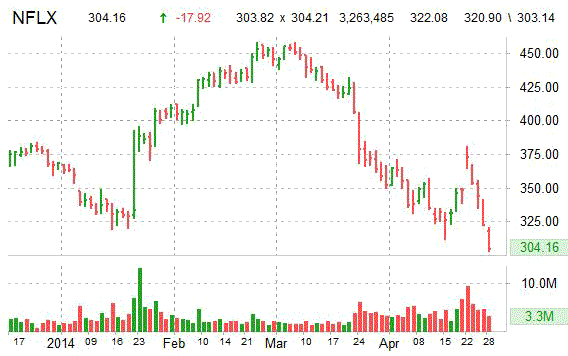

The momentum on Netflix (NFLX) is sharply to the downside this morning. Shares are down more than 16 points, or 5%, to $307.36 on 2.7 million shares. As support in the $309 level gave way, the ticker traded sideways into a congestion period for a while, moved back up a little bit but without strong technicals – a dynamic that prompted actual downward price acceleration. It looks like it’s headed for lower-lows. Next support below is at $301. Resistance is at $309.00.

Shares of Netflix, which have leaped more than 42 percent year-over-year, compared with a gain of 17% for the S&P’s 500 index, have an average 3-month average trading volume of 7.2 million shares. The ticker has a 52-wk range of $204.02 – $458.00. The company has a current market cap of $18.37 billion and a t12 P/E ratio of 164.70.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply