Bitcoin is a digital currency for which no government, bank, or corporation takes responsibility. Like many others, I was curious to learn how it works and why it seems to be succeeding.

Instead of having a sum (in dollars) in an account with a bank, you could have a sum (in Bitcoins) that you hold in an account that is kept track of by a network of individuals with a public record of where all the sums reside. The mechanics of being able to transfer an entry from one Bitcoin account to another are based on advances in cryptology that use open-architecture algorithms to convert one string of data into another. You can see one in operation here. You enter one string of characters, and out comes another string. Although the formulas by which the output is calculated are totally open and public, it is essentially infeasible to do the operation in reverse. If you only know the string that came out as a result of the operations, about the only way you can guess what went in is by trying every possible input string, a very time-consuming process even for the fastest computers. On the other hand, if you tell me the input you used and I already know the output, I can readily verify whether the input string was indeed as you reported.

The output of a Bitcoin transaction is based on combining some private code associated with your holdings, which only you know, with the full history of previous transactions, which everyone knows. If you supply the correct private code, other users can verify that you indeed were the owner of that sum because your code together with the public history correctly solves a known math problem. In this way, your participation is required to transfer your sum to a new owner, with security of the system maintained by the difficulty of anyone simply guessing the code.

OK, so let’s grant for the time being that the technology exists for you to securely order the transfer of some of your Bitcoin holdings to somebody else without any government or bank needing to be involved. Why does the stuff have value in the first place? The answer is that it would be very helpful to many buyers and sellers of real goods and services if they were able to pay for transactions in this way. We can think of any form of money as an asset that provides liquidity services, which refers to the tangible benefit to its holder coming from the ability of the asset to facilitate certain transactions. The value of money, that is, the value of real stuff you’d be willing to give up to hold money, can be thought of as the present value of the stream of these future liquidity services.

Bitcoin has two potential advantages over credit cards for providing such liquidity services. First, the supporting network only needs to verify that the private code is valid, which is less costly than verifying that you are indeed the rightful owner of a credit card and are ultimately going to deliver good funds. With a conventional credit card, the merchant needs to pay the card company a significant fee for the transaction which in an economic sense results from that high cost of verifying everybody’s compliance. That’s why many merchants are embracing Bitcoin. Your Bitcoin gets deposited into the account of a third party that the merchant specifies. That third party then gives the merchant dollars, confident they will be able to get dollars in turn from somebody else who will want the Bitcoins to pay for some other transaction.

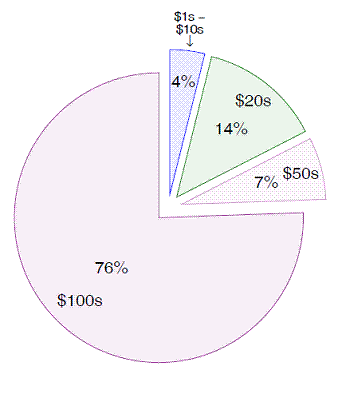

Share of U.S. currency outstanding by denomination. Source: Judson (2012)

Second, Bitcoins are relatively more anonymous than credit cards. In this respect, they enjoy some of the same advantages as cash. It’s striking that of the $1.2 trillion currency in circulation, three-quarters is held in the form of $100 bills, which many of us never carry. The use of Bitcoin for illicit transactions may have been part of what helped it initially develop into something that had a dollar value. But people like Charlie Shrem can tell you the internet isn’t nearly as anonymous as it seems. Marc Andreessen explains:

Much like email, which is quite traceable, Bitcoin is pseudonymous, not anonymous. Further, every transaction in the Bitcoin network is tracked and logged forever in the Bitcoin blockchain, or permanent record, available for all to see. As a result, Bitcoin is considerably easier for law enforcement to trace than cash, gold or diamonds.

Yet another group helping to establish Bitcoin’s value are people who have an ideological passion for a system of exchange that is independent of any government or bank, perhaps some of the same individuals who want to hold their wealth in the form of gold, despite the volatile value of both. And like gold, the fact that Bitcoin has been appreciating in value relative to the U.S. dollar brings in some who assume the trend has to continue. Much of the current value of a Bitcoin, just like much of the current value of an ounce of gold, could well turn out to be a speculative bubble.

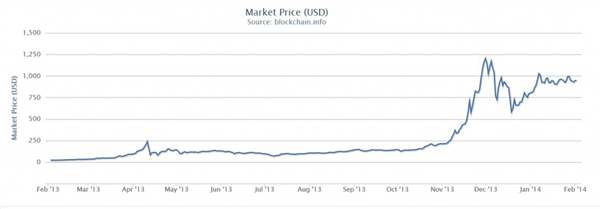

Dollar value of one Bitcoin. Source: Blockchain

At a current price of $944 per Bitcoin and 12.3 million Bitcoins in circulation that gives a total market value of $11.7 B. That’s a little more than the $10.3 B worth of U.S. one-dollar bills that were in circulation as of the end of 2012.

Will it keep up? The value of the liquidity services that something like Bitcoin could provide is certainly quite tangible. Bitcoin’s functionality relies on the security of the underlying cryptology, and I am no one to judge whether better algorithms might develop for hacking the code or usurping the network on which the system depends. Another detail I am unclear about is whether a peer-to-peer network can continue to be relied on to provide verification to merchants at minimal cost. Currently the system creates new Bitcoins that are credited to entities on the network who successfully solve sets of new verification problems, giving individuals an incentive to maintain and update the system of accounts as well as ensure that the number of Bitcoins grows at a fixed rate over time. But the system is set up so that the maximum number of Bitcoins could not exceed 21 million, a ceiling that we are already more than halfway toward. Could a variant of the system continue to survive after we reach peak Bitcoin?

Hard to know where this is all going to lead. But one thing is clear– we have added a very interesting new chapter in the history of money.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply