Shake off the cobwebs from the long weekend. Investors now have a bit of clarity on the Syria situation. Futures are pointing toward a higher open to begin the new month. The market’s ready to start things off with a bang.

Not so fast.

I want you to ignore the excitement for a moment. Today, your attention should remain squarely on just one section of the market. The performance of this basket of stocks could help the broad market find stability this month. Or it could potentially sink any attempt at a rally. I’ll explain in just a second.

First, let’s put it all in perspective…

“Over the course of 2013, stocks have lived up to the mantra ‘new month, new market’. Each calendar month has brought a new sort of cadence or direction to how stocks trade,” my trading buddy Jonas Elmerraji told his Elite readers last night…

Jonas continues…

“Typically, September is an important month for Wall Street: it’s the official end to the summer doldrums. This year, though, summer trading has been pretty eventful. So it should be interesting to see what happens once markets are back to ‘normal mode’.”

Indeed. August is finally behind us. No more excuses for the market. No more low-volume rallies and corrections. It’s time to play for keeps.

That’s why I’m closely watching the Dow this week. If the big index can’t catch a break, I don’t know how the broad market will be able to sustain a meaningful rally…

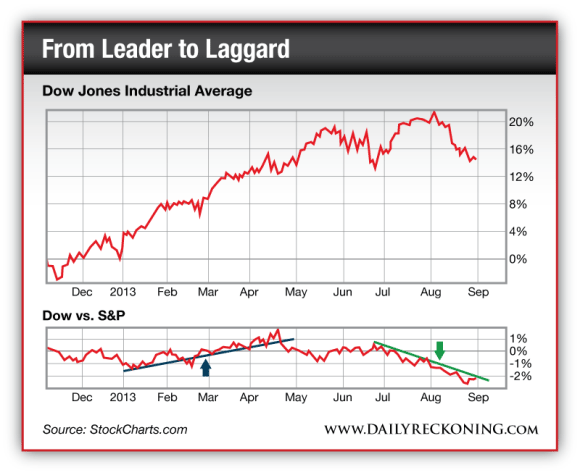

The Dow was red-hot at the beginning of the year. Its components were easily besting the broad market, delivering gains usually reserved for popular growth stocks.

However, the summer was far from kind to the Dow. It began to slip in early July relative to the S&P 500. As of right now, the Big Board has yet to find its footing.

We don’t need the Dow to scream past the broad market like it did earlier this year. I doubt it will regain that kind of momentum. However, it is crucial for the Dow to stabilize between 14,700 – 14,800. If it can’t find support soon, it could easily drag the market lower this month.

If you’re looking to play this morning’s bounce, there are better options out there than Dow components. Look toward the technology or basic materials sectors for strength. These stocks should provide better returns if the market manages to stabilize…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply