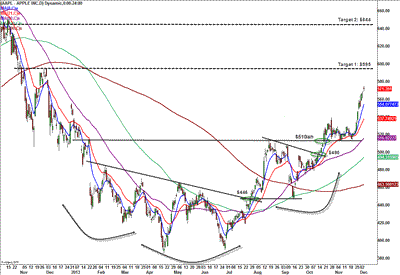

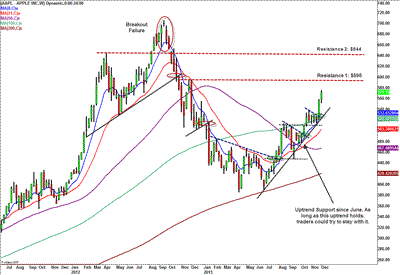

Apple (AAPL) stock experienced well-publicized decline from over $700 down to below $400, but finally found its footing in late June-early July. Since then, AAPL has presented multiple technical set-ups to potentially provide calculated entries.

In my weekly appearance on theStreet yesterday I spoke with Debra Borchardt about AAPL’s recent movement and potential for the next few weeks/months.

Below you can see the three charts that I sent over to theStreet ahead of the segment that outline the cleanest set-ups in AAPL that have shown their face over the past few months.

(click to enlarge)

(click to enlarge)

(click to enlarge)

While AAPL has come a long way over the past few months, I believe after some consolidation of recent gains it can still go higher. New iPad Air Sales have been robust, the China Mobile deal opens up the iPhone to a customer base that is 7 times as big as Verizon, and we still haven’t gotten announcements about new products that seem clearly to be in the works. Prominent investors like Carl Icahn have taken stakes in the company and declared it a great value investment even without a more aggressive share buyback program.

Disclosure: No current position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply