions dispensed in September, as the warehouse continues to build. Accordingly, we increase our worldwide Sovaldi revenue estimate for 3Q14 to $2.97 billion, in line with current consensus.”

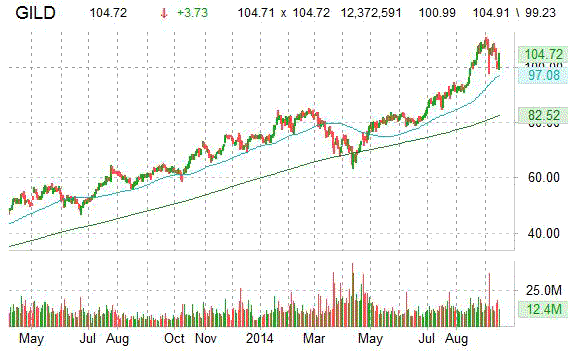

GILD shares recently gained $3.70 to $104.69. In the past 52 weeks, shares of Foster City, California-based biopharmaceutical company have traded between a low of $58.81 and a high of $110.64. Shares are up 66.30% year-over-year and 39.35% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Microsoft (MSFT) – The software giant is expected to introduce its new Windows 9 operating system at an event in San Francisco on Sept. 30, according to reports.

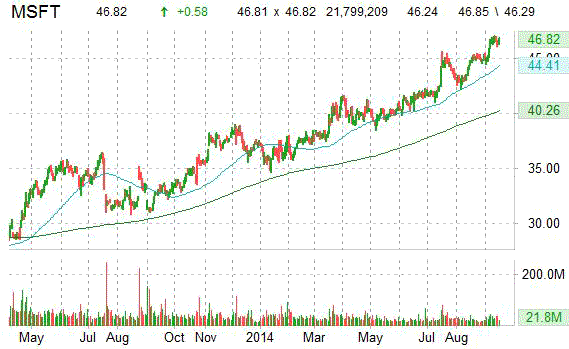

MSFT shares recently gained $0.55 to $46.79. In the past 52 weeks, shares of Redmond, Washington-based company have traded between a low of $32.15 and a high of $47.02. Shares are up 42.69% year-over-year and 25.11% year-to-date.

In other Microsoft news, today the company announced the $2.5 billion purchase of Mojang, the Swedish-based development studio behind massive hit Minecraft. Confirmation of the merger comes a week after a Wall Street Journal report claimed that the two companies were in the final stages of a deal.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply