Eli Lilly and Company (LLY) shares are down 1.50% in early trading after the drug maker was downgraded to ‘Neutral’ from ‘Buy’ by equities research analysts at Citigroup (C), in a research note issued to investors on Thursday. The firm however, raised its price target on the stock to $68, up from their previous price target of $60. Citi’s new LLY 12-month base case estimate points to a potential upside of 10.24% from the stock’s current price-per-share.

A number of other investment firms have also come out with their opinions about Eli Lilly and Co. In a note on July 29, analysts at Argus Research maintained a ‘Buy’ rating and a $72.00 price target on the pharmaceutical company. Jefferies analysts maintained a ‘Hold’ rating on LLY in a research note on July 14, reiterating a price target of $65.00 per share on the stock. In a research note on July 2nd, analysts at Barclays (BCS) upgraded their ‘Underweight’ rating to an’ Equal-weight’ rating on the shares of Eli Lilly, and placed a price target of $63.00 on the stock.

LLY currently trades at a trailing-12 P/E of 17.20, a forward P/E of 19.51 and a P/E to growth ratio of 7.61. The median Wall Street price target on the company’s stock is $63.00 with a high target of $73.00.

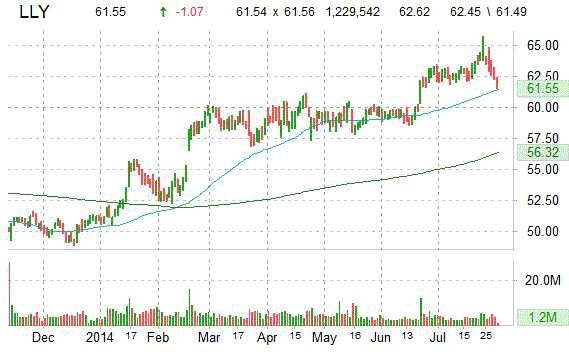

Profitability-wise, Eli Lilly’s trailing-12 profit margin currently stands at 16% while operating margin is at 20.24%. The $66 billion market cap company reported $5.13 billion in cash vs. $5.33 billion in debt in its most recent quarter. The name has a 52 week low of $47.53 and a 52 week high of $65.70. The stock’s 50-day moving average is $62.12 and its 200-day moving average is $58.90.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

In today’s session, the equity is changing hands at $61.65 a share. LLY is up 15.85% year-over-year, and 20.65% year-to-date.

Eli Lilly and Co. is a developer and manufacturer of pharmaceutical products worldwide. The company was founded in 1876 and is headquartered in Indianapolis, Indiana.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply