In the wake of the recent crisis, the debate about the economic benefits from EU membership has intensified. This column presents new results about the benefits countries derive from becoming EU members, using data from the 1980s and 2004 enlargements. There are substantial positive pay-offs, with a gain in per capita GDP of approximately 12%. Despite differences across countries, the evidence shows that the benefits of EU membership outweighed the costs for most countries – except for Greece. An important research question would be to identify factors that allow countries to better exploit EU entry.

The process of economic integration in Europe is more than half a century old. WWII provided impetus and, even if from the outset it was driven much by politics, considerations about economic benefits have always been paramount (Martin et al. 2012.) Integration has since deepened and broadened, with slowdowns but without major reversals.

In the wake of the Great Recession and of the Eurozone crisis, the intense debate about the economic benefits from EU membership is hardly a surprise. What is surprising is how far the economic research lags on the issue.

This column argues that the econometric evidence has been scant, and presents new and improved estimates of the monetary benefits countries derive from being EU members. It reports substantial and positive increases in per capita GDP after EU membership for all countries that joined in the 1980s and in 2004, with the exception of Greece.

Not all that glitters

There is disappointingly small literature presenting econometric estimates of the monetary benefits from EU membership. More precisely, there are very few papers or books that answer questions, such as “what would be the level of per capita income in a given country had it not joined the EU?”. Many believe, incorrectly, that this literature is vast because of the many papers on the benefits from trade liberalization, from the single market, and from the euro.1 Yet, papers on the benefits of membership itself are few.2

Moreover, the majority of these studies warn about the fragility of their estimates. Henrekson et al. (1997) estimate the benefits from membership to be about 0.6 to 0.8% per year but note that such estimates are “not completely robust” (1997, p. 1551). Badinger (2005) estimates that “GDP per capita of the EU would be approximately one-fifth lower today if no integration had taken place since 1950” but cautions that these are “not completely robust” (p. 50). Crespo et al. (2008) find large growth effects from EU membership, but warn that country heterogeneity remains a severe concern.

Constructing counterfactuals

In a recent paper, we use the synthetic counterfactuals method (SCM) pioneered by Abadie and Gardeazabal (2003) to estimate EU membership benefits – on a country-by-country basis – in terms of economic growth and productivity (Campos, Coricelli, and Moretti 2014).

The simplicity (or binarity) of membership is key to construct counterfactuals. Yet, it must square with the complexity and timing of integration. This raises three problems:

- Although EU membership is ultimately binary (membership is yes/no), economic integration is a continuum. There are many areas over which economies integrate (finance, goods, services, policies, etc.) and it is plausible that this process varies across areas and over time.

- A second difficulty refers to timing. Because membership is announced in advance, anticipation effects are an issue. In particular, they may lessen the relevance of the official date of EU accession as a ‘treatment’.

- Another difficulty is that because enlargements were spread over time, the ‘accession criteria’ changed substantially between 1973 and 2013 as have the set of incumbent countries (and, of course, the economic and political context).

Synthetic counterfactuals are used to estimate what would have been the levels of per capita GDP if such country had not become a full-fledged EU member.

The synthetic control method estimates the effect of a given intervention (in this case, EU membership) by comparing the evolution of an aggregate outcome variable for a country affected by the intervention vis-à-vis that for an “artificial control group” (Imbes and Wooldridge 2009, p. 79). The latter is a weighted combination of other units (countries) chosen so as to match the treated country, before intervention, for a set of predictors of the outcome variable.

A tale of two enlargements

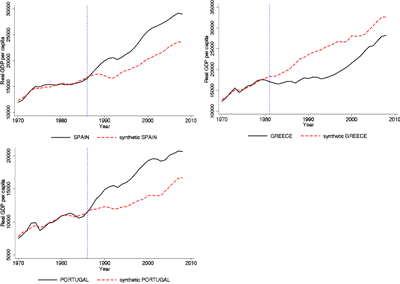

Here we focus on two enlargements: 1980s and 2004.3 Figure 1 shows SCM results for the 1980s enlargement. The continuous line is for actual per capita GDP, while the dashed (red) line is for the estimated synthetic counterfactual.

Figure 1. Actual and synthetic real per capita GDP in the 1980s EU enlargements

(click to enlarge)

Let us consider the example of Spain, which became a full-fledged member of the EU in 1986 (vertical dotted line). The results suggest that per capita GDP in Spain would be considerably lower today had it not joined the EU in 1986. The actual and the synthetic Spain series are reasonably close before 1986, while they diverge in or around 1986, indicating that there was little anticipation (or delay) of the effects from EU membership. In addition, the difference between actual and synthetic is relatively constant, suggesting that the benefits from EU membership in this case seem more likely to be permanent than temporary. SCM results for the Eastern European countries that joined in 2004 also show positive effects from EU membership but these are more mixed. Perhaps this is because benefits from EU membership may have started a few years before the actual accession date, that is, they were ‘anticipated’.

Greece as the outlier

Overall, these results show substantial increases in per capita GDP for all countries that joined the EU in the 1980s and in 2004, with one exception – Greece. The results suggest that Greek per capita GDP would have been higher if Greece had not joined the EU in 1981. But does this imply Greece would be better off leaving the EU as quickly as possible? Obviously not. From 1981 to 1995, growth rates in the EU were relatively higher, and Greece experienced divergence (Vamvakidis, 2003). The opening up of the uncompetitive domestic industry may have been too sudden.4 Yet, entry into the economic and monetary union represents a turnaround, with growth rates faster than in the EU for 1996-2008, driven by shipping, tourism, and the financial sector. Mind the latter is one of the few sectors in which structural reforms were implemented (Mitsopoulos and Pelagidis 2012.) Until the Eurozone crisis, integration delayed a broad range of structural reforms in Greece. Signs are that this is now slowly changing (Fernández-Villaverde et al. 2013).

The power of anticipation and average effects

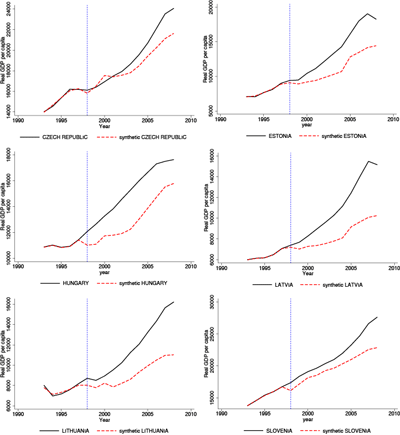

‘Anticipation effects’ may be powerful for the 2004 Eastern enlargement. This enlargement differs in that it was the largest (in number of entrants) and required ample institutional changes. Consequently, our synthetic counterfactuals are re-estimated using 1998 (the year of the Russian crisis) instead of the official accession date (2004). As Figure 2 shows, accounting for anticipation effects improves the fit, and still reveals large positive dividends from EU membership.5

What is the magnitude of these economic benefits? We compute the difference between actual and synthetic counterfactual in per capita GDP for the whole period, using the first ten and the first five years after accession. We find substantial payoffs for both the 1980s and the 2004 enlargement (considering anticipation effects): incomes would be around 12% lower if European integration had not occurred. Without integration, growth rates would have been approximately 1 percentage point lower. The Baltic countries benefited the most, while Greece is the country that benefited the least.

Figure 2. Actual and synthetic real per capita GDP in the 2004 EU Enlargement (accounting for “anticipation effects”)

(click to enlarge)

Conclusions

This column presents new estimates of the economic (monetary) benefits from EU membership. The main finding is that of substantial and positive pay-offs, with approximately 12% gain in per capita GDP. Despite substantial differences across countries, there are clear indications that the benefits of EU membership have significantly outweighed the costs (except for Greece). An important question is to identify factors that allow countries to better exploit EU entry. Campos et al. (2014) began investigating this issue and their preliminary findings highlight the role of financial development (i.e., more financially developed countries growing significantly faster after EU membership) and, somewhat less surprisingly, trade openness.

Footnotes

1. See, among others, Baldwin (1989), Baldwin and Seghezza (1996), and Frankel (2010), respectively.

2. Badinger and Breuss (2011) and Sapir (2011) survey the literature and offer two somewhat different reasons for this paucity. Badinger and Breuss note that “Generally it is easier to conduct ex ante studies on economic integration than to analyse the outcome ex post. This is also documented by the much larger number of ex ante studies. Some of the rare ex post studies, in particular those on the Single Market, are somewhat disillusioning. The expected pro- competitive effects and the implied growth bonus from the Single Market appear to have not been fully realised so far. To some extent this also applies to EMU” (p. 308). Sapir (2011) notes that while the literature on the static benefits of integration is vast, that on the dynamic benefits is scarce.

3. Campos et al. (2014) discuss results for the 1973 and 1995 enlargements. Compared to the above, estimated benefits from EU membership are smaller for the 1995 but larger for the 1973 enlargement.

4. In 1976, the Council of Ministers extraordinarily rejected the European Commission’s view which was against opening accession negotiations with Greece, and in favour of delaying entry until Greek producers were deemed able to compete in the Common Market.

5. Results for Poland and Slovakia are not shown for the sake of space (cf. Campos et al. 2014).

6. Differences for the whole post accession period compared to the first ten years are small.

References

Abadie, A and J Gardeazabal (2003), “The Economic Costs of Conflict: A Case Study of the Basque Country”, American Economic Review, 93: 113–132.

Badinger, H (2005), “Growth Effects of Economic Integration: Evidence from the EU Member States”, Review of World Economics, 141: 50–78.

Badinger, H and F Breuss (2011), “The Quantitative Effects of European Post-war Economic Integration”, in M Jovanovic (ed.), International Handbook on the Economics of Integration, London: Palgrave.

Baldwin, R (1989), “The Growth Effects of 1992”, Economic Policy, 9: 247–281.

Baldwin, R and E Seghezza (1996), “Growth and European Integration: Towards an Empirical Assessment”, CEPR Discussion Paper No. 1393.

Campos, N, F Coricelli and L Moretti (2014), “Economic Growth and Political Integration: Synthetic Counterfactuals Evidence from Europe”, mimeo.

Crespo, J, M Silgoner, and D Ritzberger-Grünwald (2008), “Growth, Convergence and EU Membership”, Applied Economics, 40: 643–656.

Fernández-Villaverde, J, L Garicano, and T Santos (2013), “Political Credit Cycles: The Case of the Eurozone”, mimeo.

Frankel, J (2010), “The Estimated Trade Effects of the Euro: Why Are They Below Those from Historical Monetary Unions among Smaller Countries?”, in Alesina, A and F Giavazzi (eds.), Europe and the Euro, Chicago: University of Chicago Press.

Imbens, G and J Wooldridge (2009), “Recent Developments in the Econometrics of Program Evaluation”, Journal of Economic Literature, 47: 5–86.

Henrekson, M, J Torstensson and R Torstensson (1997), “Growth Effects of European Integration”, European Economic Review, 41: 1537–1557.

Martin, P, T Mayer, and M Thoenig (2012), “The Geography of Conflicts and Regional Trade Agreements”, American Economic Journal: Macroeconomics, 4(4): 1–35.

Mitsopoulos, M and T Pelagidis (2012), Understanding the Crisis in Greece: From Boom to Bust, London: Palgrave MacMillan.

Sapir, A (2011), “European Integration at the Crossroads: A Review Essay on the 50th Anniversary of Bela Balassa’s Theory of Economic Integration”, Journal of Economic Literature, 49(4): 1200–1229.

Vamvakidis, A (2003), “The Convergence Experience of the Greek Economy in the EU”, IMF, Washington DC, mimeo.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply